Shraddha Prime Projects Experiences Valuation Grade Change Amid Competitive Engineering Sector Dynamics

2025-04-03 08:00:08Shraddha Prime Projects, a microcap player in the engineering sector, has recently undergone a valuation adjustment. The company's current price stands at 133.90, reflecting a decline from the previous close of 138.25. Over the past year, Shraddha Prime has demonstrated a notable return of 55.34%, significantly outperforming the Sensex, which recorded a return of 3.67% during the same period. Key financial metrics for Shraddha Prime include a PE ratio of 47.54 and an EV to EBITDA ratio of 44.30, indicating a premium valuation relative to its peers. The company's return on equity (ROE) is reported at 18.94%, while the return on capital employed (ROCE) stands at 9.70%. Despite these strong performance indicators, the valuation adjustment reflects a reassessment of its market position. In comparison to its peers, Shraddha Prime's valuation metrics suggest a higher relative valuation, with competitors like Ge...

Read MoreShraddha Prime Projects Faces Intense Selling Pressure Amid Significant Price Declines

2025-04-02 09:35:05Shraddha Prime Projects Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a consecutive decline over the past four days, resulting in a total loss of 18.16% during this period. Today, the stock opened with a gap down of 4.99%, reflecting a stark contrast to the Sensex, which has gained 0.54% on the same day. In terms of performance metrics, Shraddha Prime Projects has underperformed its sector by 4.8% today. While the stock has shown impressive long-term growth, with a staggering 5062.23% increase over the past five years, recent trends indicate a shift. The stock's intraday high reached Rs 144, but it also fell to a low of Rs 131.35, highlighting the volatility in its trading activity. Despite a strong performance in the longer term, including a 52.38% increase over the past year, the current selling pressure may be attributed to ...

Read More

Shraddha Prime Projects Shows Strong Profit Growth Amid Debt Concerns and Market Outperformance

2025-04-02 08:16:19Shraddha Prime Projects, a microcap engineering firm, has adjusted its evaluation amid a mildly bullish technical outlook. The company reported a 25.82% increase in net profit and record net sales, marking five consecutive quarters of growth. However, it faces challenges with a high debt-to-EBITDA ratio.

Read MoreShraddha Prime Projects Shows Mixed Technical Trends Amid Market Volatility

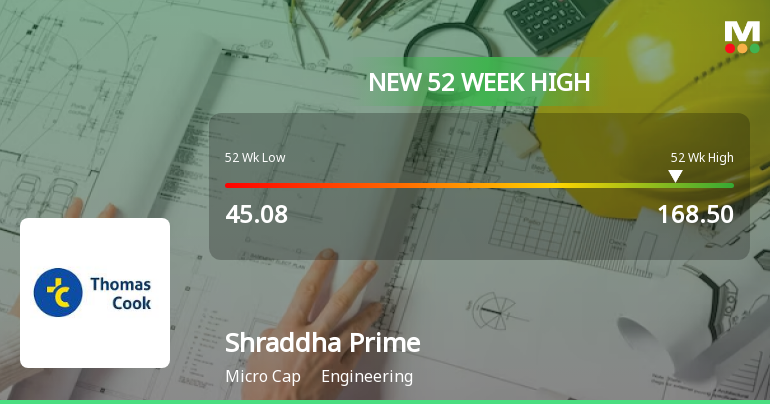

2025-04-02 08:01:49Shraddha Prime Projects, a microcap company in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 138.25, down from a previous close of 145.50, with a 52-week high of 168.50 and a low of 45.08. Today's trading saw a high of 145.00 and a low of 138.25, indicating some volatility. The technical summary reveals a mixed picture. While the MACD indicates bullish momentum on both weekly and monthly charts, the RSI shows bearish trends over the same periods. Bollinger Bands suggest a mildly bullish stance, while moving averages on a daily basis remain bullish. However, the KST reflects mildly bearish signals on both weekly and monthly fronts, and the Dow Theory indicates a bullish trend on a weekly basis with no clear trend monthly. In terms of performance, Shraddha Prime Projects has shown significant returns compared to...

Read MoreShraddha Prime Projects Faces Intense Selling Pressure Amidst Notable Price Decline

2025-04-01 10:15:06Shraddha Prime Projects Ltd is currently facing significant selling pressure, with today's trading session showing only sellers in the market. The stock has recorded a notable decline of 9.34%, starkly contrasting with the Sensex's modest drop of 0.70%. This marks a continuation of consecutive days of losses, raising concerns among market observers. Over the past week, Shraddha Prime Projects has shown a positive performance of 4.38%, but this is overshadowed by the current downturn. In the longer term, the stock has demonstrated impressive gains, with a 68.75% increase over the past year and a staggering 5333.41% rise over the last five years. However, the recent selling pressure could be attributed to various factors, including market sentiment and potential profit-taking after a strong performance. In terms of moving averages, the stock remains above the 20-day, 50-day, 100-day, and 200-day averages, a...

Read MoreShraddha Prime Projects Faces Selling Pressure Amid Notable Price Decline

2025-03-27 10:55:05Shraddha Prime Projects Ltd is currently facing significant selling pressure, with the stock showing only sellers today. After an impressive run, the stock has experienced a notable decline of 4.98% in just one day, contrasting sharply with the Sensex, which has gained 0.39%. This marks a reversal after eight consecutive days of gains, highlighting a shift in market sentiment. Over the past week, Shraddha Prime Projects has still outperformed the Sensex with a remarkable 24.14% increase, but the recent downturn raises questions about sustainability. The stock has shown impressive performance metrics over longer periods, including a 95.45% rise over the past year and an astounding 5893.46% increase over five years. However, today’s performance underperformed its sector by 4.64%. The stock opened with a gap up of 4.98%, reaching an intraday high of Rs. 168.5, before falling to a low of Rs. 152.5. Despite th...

Read More

Shraddha Prime Projects Achieves 52-Week High Amid Strong Profit Growth and Market Performance

2025-03-27 09:43:44Shraddha Prime Projects' stock reached a new 52-week high of Rs. 168.5, despite a recent decline after eight days of gains. The company reported a 25.82% increase in net profit and significant annual returns, showcasing strong operational performance in the engineering sector.

Read More

Shraddha Prime Projects Achieves All-Time High Stock Price Amid Mixed Market Performance

2025-03-27 09:31:16Shraddha Prime Projects achieved an all-time high stock price of Rs. 168.5, despite a slight decline today. The company reported a 102.11% stock growth over the past year and a 25.82% increase in net profit, showcasing strong performance metrics amid some financial challenges.

Read More

Shraddha Prime Projects Achieves 52-Week High Amid Strong Profit Growth and Market Momentum

2025-03-26 09:36:33Shraddha Prime Projects has achieved a new 52-week high, reflecting strong stock performance and a 25.82% growth in net profit in its latest quarterly results. The company has consistently reported positive results for five quarters, although it faces challenges such as a high debt-to-EBITDA ratio.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

09-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Shraddha Prime Projects Ltd |

| 2 | CIN NO. | L70100MH1993PLC394793 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 89.69 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary

EmailId: shraddhaprimeprojects@gmail.com

Designation: CFO

EmailId: shraddhaprimeprojects@gmail.com

Date: 09/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliance Certificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31.03.2025

Compliance-57 (5) : intimation after the end of quarter

09-Apr-2025 | Source : BSEIntimation under Reg 57(5) as on 31.03.2025

Corporate Actions

No Upcoming Board Meetings

Shraddha Prime Projects Ltd has declared 2% dividend, ex-date: 09 Oct 24

No Splits history available

Shraddha Prime Projects Ltd has announced 1:1 bonus issue, ex-date: 27 Jan 25

Shraddha Prime Projects Ltd has announced 365:100 rights issue, ex-date: 03 Jul 23