Shoppers Stop Faces Mixed Technical Signals Amidst Market Challenges and Long-Term Resilience

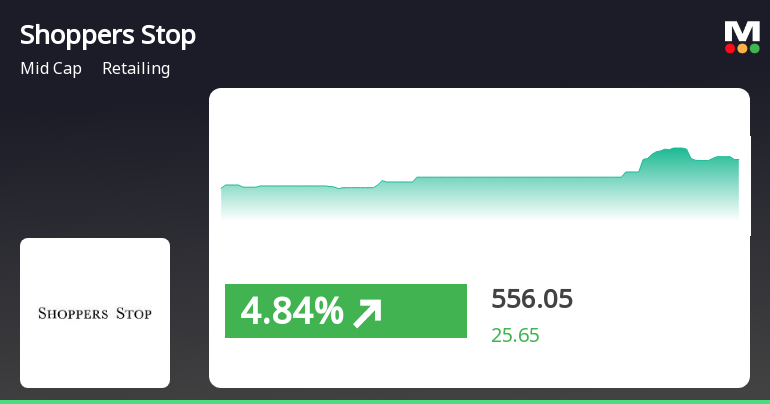

2025-04-03 08:05:08Shoppers Stop, a prominent player in the retailing sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 556.30, showing a notable increase from the previous close of 530.40. Over the past year, Shoppers Stop has experienced a decline of 27.64%, contrasting with a 3.67% gain in the Sensex, highlighting the challenges faced by the company in the broader market context. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook remains bearish. The Relative Strength Index (RSI) shows no signal on a weekly basis but indicates bullish momentum monthly. Bollinger Bands reflect a mildly bearish trend for both weekly and monthly assessments, and moving averages also indicate a mildly bearish stance on a daily basis. Despite these mixed signals, Shoppers Stop has shown resilience over lon...

Read More

Shoppers Stop Shows Signs of Recovery Amid Broader Market Challenges

2025-04-02 11:05:22Shoppers Stop experienced significant trading activity on April 2, 2025, reversing a two-day decline. The stock outperformed its sector and the Sensex, with notable gains over the past week. However, its three-month performance shows a decline, indicating ongoing challenges in the mid-cap sector.

Read MoreShoppers Stop Faces Mixed Technical Signals Amid Market Volatility and Performance Fluctuations

2025-04-02 08:07:36Shoppers Stop, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 530.40, down from a previous close of 546.80, with a notable 52-week high of 943.65 and a low of 467.50. Today's trading saw a high of 558.75 and a low of 530.40, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but is bearish on a monthly scale. The Relative Strength Index (RSI) presents no signal weekly while indicating bullishness monthly. However, Bollinger Bands and KST both reflect bearish trends on both weekly and monthly evaluations. Moving averages also indicate a bearish stance, suggesting caution in the current market environment. In terms of performance, Shoppers Stop's stock return over the past year has been signi...

Read More

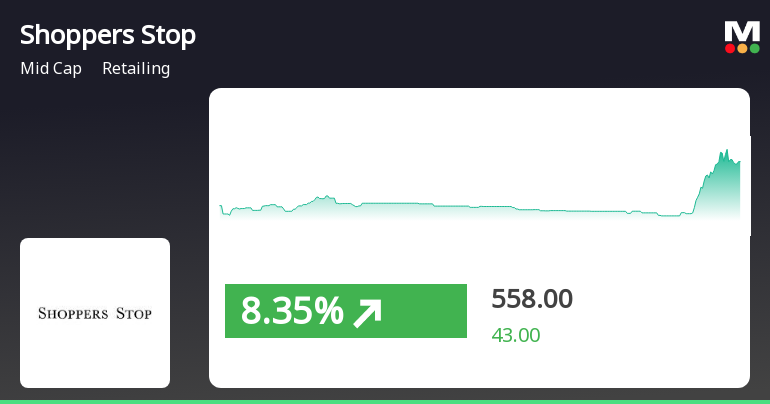

Shoppers Stop Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-27 14:35:27Shoppers Stop has shown notable activity, gaining significantly and outperforming its sector for two consecutive days. The stock reached an intraday high, reflecting high volatility. While it has performed well recently, its longer-term performance indicates challenges compared to broader market trends.

Read MoreShoppers Stop Faces Technical Trend Shifts Amid Retail Sector Challenges

2025-03-26 08:03:50Shoppers Stop, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 507.10, having closed at 521.55 previously. Over the past year, Shoppers Stop has faced challenges, with a notable decline of 32.77% compared to a 7.12% increase in the Sensex. In terms of technical indicators, the weekly MACD and KST remain bearish, while the monthly metrics show a mildly bearish trend. The Relative Strength Index (RSI) indicates bullish momentum on both weekly and monthly scales, suggesting some positive short-term activity. However, the Bollinger Bands and moving averages indicate a bearish sentiment, particularly on a daily basis. Despite the recent fluctuations, Shoppers Stop has shown resilience over longer periods, with a 141.48% return over five years, although this is still below the Sensex's 173.40% retu...

Read More

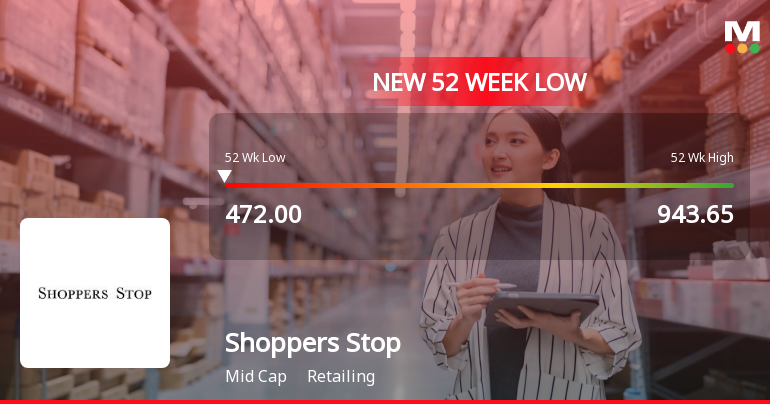

Shoppers Stop Faces Significant Volatility Amid Broader Market Gains and Financial Concerns

2025-03-13 10:08:36Shoppers Stop has faced significant volatility, reaching a new 52-week low and underperforming its sector. The company's financial health is concerning, with a high debt-to-equity ratio and weak EBIT to interest ratio. Despite some positive results, long-term growth remains challenged, with modest net sales growth over five years.

Read More

Shoppers Stop Faces Significant Volatility Amidst Declining Stock Performance and High Debt Concerns

2025-03-11 09:46:45Shoppers Stop has faced notable volatility, reaching a new 52-week low and underperforming its sector. The stock has declined over three consecutive days and shows a significant drop over the past year. Financial challenges include a high debt-to-equity ratio and slow net sales growth, despite some institutional confidence.

Read More

Shoppers Stop Faces Ongoing Challenges Amid Significant Stock Volatility and High Debt Levels

2025-03-11 09:46:45Shoppers Stop has faced notable volatility, hitting a 52-week low amid a broader market decline. The stock has underperformed its sector significantly over the past year, with a high debt-to-equity ratio indicating financial challenges. Despite recent positive sales figures, technical indicators suggest ongoing bearish trends.

Read More

Shoppers Stop Faces Financial Struggles Amid Significant Stock Volatility and Debt Concerns

2025-03-11 09:46:43Shoppers Stop has faced significant volatility, reaching a new 52-week low amid a three-day losing streak. The stock has declined 36.62% over the past year, contrasting with the Sensex's slight gain. Financial metrics reveal high debt levels and weak growth, raising concerns about the company's long-term outlook.

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

28-Mar-2025 | Source : BSEPlease find attached disclosure

Changes In Senior Management Personnel: Resignation Of Mr. Rajan Sharma As Customer Care Associate And Chief Of Private Brands. Ref: Disclosure Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Require

28-Mar-2025 | Source : BSEPlease find attached disclosure

Closure of Trading Window

24-Mar-2025 | Source : BSEPlease find attached disclosure

Corporate Actions

No Upcoming Board Meetings

Shoppers Stop Ltd has declared 15% dividend, ex-date: 22 Jul 19

Shoppers Stop Ltd has announced 5:10 stock split, ex-date: 12 Jan 11

No Bonus history available

Shoppers Stop Ltd has announced 17:70 rights issue, ex-date: 19 Nov 20