Shetron's Stock Shows Stability Amidst Debt Challenges and Declining Profits

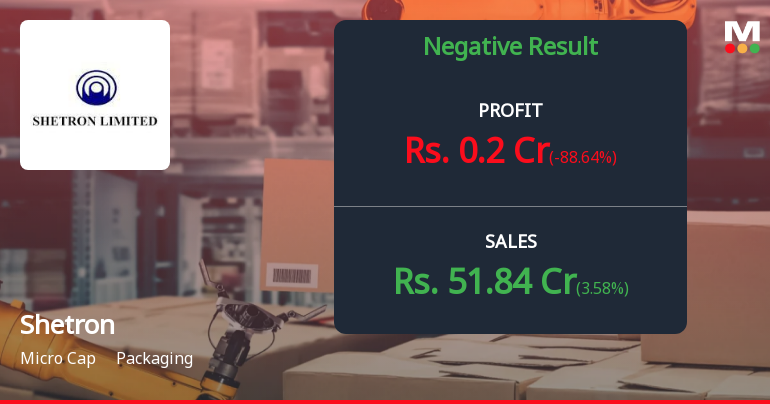

2025-04-02 08:11:32Shetron, a microcap packaging company, has recently adjusted its evaluation, indicating a shift in underlying trends. The company faces challenges with a high Debt to EBITDA ratio and modest profitability, while net sales have grown steadily. Despite a recent return, profits have declined significantly, and the stock trades at a discount to peers.

Read More

Shetron's Evaluation Adjustment Reflects Mixed Technical Trends Amid Financial Challenges

2025-03-25 08:09:10Shetron, a microcap packaging company, has recently adjusted its evaluation, reflecting a shift in its technical trend. Despite a challenging financial quarter with declining profits, the company has shown resilience with a 38.03% return over the past year, outperforming the BSE 500 index consistently for three years.

Read MoreShetron Ltd Experiences Surge in Buying Activity, Achieves Notable Price Milestones

2025-03-24 12:55:05Shetron Ltd, a microcap player in the packaging industry, is witnessing significant buying activity, with the stock surging by 17.90% today, outperforming the Sensex, which rose by 1.28%. This marks the second consecutive day of gains for Shetron, accumulating a total return of 11.11% over this period. In terms of price performance, Shetron reached an intraday high of Rs 145, reflecting a 5.3% increase from the previous close. Over the past week, the stock has shown remarkable strength, with a 38.70% rise compared to the Sensex's 5.02%. On a monthly basis, Shetron has increased by 10.44%, while the Sensex gained 4.62%. Despite a decline of 7.04% over the last three months, Shetron's one-year performance stands out with a 52.44% increase, significantly higher than the Sensex's 6.95%. The stock's current price is above its 5-day and 20-day moving averages, indicating short-term bullish momentum, although ...

Read More

Shetron Faces Financial Challenges Amidst Attractive Valuation Metrics and Market Performance

2025-03-18 08:07:13Shetron, a microcap packaging company, has recently adjusted its evaluation amid challenging financial performance in Q3 FY24-25. Key metrics indicate a high Debt to EBITDA ratio and a modest Return on Equity. Despite these issues, the company's valuation remains appealing, with consistent returns over the past three years.

Read More

Shetron Faces Profit Decline Amid Mixed Market Signals and High Debt Concerns

2025-03-11 08:06:45Shetron, a microcap packaging company, has recently adjusted its evaluation based on market conditions and financial metrics. Despite a decline in profits and negative trends in Q3 FY24-25, the company shows mildly bullish technical indicators and maintains a competitive return on capital employed, though it faces challenges with high debt levels.

Read More

Shetron Faces Financial Challenges Amidst Market Position Evaluation Adjustments

2025-03-03 18:38:17Shetron, a microcap packaging company, has recently adjusted its evaluation, reflecting current financial challenges. The latest quarter showed a decline in profit after tax and concerns over debt servicing. Despite modest growth in sales and operating profit over five years, recent profitability has dropped significantly.

Read More

Shetron Faces Financial Challenges Amidst Attractive Valuation and Declining Profits

2025-02-13 18:44:14Shetron, a microcap packaging company, has recently adjusted its evaluation amid challenging financial performance in Q3 FY24-25. Despite a significant profit decline, the company maintains a favorable valuation with a solid Return on Capital Employed and has outperformed the BSE 500 index over the past three years.

Read More

Shetron Reports Mixed Financial Results for December Quarter, Highlighting Debt Reduction and Profit Decline

2025-02-11 19:32:28Shetron has released its financial results for the quarter ending December 2024, highlighting a mix of improvements and challenges. The company achieved its lowest debt-equity ratio and highest cash reserves, while also facing declines in profitability metrics, including profit before tax and operating profit margin.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74 (5) of the SEBI (Depositories and Participants) Regulation 2018 for the quarter ended 31st March 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEAs per the Companys Code of Conduct for prohibition of Insider Trading framed pursuant to SEBI (PIT) Regulation 2015 and amended from time to time the Trading Window for dealing in securities of the Company shall remain closed from Tuesday 1st April 2025 till the expiry of 48 hours after the declaration of the audited Financial Results of the Company for the fourth quarter and year ended 31st March 2025. During the aforesaid closed Trading Window period the Employees Directors Key Managerial Personnel Promoters Designated Persons and their immediate relatives or any other insider shall not trade in the Companys Share/Securities. The date of the Board Meeting for declaration of the financial results of the Company for the fourth quarter and year ended 31st March 2025 will be intimated in due course.

Integrated Filing (Financial)

12-Feb-2025 | Source : BSEIntegrated Filing (Financial) for the 3rd Quarter and Nine months ended 31st December 2024.

Corporate Actions

No Upcoming Board Meetings

Shetron Ltd has declared 10% dividend, ex-date: 05 Sep 24

No Splits history available

No Bonus history available

No Rights history available