Shreyans Industries Adjusts Valuation Amidst Ongoing Financial Challenges and Competitive Metrics

2025-04-02 08:10:28Shreyans Industries, a microcap in the Paper & Paper Products sector, has recently experienced a change in its evaluation status. Key financial metrics include a PE ratio of 5.08, a price-to-book value of 0.60, and a dividend yield of 2.89%, reflecting its competitive valuation despite recent operational challenges.

Read MoreShreyans Industries Adjusts Valuation Grade Amidst Competitive Market Positioning

2025-04-02 08:00:47Shreyans Industries, a microcap player in the Paper & Paper Products sector, has recently undergone a valuation adjustment. The company's current price stands at 172.80, reflecting a modest increase from the previous close of 167.35. Over the past year, Shreyans has faced challenges, with a stock return of -24.71%, contrasting with a 2.72% gain in the Sensex during the same period. Key financial metrics for Shreyans Industries include a PE ratio of 5.08 and an EV to EBITDA ratio of 1.26, indicating a competitive position within its industry. The company also boasts a dividend yield of 2.89% and a return on capital employed (ROCE) of 18.70%, which are noteworthy indicators of its operational efficiency. In comparison to its peers, Shreyans Industries presents a favorable valuation profile, particularly when contrasted with companies like Pudumjee Paper and T N Newsprint, which exhibit higher PE ratios and ...

Read More

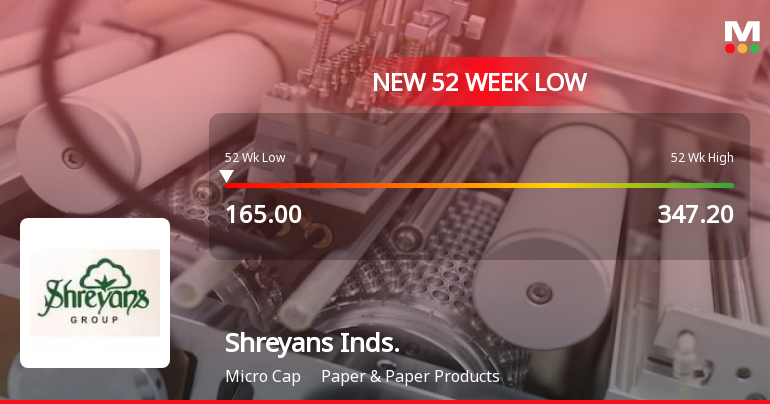

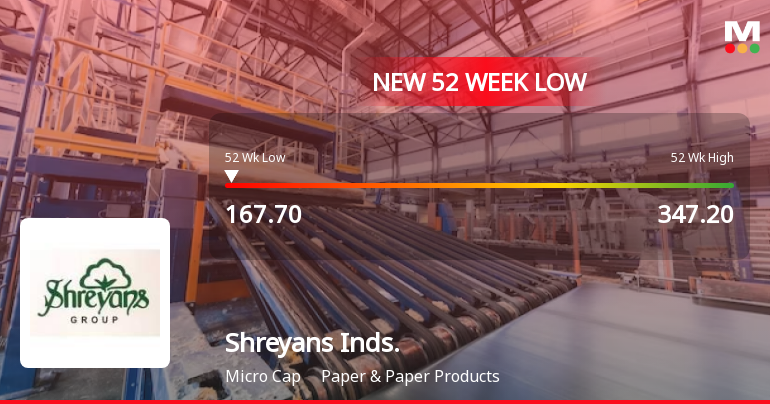

Shreyans Industries Faces Ongoing Challenges Amid Declining Profits and Market Underperformance

2025-03-28 14:37:30Shreyans Industries, a microcap in the Paper & Paper Products sector, has hit a new 52-week low and has underperformed its industry. The company faces declining profits, with negative results for five consecutive quarters and a significant drop in profit metrics. Technical indicators reflect a bearish trend amid ongoing financial challenges.

Read More

Shreyans Industries Faces Valuation Shift Amidst Declining Profitability Challenges

2025-03-25 08:07:55Shreyans Industries, a microcap in the Paper & Paper Products sector, has experienced a valuation adjustment reflecting changes in its financial standing. Key metrics include a PE ratio of 5.20 and a price-to-book value of 0.61, alongside a dividend yield of 2.82% and a ROCE of 18.70%.

Read More

Shreyans Industries Faces Valuation Shift Amid Declining Financial Performance and Market Challenges

2025-03-20 08:03:00Shreyans Industries, a microcap in the Paper & Paper Products sector, has experienced a change in its valuation grade, moving to an attractive status. Key financial metrics include a PE ratio of 5.22 and a dividend yield of 2.81%. However, the company has faced declining operating profits and recent negative performance.

Read MoreShreyans Industries Experiences Valuation Grade Change Amid Competitive Market Landscape

2025-03-20 08:00:12Shreyans Industries, a microcap player in the Paper & Paper Products sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 5.22 and a price-to-book value of 0.62, indicating a potentially favorable valuation relative to its earnings and assets. Additionally, Shreyans Industries shows a robust return on capital employed (ROCE) of 18.70% and a return on equity (ROE) of 11.78%, reflecting solid operational efficiency. In comparison to its peers, Shreyans Industries maintains a competitive edge with a lower PE ratio than several companies in the industry, such as Pudumjee Paper and Kuantum Papers, which have higher valuations. The company's enterprise value to EBITDA stands at 1.38, which is also more attractive than some competitors. Despite a challenging year-to-date return of -22.18%, Shreyans Industries has outperformed the Sensex over a t...

Read More

Shreyans Industries Faces Challenges Amidst Market Resilience and Declining Profits

2025-03-17 11:00:33Shreyans Industries, a microcap in the Paper & Paper Products sector, is nearing its 52-week low, reflecting a challenging year with a notable decline. Despite outperforming its sector today, the company has faced consistent financial difficulties, including declining profits and negative results over recent quarters, amid bearish technical indicators.

Read More

Shreyans Industries Faces Ongoing Financial Struggles Amid Declining Performance Metrics

2025-03-13 08:02:41Shreyans Industries, a microcap in the Paper & Paper Products sector, has faced ongoing financial difficulties, highlighted by a recent evaluation adjustment. The company has reported negative results for five consecutive quarters, with declining operating profits and a lagging stock performance compared to the broader market.

Read MoreShreyans Industries Experiences Valuation Grade Change Amidst Competitive Market Dynamics

2025-03-10 08:00:15Shreyans Industries, a microcap player in the Paper & Paper Products sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a price-to-earnings (P/E) ratio of 5.38 and a price-to-book value of 0.63, indicating a relatively low valuation compared to its peers. Additionally, Shreyans Industries shows an enterprise value to EBITDA ratio of 1.51 and an enterprise value to sales ratio of 0.14, which further highlights its market positioning. The company has a dividend yield of 2.73% and a return on capital employed (ROCE) of 18.70%, alongside a return on equity (ROE) of 11.78%. In comparison to its peers, Shreyans Industries presents a more favorable valuation profile, particularly when contrasted with companies like Kuantum Papers and T N Newsprint, which exhibit significantly higher P/E ratios and enterprise value metrics. Despite recent performance challenges, includin...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate for the quarter ended 31st March 2025

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

06-Feb-2025 | Source : BSENewspaper publication of financial results

Corporate Actions

No Upcoming Board Meetings

Shreyans Industries Ltd has declared 30% dividend, ex-date: 29 Jul 24

No Splits history available

No Bonus history available

No Rights history available