Shree Ganesh Remedies Shows Mixed Technical Trends Amid Market Volatility

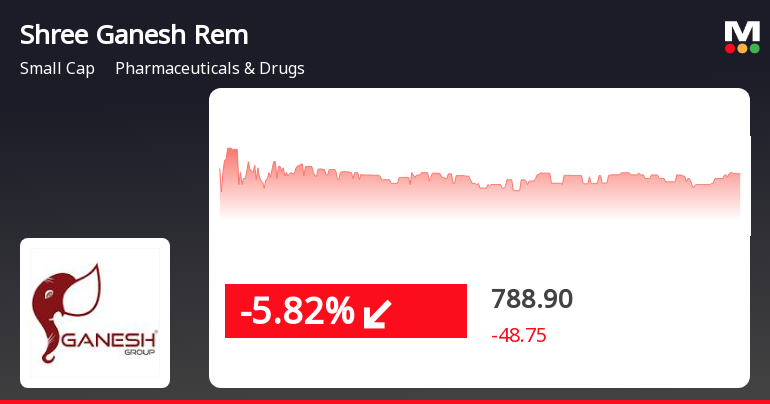

2025-03-18 08:04:02Shree Ganesh Remedies, a microcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 701.95, showing a notable increase from the previous close of 658.00. Over the past year, the stock has reached a high of 950.05 and a low of 557.95, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) does not signal any immediate trends on both weekly and monthly charts. Bollinger Bands indicate a mildly bearish stance weekly, contrasting with a bullish outlook monthly. Moving averages reflect a bearish sentiment on a daily basis, while the KST shows a mildly bullish trend weekly and mildly bearish monthly. When comparing the stock's performance to the Sensex, Shre...

Read MoreShree Ganesh Remedies Faces Mixed Technical Signals Amid Market Evaluation Revision

2025-03-13 08:02:30Shree Ganesh Remedies, a microcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 675.00, down from a previous close of 707.00, with a 52-week high of 950.05 and a low of 557.95. Today's trading saw a high of 725.05 and a low of 664.15, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signal weekly while indicating bearish sentiment monthly. Bollinger Bands and moving averages both reflect bearish trends, suggesting caution in the short term. In terms of performance, Shree Ganesh Remedies has shown resilience over longer periods. Over the past three years, the stock has returned 141.26%, sig...

Read MoreShree Ganesh Remedies Faces Mixed Technical Signals Amid Market Evaluation Revision

2025-03-13 08:02:30Shree Ganesh Remedies, a microcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 675.00, down from a previous close of 707.00, with a 52-week high of 950.05 and a low of 557.95. Today's trading saw a high of 725.05 and a low of 664.15, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signal weekly while indicating bearish sentiment monthly. Bollinger Bands and moving averages both reflect bearish trends, suggesting caution in the short term. In terms of performance, Shree Ganesh Remedies has shown resilience over longer periods. Over the past three years, the stock has returned 141.26%, sig...

Read MoreShree Ganesh Remedies Shows Mixed Technical Trends Amid Strong Market Resilience

2025-03-12 08:03:07Shree Ganesh Remedies, a microcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 707.00, down from a previous close of 738.00, with a 52-week high of 950.05 and a low of 557.95. Today's trading saw a high of 736.50 and a low of 700.00. The technical summary indicates a mixed performance across various metrics. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no signals for both weekly and monthly evaluations. Bollinger Bands reflect a bearish stance weekly, contrasting with a bullish outlook monthly. Daily moving averages indicate a bearish trend, while the KST shows a mildly bullish weekly trend but a mildly bearish monthly trend. Dow Theory also presents a mixed picture, wi...

Read MoreShree Ganesh Remedies Shows Mixed Technical Trends Amid Market Volatility

2025-03-11 08:04:59Shree Ganesh Remedies, a microcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 738.00, showing a slight increase from the previous close of 730.00. Over the past year, the stock has reached a high of 950.05 and a low of 557.95, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish trends on both weekly and monthly charts, suggesting potential price stability. However, moving averages present a mildly bearish signal on a daily basis, reflecting mixed short-term performance. When comparing Shree Ganesh Remedies' performance to the Sensex, the company has shown notable resilience. Over the past week, the stock return...

Read MoreShree Ganesh Remedies Experiences Mixed Technical Trends Amid Market Volatility

2025-03-07 08:03:44Shree Ganesh Remedies, a microcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 715.00, showing a notable increase from the previous close of 670.25. Over the past year, the stock has reached a high of 950.05 and a low of 557.95, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish trend, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish stance on a monthly scale. The daily moving averages reflect a bearish sentiment, which may influence short-term trading strategies. When comparing the stock's performance to the Sensex, Shree Ganesh Remedies has shown a mixed return profile. Over the past week, the stock returned...

Read More

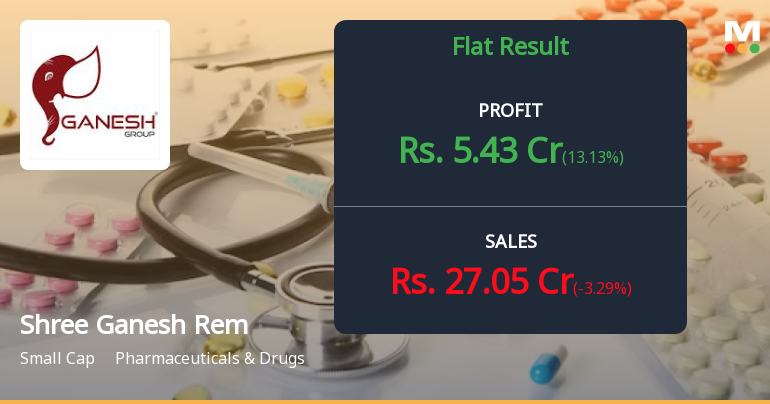

Shree Ganesh Remedies Reports Flat Q3 FY24-25 Results Amidst Technical Trend Shift

2025-02-10 19:04:16Shree Ganesh Remedies, a small-cap pharmaceutical company, recently experienced an evaluation adjustment amid flat financial performance for Q3 FY24-25. Despite this stability, the company boasts a strong return on equity of 21.8% and a low debt-to-equity ratio of 0.14, indicating solid financial health and rising promoter confidence.

Read More

Shree Ganesh Remedies Faces Stock Volatility Amid Broader Market Fluctuations

2025-02-06 15:05:24Shree Ganesh Remedies, a small-cap pharmaceutical company, has faced notable stock volatility, declining for two consecutive days and experiencing a significant drop today. Despite recent challenges, the stock has shown a positive trend over the past month, outperforming the broader market index, the Sensex.

Read More

Shree Ganesh Remedies Reports Stable Q3 FY24-25 Results Amid Score Evaluation Shift

2025-02-05 17:35:35Shree Ganesh Remedies has announced its financial results for the quarter ending February 2025, showing stable performance in Q3 FY24-25. However, the company's stock evaluation score has notably decreased, indicating a shift in the assessment of its financial standing, prompting potential scrutiny from stakeholders.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance Certificate u/s. 74 (5) of SEBI (DP) Regulations 2018

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Commissioning Of 2.5 MW Solar Power Project

25-Mar-2025 | Source : BSECommissioning of 2.5 MW Solar Power Project

Corporate Actions

No Upcoming Board Meetings

Shree Ganesh Remedies Ltd has declared 5% dividend, ex-date: 07 Sep 23

No Splits history available

Shree Ganesh Remedies Ltd has announced 1:5 bonus issue, ex-date: 01 Nov 21

Shree Ganesh Remedies Ltd has announced 7:100 rights issue, ex-date: 03 Feb 23