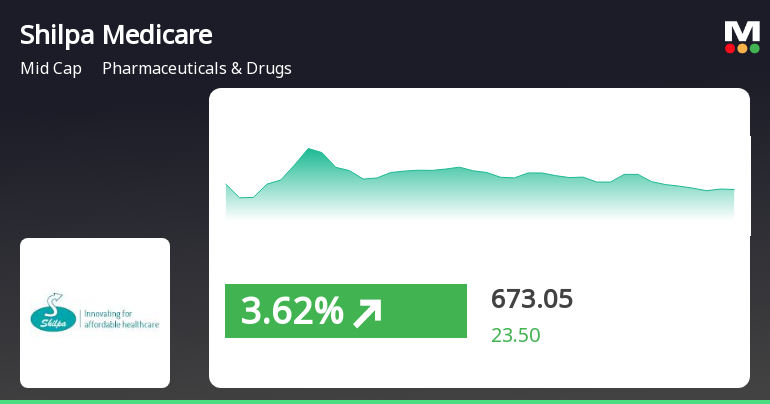

Shilpa Medicare Shows Trend Reversal Amid Strong Monthly Performance and Sector Outperformance

2025-04-03 09:35:23Shilpa Medicare has experienced a significant rebound, gaining 5.69% on April 3, 2025, after three days of decline. The stock has outperformed its sector and has shown strong monthly performance, although it remains down year-to-date. Over the past year, it has achieved a notable gain compared to the Sensex.

Read More

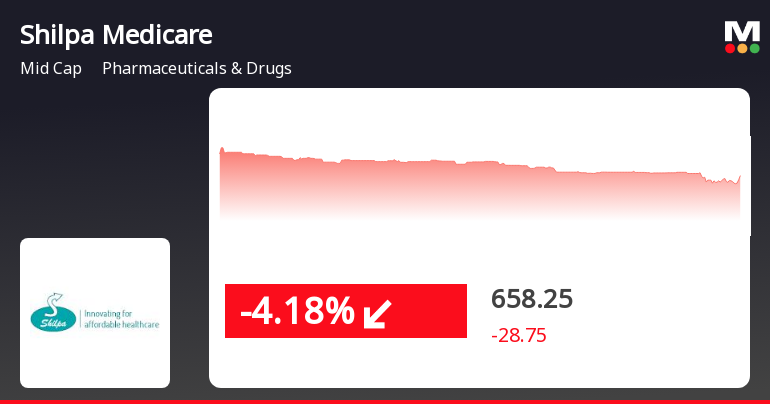

Shilpa Medicare Faces Volatility Amid Broader Market Gains and Mixed Performance Indicators

2025-03-28 14:50:20Shilpa Medicare, a midcap pharmaceutical company, saw a significant decline on March 28, 2025, underperforming its sector. The stock's performance has been volatile, with recent decreases over one day and one week, but a monthly gain. Year-to-date, it remains down, contrasting with a yearly increase.

Read More

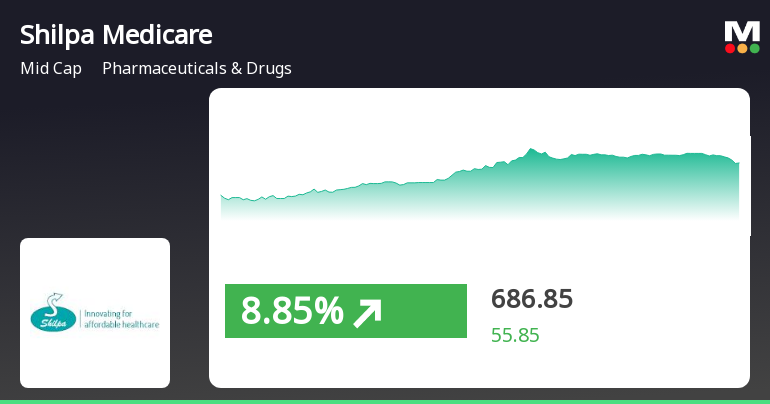

Shilpa Medicare Shows Strong Performance Amidst Market Volatility and Sector Gains

2025-03-18 10:35:23Shilpa Medicare has experienced notable stock activity, gaining 7.77% on March 18, 2025, and outperforming its sector. The stock opened higher and reached an intraday peak, despite significant volatility. Year-to-date, it shows a decline, contrasting with a substantial increase over the past year.

Read MoreShilpa Medicare Experiences Valuation Grade Change Amidst Competitive Industry Landscape

2025-03-17 08:00:36Shilpa Medicare, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 628.20, reflecting a notable shift from its previous close of 647.65. Over the past year, Shilpa Medicare has demonstrated a return of 55.00%, significantly outperforming the Sensex, which recorded a return of 1.47% in the same period. Key financial metrics for Shilpa Medicare include a PE ratio of 74.14 and an EV to EBITDA ratio of 21.32. The company's return on capital employed (ROCE) is reported at 6.68%, while the return on equity (ROE) is at 2.39%. These figures indicate a complex financial landscape for the company. In comparison to its peers, Shilpa Medicare's valuation metrics present a mixed picture. For instance, AstraZeneca and Pfizer are positioned at higher valuation levels, while Emcure Pharma and ERIS Lifescience also reflect elevated v...

Read MoreShilpa Medicare Faces Mixed Technical Indicators Amid Market Evaluation Adjustments

2025-03-11 08:03:25Shilpa Medicare, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 660.00, slightly down from the previous close of 667.00. Over the past year, Shilpa Medicare has shown a notable return of 56.55%, significantly outperforming the Sensex, which remained nearly flat at -0.01%. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly metrics present a mixed picture with some indicators leaning towards bullish. The stock's moving averages indicate a bearish trend on a daily basis, while the KST shows a bullish stance on a monthly basis. The overall technical summary reflects a complex landscape, with various indicators providing differing signals. Shilpa Medicare's performance over different time frames highlights its resilience...

Read More

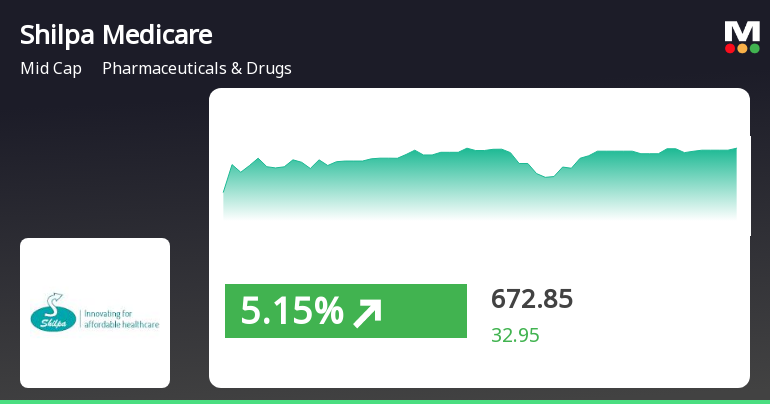

Shilpa Medicare Shows Strong Performance Amid Broader Market Volatility

2025-03-06 09:50:19Shilpa Medicare has experienced significant activity, gaining 5.15% on March 6, 2025, and outperforming its sector. The stock has shown consecutive gains over three days, with a total return of 12.44%. In contrast, the broader market, represented by the Sensex, is facing a downturn.

Read MoreShilpa Medicare Adjusts Valuation Amid Strong Yearly Performance and Peer Comparisons

2025-03-06 08:00:52Shilpa Medicare, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 639.90, reflecting a slight increase from the previous close of 626.25. Over the past year, Shilpa Medicare has shown a notable return of 55.58%, significantly outperforming the Sensex, which recorded a mere 0.07% return during the same period. Key financial metrics for Shilpa Medicare include a PE ratio of 75.52 and an EV to EBITDA ratio of 21.69. The company’s return on capital employed (ROCE) is reported at 6.68%, while the return on equity (ROE) is at 2.39%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, Shilpa Medicare's valuation metrics indicate a distinct positioning within the industry. For instance, Concord Biotech and Pfizer are categorized with higher valuation metrics...

Read More

Shilpa Medicare Reports Strong Profit Growth Amid Long-Term Financial Challenges

2025-03-05 08:07:31Shilpa Medicare, a midcap pharmaceutical company, recently adjusted its evaluation following strong Q3 FY24-25 results, including a notable net profit increase. However, challenges in long-term fundamentals persist, with modest growth rates and bearish technical indicators, despite attractive valuation compared to peers amid broader market declines.

Read MoreShilpa Medicare Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-05 08:02:21Shilpa Medicare, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 626.25, showing a notable change from its previous close of 598.40. Over the past year, Shilpa Medicare has experienced a return of 46.80%, significantly outperforming the Sensex, which recorded a return of -1.19% during the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands present a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Daily moving averages also reflect a bearish sentiment, while the KST shows a bearish weekly trend but a bullish monthly outlook. Despite recent challenges, Shi...

Read MoreUS Approval For Varenicline Tablets 0.5 Mg And 1 Mg

09-Apr-2025 | Source : BSEUS Approval for Varenicline Tablets 0.5 mg and 1 mg

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliance certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Launch Of 2Nd NDA Bortezomib For Injection 3.5Mg/1.4Ml In US

03-Apr-2025 | Source : BSELaunch of 2nd NDA Bortezomib for injection 3.5mg/1.4ml in US

Corporate Actions

No Upcoming Board Meetings

Shilpa Medicare Ltd has declared 110% dividend, ex-date: 19 Sep 22

Shilpa Medicare Ltd has announced 1:2 stock split, ex-date: 06 Nov 15

Shilpa Medicare Ltd has announced 1:2 bonus issue, ex-date: 16 Jul 13

No Rights history available