SignatureGlobal's Technical Indicators Signal Mixed Trends Amid Market Challenges

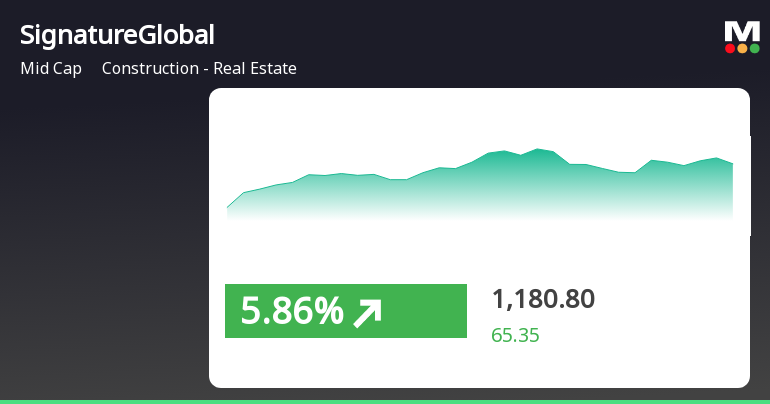

2025-04-02 08:10:29SignatureGlobal India, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1078.25, down from a previous close of 1090.90, with a notable 52-week high of 1,645.85 and a low of 1,010.95. Today's trading saw a high of 1098.50 and a low of 1072.05. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the moving averages also reflect a bearish stance. The Bollinger Bands present a bearish outlook weekly but are sideways on a monthly basis. Notably, the Dow Theory suggests a mildly bullish trend on a weekly basis, contrasting with other indicators. In terms of returns, SignatureGlobal has faced challenges compared to the Sensex. Over the past week, the stock has returned -5.99%, while the Sensex saw a dec...

Read MoreSignatureGlobal Faces Bearish Technical Trends Amid Market Volatility and Underperformance

2025-04-01 08:03:43SignatureGlobal India, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 1,090.90, has seen fluctuations with a 52-week high of 1,645.85 and a low of 1,010.95. Today's trading range was between 1,087.50 and 1,145.50, indicating some volatility. The technical summary for SignatureGlobal reveals a bearish sentiment across several indicators. The MACD and Bollinger Bands are signaling bearish trends on a weekly basis, while moving averages also reflect a bearish stance. The KST and Dow Theory show no significant trends, with the latter indicating a mildly bearish outlook on a monthly basis. The On-Balance Volume (OBV) is similarly showing no trend, suggesting a lack of strong buying or selling pressure. In terms of performance, SignatureGlobal's returns have lagged behind the Sensex over...

Read MoreSignatureGlobal India Faces Technical Challenges Amidst Market Resilience in Real Estate Sector

2025-03-28 08:04:14SignatureGlobal India, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1138.20, showing a slight increase from the previous close of 1135.05. Over the past year, the stock has experienced a decline of 13.91%, contrasting with a 6.32% gain in the Sensex, highlighting the challenges faced by the company in a competitive market. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the daily moving averages indicate a mildly bearish trend. The KST and Dow Theory also reflect a lack of strong upward momentum, with the weekly OBV showing no definitive trend. The RSI readings for both weekly and monthly periods indicate no significant signals at this time. Despite the recent challenges, SignatureGlobal has shown resilience with a 2....

Read MoreSignatureGlobal Faces Technical Challenges Amidst Market Underperformance and Short-Term Resilience

2025-03-27 08:04:10SignatureGlobal India, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1135.05, slightly down from its previous close of 1146.90. Over the past year, the stock has experienced a decline of 12.26%, contrasting with a 6.65% gain in the Sensex, highlighting a notable underperformance relative to the broader market. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the daily moving averages also reflect a similar trend. The KST and Dow Theory metrics indicate a lack of a definitive trend, with the RSI showing no signals on both weekly and monthly bases. Despite these technical challenges, SignatureGlobal has shown resilience in the short term, with a weekly return of 5.4%, outperforming the Sensex's 2.44% return in the same p...

Read MoreSignatureGlobal's Stock Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-24 08:03:07SignatureGlobal India, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1160.00, showing a notable increase from the previous close of 1115.45. Over the past week, the stock has demonstrated a return of 6.33%, outperforming the Sensex, which recorded a return of 4.17% in the same period. In terms of technical indicators, the MACD on a weekly basis remains bearish, while the daily moving averages indicate a mildly bearish sentiment. The Bollinger Bands also reflect a mildly bearish trend on a weekly basis. The On-Balance Volume (OBV) shows a consistent mildly bearish stance, suggesting a cautious market sentiment. Despite the recent fluctuations, SignatureGlobal's performance over the past month has yielded a return of 6.71%, again surpassing the Sensex's 2.12%. However, the y...

Read More

SignatureGlobal India Shows Strong Performance Amid Mixed Market Sentiment

2025-03-21 09:35:34SignatureGlobal India has experienced significant gains, outperforming its sector and achieving consecutive increases over two days. The stock reached an intraday high, indicating positive short-term momentum, while broader market trends show mixed signals, with small-cap stocks leading despite a slight decline in the Sensex.

Read More

SignatureGlobal India Faces Significant Volatility Amidst Declining Financial Metrics and Market Sentiment

2025-03-06 13:21:10SignatureGlobal India has faced notable volatility, hitting a 52-week low and experiencing a decline over the past year. Financial metrics indicate challenges, including a stagnant return on capital and decreasing net sales. Despite recent profit growth, market sentiment remains cautious amid broader trends in the small-cap sector.

Read More

SignatureGlobal Hits New Low Amid Broader Challenges in Real Estate Sector

2025-03-03 10:08:30SignatureGlobal India, a midcap construction and real estate firm, has reached a new 52-week low, marking its fourth consecutive day of losses. The stock has declined significantly over the past year, underperforming compared to the Sensex, and is trading below key moving averages, indicating ongoing challenges in the sector.

Read MoreSignatureGlobal Faces Continued Stock Volatility Amid Broader Market Trends

2025-02-17 09:55:19SignatureGlobal India, a midcap player in the construction and real estate sector, has experienced significant volatility in its stock performance today. The stock opened with a notable loss of 5.8%, reaching an intraday low of Rs 1100.05. This decline marks a continuation of a downward trend, as the stock has now fallen for five consecutive days, resulting in a total decrease of 12.79% over this period. In terms of market performance, SignatureGlobal underperformed its sector by 1.07% today, with a one-day performance decline of 2.95%, compared to the Sensex's decrease of 0.71%. Over the past month, however, the stock has shown a slight gain of 0.27%, while the Sensex has declined by 1.59%. Additionally, SignatureGlobal is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend in its stock performance. Investors and market watchers will be keen...

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

08-Apr-2025 | Source : BSEPress Release for Key Operational Updates

Key Operational Performance Of The Company For The FY25

08-Apr-2025 | Source : BSEKey Operational Updates for FY25

Closure of Trading Window

28-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available