Shree Karthik Papers Faces Financial Struggles Amidst Industry Volatility and High Debt Levels

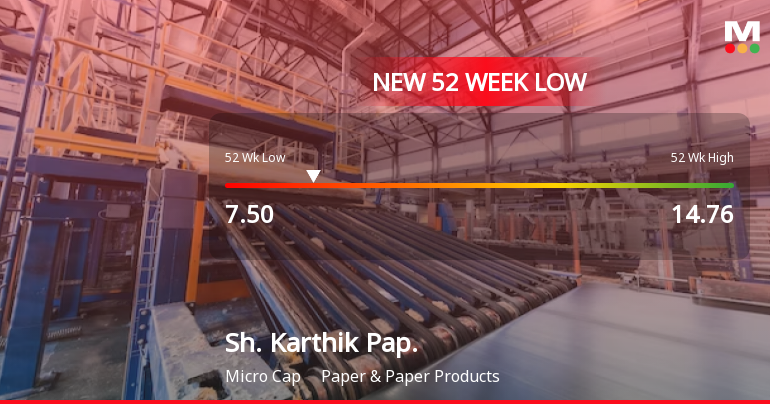

2025-03-18 09:49:26Shree Karthik Papers, a microcap in the Paper & Paper Products sector, has hit a new 52-week low amid significant volatility. The company faces challenges with a high debt-to-equity ratio and stagnant profits, while net sales have shown minimal growth, reflecting broader difficulties in its financial health.

Read More

Shree Karthik Papers Faces Financial Struggles Amidst Industry Volatility and High Debt Concerns

2025-03-18 09:49:25Shree Karthik Papers has faced notable volatility, reaching a new 52-week low amid underperformance in its sector. The company has experienced a significant decline in stock performance over the past year, coupled with concerns over its financial health, including a high debt-to-equity ratio and stagnant operating profit.

Read More

Shree Karthik Papers Faces Financial Struggles Amidst Industry Volatility and High Debt Concerns

2025-03-18 09:49:24Shree Karthik Papers, a microcap in the Paper & Paper Products sector, has hit a new 52-week low amid significant volatility and underperformance. The company faces challenges, including a high debt-to-equity ratio and stagnant sales, while profits have plummeted by 78% over the past year.

Read MoreShree Karthik Papers Experiences Valuation Grade Change Amidst Competitive Industry Pressures

2025-03-05 08:00:48Shree Karthik Papers, a microcap player in the Paper & Paper Products industry, has recently undergone a valuation adjustment. The company's current price stands at 8.75, reflecting a notable shift from its previous close of 8.01. Over the past year, Shree Karthik Papers has experienced a stock return of -26.90%, contrasting with a modest -1.19% return from the Sensex during the same period. Key financial metrics for Shree Karthik Papers include a PE ratio of 16.72 and an EV to EBITDA ratio of 27.36. The company's return on capital employed (ROCE) is reported at 4.48%, while the return on equity (ROE) is at 2.81%. These figures indicate a challenging performance landscape. In comparison to its peers, Shree Karthik Papers' valuation metrics appear less favorable. For instance, Kuantum Papers and Pudumjee Paper show significantly lower PE ratios and EV to EBITDA ratios, suggesting a more attractive valuatio...

Read More

Shree Karthik Papers Faces Significant Volatility Amidst Ongoing Market Challenges

2025-03-03 09:36:39Shree Karthik Papers has faced significant volatility, hitting a new 52-week low and underperforming its sector. The stock has declined consecutively over four days, with a total drop of 23.43%. Over the past year, it has decreased by 32.67%, contrasting sharply with the Sensex's minor decline.

Read MoreShree Karthik Papers Faces Bearish Technical Trends Amid Market Volatility

2025-02-25 10:32:50Shree Karthik Papers, a microcap player in the Paper & Paper Products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 9.74, slightly down from the previous close of 9.90. Over the past year, the stock has experienced significant volatility, with a 52-week high of 14.76 and a low of 8.50. The technical summary indicates a bearish sentiment in various indicators, including the MACD and moving averages, which suggest a cautious outlook. The Bollinger Bands and KST also reflect a mildly bearish trend on a monthly basis, while the RSI shows no signals on both weekly and monthly charts. In terms of performance, Shree Karthik Papers has shown mixed results compared to the Sensex. Over the past week, the stock returned 3.62%, contrasting with the Sensex's decline of 1.72%. However, on a longer-term basis, the stock has under...

Read MoreShree Karthik Papers Faces Stock Volatility Amid Broader Market Trends and Challenges

2025-02-25 09:57:26Shree Karthik Papers, a microcap player in the Paper & Paper Products industry, has experienced significant volatility in its stock performance today. The company's market capitalization stands at Rs 19.00 crore, with a price-to-earnings (P/E) ratio of 18.92, notably higher than the industry average of 12.00. Over the past year, Shree Karthik Papers has seen a decline of 25.86%, contrasting sharply with the Sensex, which has gained 2.21% during the same period. Today's trading session reflects a drop of 5.86% for the stock, while the Sensex has increased by 0.41%. In terms of longer-term performance, the company has faced challenges, with a year-to-date decline of 21.02% compared to the Sensex's 4.33% drop. However, the stock has shown resilience over a three-year horizon, boasting a gain of 55.85%, outpacing the Sensex's 33.83% increase. Technical indicators suggest a bearish sentiment in the short t...

Read MoreShree Karthik Papers Adjusts Valuation Amidst Competitive Industry Landscape

2025-02-24 12:57:25Shree Karthik Papers, a microcap player in the Paper & Paper Products industry, has recently undergone a valuation adjustment. The company's current price stands at 9.90, reflecting a slight increase from the previous close of 9.60. Over the past year, Shree Karthik Papers has experienced a stock return of -21.24%, contrasting with a modest gain of 1.96% in the Sensex. Key financial metrics reveal a PE ratio of 18.35 and an EV to EBITDA ratio of 28.54, indicating its market positioning relative to peers. The company's return on capital employed (ROCE) is reported at 4.48%, while the return on equity (ROE) is at 2.81%. In comparison to its industry peers, Shree Karthik Papers shows a more conservative valuation profile, with competitors like T N Newsprint and Satia Industries exhibiting significantly higher PE ratios and more favorable EV to EBITDA metrics. This evaluation revision highlights the company's...

Read More

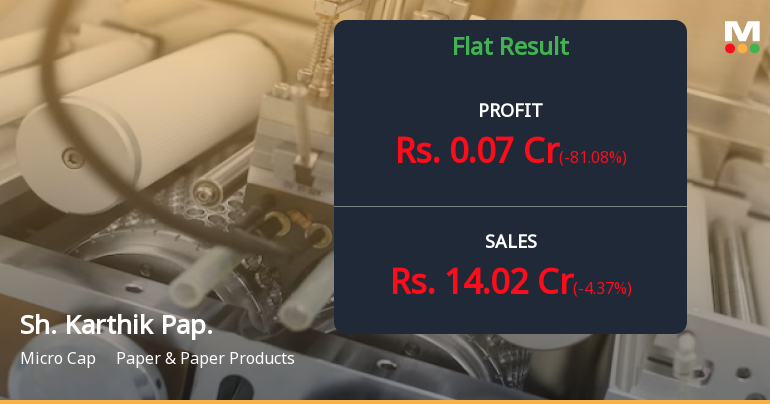

Shree Karthik Papers Reports Mixed Financial Results Amid Sales Challenges in February 2025

2025-02-17 13:47:24Shree Karthik Papers announced its financial results for the quarter ending December 2024, revealing flat performance overall. However, Profit After Tax for the nine-month period increased to Rs 0.45 crore. In contrast, quarterly net sales fell to Rs 14.02 crore, marking the lowest in five quarters.

Read MoreClosure of Trading Window

03-Apr-2025 | Source : BSEThe closure of Trading Window letter signed by MD is filed for taking on record

Integrated Filing (Financial)

23-Feb-2025 | Source : BSEThe Financial results of Decemmbers2024 of the outcome of the Board Meeting and resultss were already submittted on 14/02/2024. However due to non availaibility of integrated filing mode is not available on that date and now this integrfated filing is filed for 3 ;months and 11 months is filed for taking on record.

Board Meeting Outcome for Unaudited Financi Results For The Quarter And Nine Months Ended 31/12/2024

14-Feb-2025 | Source : BSEThe Board of Directors have approved the unaudited financial results for the quarter and nine months ended 31/12/2024

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available