Shri Jagdamba Polymers Shows Strong Financial Performance Amid Positive Technical Outlook

2025-03-27 08:08:35Shri Jagdamba Polymers, a microcap in the packaging sector, has experienced a recent evaluation adjustment reflecting a bullish technical outlook. The company reported strong financial results, with net sales of Rs 240.26 crore and a high return on capital employed, while outperforming the broader market over the past year.

Read MoreShri Jagdamba Polymers Shows Strong Technical Trends Amid Market Volatility

2025-03-27 08:02:16Shri Jagdamba Polymers, a microcap player in the packaging industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 923.00, slightly above its previous close of 920.00, with a notable 52-week high of 1,020.00 and a low of 490.50. Today's trading saw a high of 945.00 and a low of 920.00, indicating some volatility. The technical summary for Shri Jagdamba Polymers shows a predominantly bullish outlook across various indicators. The MACD and Bollinger Bands are both bullish on weekly and monthly charts, suggesting a positive momentum. Additionally, moving averages on a daily basis also reflect a bullish trend, while the KST aligns with this sentiment on both weekly and monthly scales. The Dow Theory indicates a mildly bullish stance, which complements the overall technical picture. In terms of performance, the company has demonstrated si...

Read MoreShri Jagdamba Polymers Demonstrates Strong Market Position Amid Packaging Sector Growth

2025-03-26 18:00:06Shri Jagdamba Polymers, a microcap player in the packaging industry, has shown remarkable performance metrics that highlight its strong market position. Over the past year, the stock has surged by 65.93%, significantly outperforming the Sensex, which recorded a modest 6.65% gain during the same period. In the short term, the stock has also demonstrated resilience, with a 0.33% increase today, while the Sensex dipped by 0.93%. Over the past month, Shri Jagdamba Polymers has achieved a notable 25.92% rise, compared to the Sensex's 3.60% increase. Technical indicators reflect a bullish sentiment, with the MACD and Bollinger Bands signaling positive momentum on both weekly and monthly charts. The stock's moving averages are also in a bullish phase, reinforcing its upward trajectory. With a market capitalization of Rs 806.00 crore and a P/E ratio of 20.28, Shri Jagdamba Polymers continues to carve out a si...

Read MoreShri Jagdamba Polymers Adjusts Valuation Grade Amid Strong Market Performance and Metrics

2025-03-17 08:00:31Shri Jagdamba Polymers, a microcap player in the packaging industry, has recently undergone a valuation adjustment reflecting its financial metrics and market positioning. The company currently exhibits a price-to-earnings (P/E) ratio of 18.90 and a price-to-book value of 2.87, indicating its valuation relative to its earnings and assets. Additionally, its enterprise value to EBITDA stands at 11.73, while the enterprise value to sales is recorded at 1.59. The company's return on capital employed (ROCE) is reported at 19.65%, and its return on equity (ROE) is at 15.17%, showcasing its efficiency in generating profits from its capital and equity. In comparison to its peers, Shri Jagdamba Polymers maintains a competitive edge with a lower PEG ratio of 0.60, suggesting a favorable growth outlook relative to its valuation. When looking at stock performance, Shri Jagdamba Polymers has outperformed the Sensex ...

Read MoreShri Jagdamba Polymers Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-07 08:02:29Shri Jagdamba Polymers, a microcap player in the packaging industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 788.00, showing a notable increase from the previous close of 732.00. Over the past year, the stock has demonstrated a robust performance, with a return of 30.03%, significantly outperforming the Sensex, which recorded a mere 0.34% return during the same period. The technical summary indicates a mixed outlook, with bullish signals in the MACD and Bollinger Bands on both weekly and monthly charts. However, moving averages present a mildly bearish stance on a daily basis, suggesting some volatility in short-term trading. The KST also reflects bullish momentum, aligning with the overall positive sentiment in the longer term. In terms of price movement, the stock has seen a 52-week high of 1,020.00 and a low of 490.50, indic...

Read MoreShri Jagdamba Polymers Adjusts Valuation Amid Strong Performance in Packaging Sector

2025-03-07 08:01:00Shri Jagdamba Polymers, a microcap player in the packaging industry, has recently undergone a valuation adjustment. The company's current price stands at 788.00, reflecting a notable increase from the previous close of 732.00. Over the past year, the stock has demonstrated a return of 30.03%, significantly outperforming the Sensex, which recorded a modest gain of 0.34%. Key financial metrics for Shri Jagdamba Polymers include a PE ratio of 17.31 and an EV to EBITDA ratio of 10.74, indicating its market positioning within the sector. The company's return on capital employed (ROCE) is reported at 19.65%, while the return on equity (ROE) stands at 15.17%. These figures suggest a solid operational performance relative to its peers. In comparison to other companies in the packaging sector, Shri Jagdamba Polymers presents a competitive profile. For instance, while it maintains a lower PE ratio than some peers, ...

Read More

Shri Jagdamba Polymers Reports Strong Sales Growth Amid Market Evaluation Adjustments

2025-02-17 14:15:11Shri Jagdamba Polymers, a microcap in the packaging sector, has reported strong financial results for Q3 FY24-25, with net sales reaching Rs 240.26 crore. The company shows solid management efficiency and a robust financial foundation, although it has experienced slower long-term growth in operating profit.

Read More

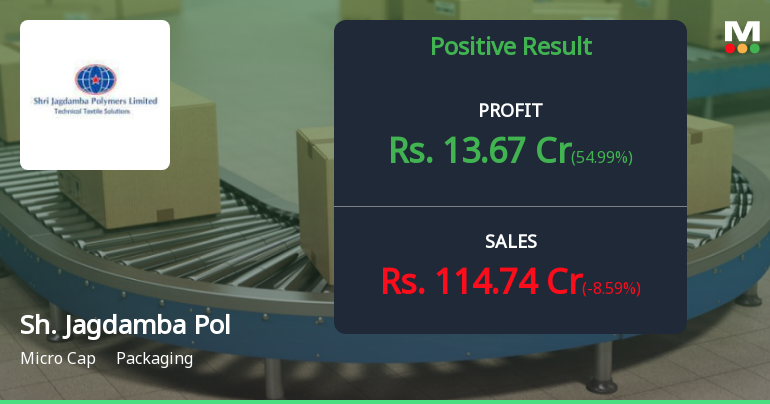

Shri Jagdamba Polymers Reports Strong Financial Growth in December 2024 Results

2025-02-15 13:28:29Shri Jagdamba Polymers has announced its financial results for the quarter ending December 2024, highlighting a year-on-year net sales increase of 53.67% to Rs 240.26 crore. The company also reported significant growth in profit before tax and profit after tax, alongside a notable rise in operating profit and earnings per share.

Read More

Shri Jagdamba Polymers Reports Strong Financial Metrics Amidst Growth Challenges in October 2023

2025-02-12 18:48:18Shri Jagdamba Polymers, a microcap in the packaging sector, has recently adjusted its evaluation amid strong financial performance, including a 25.14% return on capital employed and a low debt to EBITDA ratio. The company reported net sales of Rs 125.52 crore and declared a dividend of Rs 0.75 per share.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPursuant to Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 we herewith submit the confirmation certificate as received from the Registrar and Share Transfer Agent for the quarter ended March 31 2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEPursuant to the provisions of SEBI (PIT) Regulations 2015 as may be amended we would like to inform you that the Trading Window of the company will be closed for the Promoters Directors Designated persons and their immediate relatives with effect from April 1 2025 till the completion of 48 hours after the declaration of Audited Financial Results of the Company for the Quarter and Year ending on March 31 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSEPursuant to Regulation 33 read with regulation 47(3) of SEBI (LODR) Regulation 2015 please find enclosed newspaper publication of the extract of the Unaudited Financial Results of the company for the third quarter and nine months ended on December 31 2024 Published in Financial Express (English and Gujrati) Edition on Saturday February 15 2025

Corporate Actions

No Upcoming Board Meetings

Shri Jagdamba Polymers Ltd has declared 50% dividend, ex-date: 22 Sep 23

Shri Jagdamba Polymers Ltd has announced 1:10 stock split, ex-date: 01 Nov 17

No Bonus history available

No Rights history available