Shriram Pistons & Rings Shows Stabilization Amid Mixed Technical Indicators and Market Dynamics

2025-04-02 08:00:25Shriram Pistons & Rings, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1889.95, slightly down from the previous close of 1900.00. Over the past year, the stock has seen a high of 2,100.00 and a low of 1,651.00, indicating a range of performance amid fluctuating market conditions. The technical summary reveals a mixed picture, with various indicators such as MACD, RSI, and Bollinger Bands showing no definitive trends on both weekly and monthly bases. The moving averages and other technical metrics suggest a period of stabilization rather than significant movement. In terms of performance, Shriram Pistons has shown resilience compared to the Sensex. Over the past week, the stock returned 1.23%, while the Sensex experienced a decline of 2.55%. In the one-month period, the stock's return was 2.4...

Read MoreShriram Pistons & Rings Shows Technical Trend Changes Amid Market Volatility

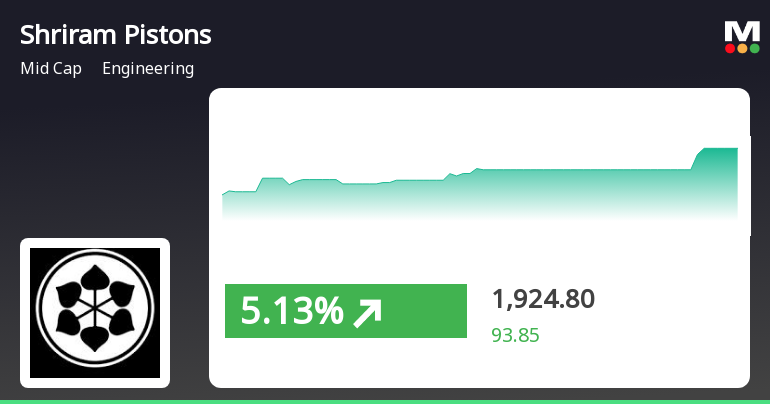

2025-03-25 08:00:15Shriram Pistons & Rings, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1887.05, showing a notable increase from the previous close of 1839.45. Over the past week, the stock has demonstrated a return of 5.72%, outperforming the Sensex, which recorded a return of 5.14% during the same period. The company's performance metrics indicate a 52-week high of 2,100.00 and a low of 1,651.00, highlighting its volatility and potential for growth. Today's trading saw a high of 1947.80 and a low of 1839.45, suggesting active market engagement. In terms of technical indicators, the stock's summary reveals a mildly bullish sentiment in the Dow Theory on a weekly basis, while other metrics such as MACD, RSI, and Bollinger Bands are being monitored for further insights. The On-Balance Volume (OBV) shows no si...

Read More

Shriram Pistons & Rings Outperforms Sector Amid Broader Market Recovery Trends

2025-03-21 10:30:16Shriram Pistons & Rings has experienced significant trading activity, outperforming its sector. The stock has reached an intraday high and is positioned above its short-term moving averages, while lagging behind longer-term ones. The broader market is recovering, with small-cap stocks leading gains.

Read MoreShriram Pistons & Rings Faces Technical Trend Shifts Amid Market Volatility

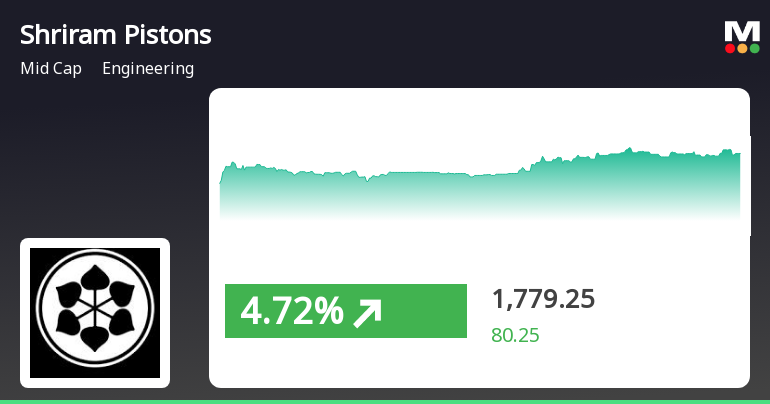

2025-03-06 08:00:09Shriram Pistons & Rings, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1800.00, showing a notable shift from its previous close of 1699.00. Over the past year, the stock has reached a high of 2,100.00 and a low of 1,651.00, indicating a degree of volatility. In terms of technical indicators, the company’s performance metrics, including MACD, RSI, and Bollinger Bands, are being closely monitored. The daily moving averages and other technical summaries suggest a complex market environment that investors should consider. When comparing the stock's performance to the Sensex, Shriram Pistons has experienced a decline of 5.2% over the past week and 9.5% over the past month, while the Sensex has seen a smaller drop of 1.17% and 5.80%, respectively. However, over a longer horizon, the stock has show...

Read More

Shriram Pistons & Rings Shows Short-Term Gains Amid Long-Term Market Challenges

2025-03-05 14:50:13Shriram Pistons & Rings saw a significant increase on March 5, 2025, reversing a two-day decline and outperforming the engineering sector. Despite today's gains, the stock remains below key moving averages and has experienced declines over the past week and month, indicating ongoing market challenges.

Read More

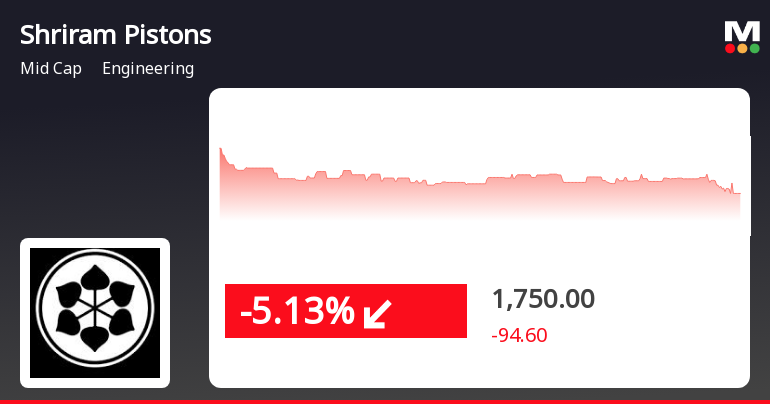

Shriram Pistons Faces Pressure Amid Broader Market Decline and Bearish Trends

2025-03-03 18:00:17Shriram Pistons & Rings saw a notable decline on March 3, 2025, closing near its 52-week low and underperforming its sector. The stock traded below multiple moving averages, indicating a bearish trend. In the broader market, the Nifty index experienced a slight drop, continuing its recent downward trajectory.

Read MoreShriram Pistons Faces Technical Trend Shifts Amid Market Volatility and Evaluation Revision

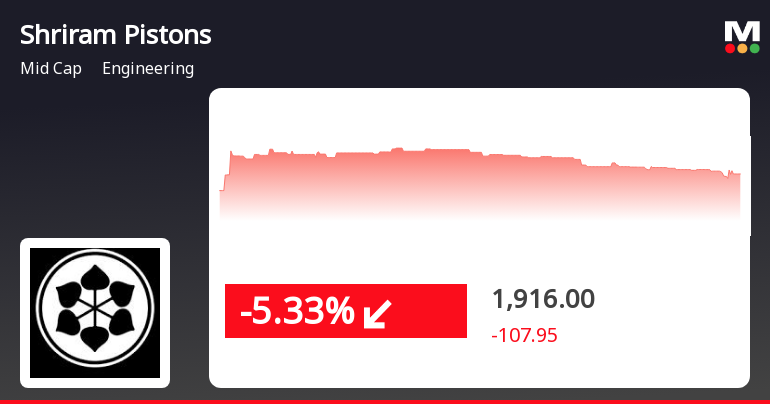

2025-02-25 10:26:03Shriram Pistons & Rings, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1887.00, down from a previous close of 1916.00, with a 52-week high of 2100.00 and a low of 1705.00. Today's trading saw a high of 1959.95 and a low of 1844.55, indicating some volatility. The technical summary reveals a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands present a mixed picture, with weekly readings indicating bearishness and monthly readings leaning towards a mildly bullish outlook. The KST also reflects a bearish stance on a weekly basis, while the monthly shows a mildly bearish trend. In terms of performance, Shriram Pistons has experienced a decline of 3.78% over the past week, contrasting with a 1.74% drop in the Sen...

Read MoreShriram Pistons & Rings Adjusts Valuation Grade Amid Strong Financial Performance Metrics

2025-02-25 10:22:38Shriram Pistons & Rings, a midcap player in the engineering sector, has recently undergone a valuation adjustment reflecting its financial performance and market position. The company currently exhibits a price-to-earnings (PE) ratio of 17.59 and an EV to EBITDA ratio of 11.27, indicating a competitive stance within its industry. Additionally, the firm boasts a robust return on capital employed (ROCE) of 37.45% and a return on equity (ROE) of 21.78%, showcasing its efficiency in generating profits relative to its equity base. In comparison to its peers, Shriram Pistons stands out with a favorable valuation profile. For instance, while Triveni Turbine is marked as very expensive with a PE ratio of 52.55, Shriram Pistons maintains a more attractive valuation. Other competitors like Craftsman Auto and Engineers India also reflect higher valuation metrics, positioning Shriram Pistons as a more appealing option...

Read More

Shriram Pistons Faces Significant Volatility Amid Broader Engineering Sector Challenges

2025-02-24 15:30:14Shriram Pistons & Rings, a midcap engineering firm, faced notable volatility with shares hitting a 52-week low amid broader market pressures. The stock underperformed its sector and is trading below key moving averages, reflecting ongoing challenges within the engineering sector and a difficult market environment.

Read MoreAnnouncement under Regulation 30 (LODR)-Updates on Acquisition

01-Apr-2025 | Source : BSEAs per attachment enclosed.

Closure of Trading Window

31-Mar-2025 | Source : BSEAs per attachment enclosed.

Announcement under Regulation 30 (LODR)-Change in Directorate

25-Mar-2025 | Source : BSEAs per attachment enclosed

Corporate Actions

No Upcoming Board Meetings

Shriram Pistons & Rings Ltd has declared 50% dividend, ex-date: 07 Feb 25

No Splits history available

Shriram Pistons & Rings Ltd has announced 1:1 bonus issue, ex-date: 24 Jul 23

No Rights history available