Signet Industries Adjusts Valuation Grade Amidst Competitive Financial Metrics and Market Challenges

2025-03-18 08:00:11Signet Industries, a microcap player in the plastic products sector, has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics. The company currently boasts a price-to-earnings (P/E) ratio of 10.47 and a price-to-book value of 0.56, indicating a potentially favorable valuation relative to its assets. Additionally, its enterprise value to EBITDA stands at 5.62, while the enterprise value to sales is notably low at 0.38, suggesting efficient revenue generation. The company's return on capital employed (ROCE) is reported at 12.64%, and its return on equity (ROE) is at 5.30%, which are critical indicators of its operational efficiency and profitability. In comparison to its peers, Signet Industries presents a competitive edge with a lower P/E ratio than several companies in the sector, such as Arrow Greentech and Premier Polyfilm, which have higher valuations. Despite ...

Read More

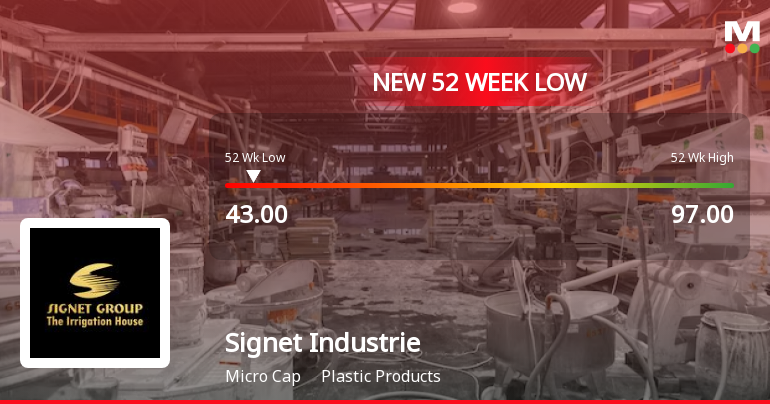

Signet Industries Faces Significant Challenges Amidst Declining Stock Performance and High Debt Levels

2025-03-17 15:37:22Signet Industries has faced notable volatility, reaching a new 52-week low. The company has seen a substantial decline over the past year, with financial metrics indicating challenges, including a high Debt to EBITDA ratio and low Return on Equity. Technical indicators suggest a bearish trend, highlighting ongoing performance hurdles.

Read More

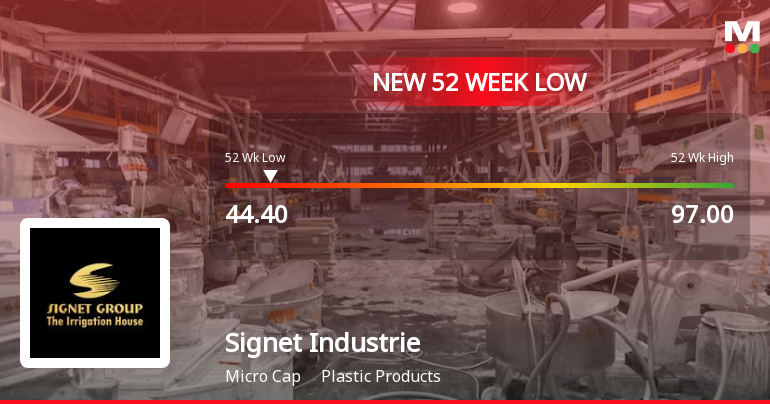

Signet Industries Faces Ongoing Challenges Amid Significant Stock Volatility and Poor Financial Metrics

2025-03-05 10:06:03Signet Industries has faced notable volatility, reaching a new 52-week low and marking its sixth consecutive day of decline. The company has underperformed its sector significantly over the past year, with concerning financial metrics, including a high Debt to EBITDA ratio and low Return on Equity, indicating ongoing challenges.

Read More

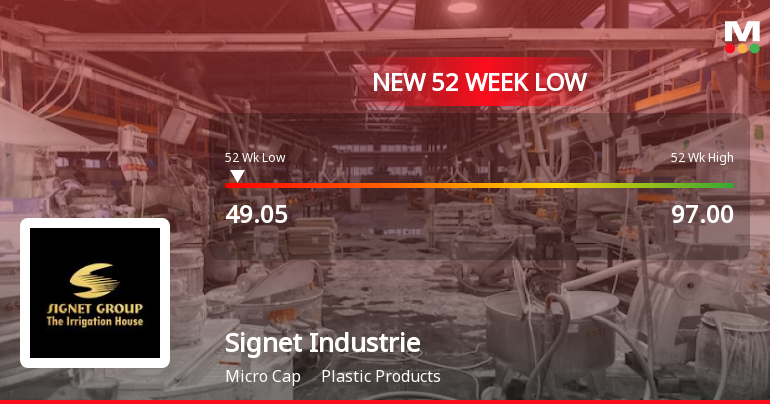

Signet Industries Faces Financial Struggles Amid Significant Stock Volatility and Declining Metrics

2025-03-04 15:35:49Signet Industries has faced notable volatility, reaching a new 52-week low and underperforming its sector. The company struggles with a high Debt to EBITDA ratio and a low Return on Equity. Over the past year, the stock has declined significantly, indicating a challenging market position.

Read More

Signet Industries Hits 52-Week Low Amid Ongoing Market Challenges and Decline

2025-03-03 09:35:46Signet Industries, a microcap in the plastic products sector, reached a new 52-week low today, reflecting ongoing challenges in its market position. The stock has declined 30.46% over the past year, significantly underperforming compared to the Sensex, which has seen only a minor decrease.

Read More

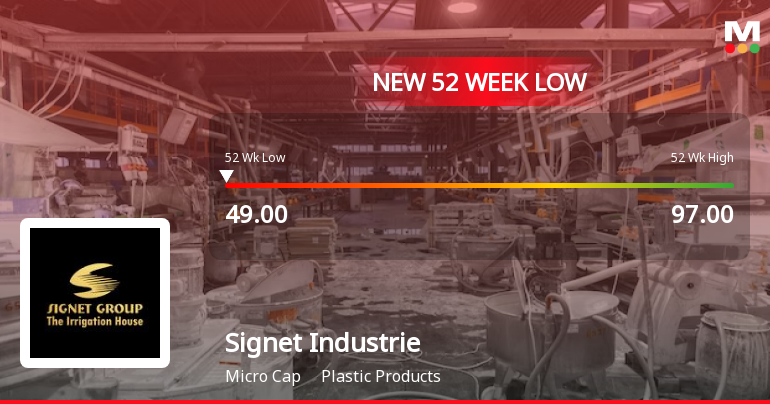

Signet Industries Faces Continued Volatility Amid Prolonged Underperformance in Market

2025-02-28 11:05:14Signet Industries, a microcap in the plastic products sector, has faced notable volatility, hitting a new 52-week low of Rs. 49. The stock has underperformed its sector and is trading below multiple moving averages, reflecting a significant decline of over 31% in the past year compared to the Sensex.

Read More

Signet Industries Faces Ongoing Challenges Amid Broader Market Gains and Volatility

2025-02-19 09:36:00Signet Industries, a microcap in the plastic products sector, has hit a new 52-week low, continuing a four-day decline. Despite outperforming its sector today, the stock remains below key moving averages and has seen a significant year-over-year decline, contrasting with the overall market's positive performance.

Read More

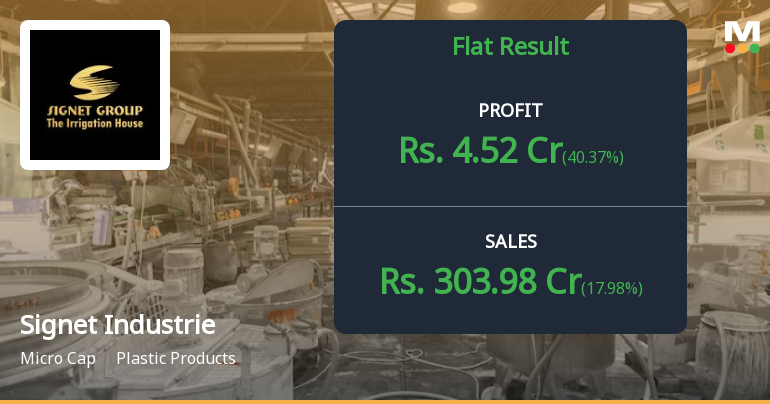

Signet Industries Reports Strong Financial Growth and Improved Profitability in December 2024 Results

2025-02-15 10:04:25Signet Industries has announced its financial results for the quarter ending December 2024, showcasing significant improvements. The company achieved its highest operating profit to interest ratio in five quarters, with profit before tax rising to Rs 5.90 crore and profit after tax reaching Rs 4.52 crore, reflecting strong growth.

Read More

Signet Industries Shows Short-Term Rebound Amid Long-Term Sector Challenges

2025-02-12 10:05:44Signet Industries has seen notable trading activity today, rebounding after four days of decline. The stock outperformed its sector amid high volatility, although it remains below key moving averages. Over the past year, the company has faced significant challenges, contrasting with broader market trends.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg 74(5) of DP regulations

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Apr-2025 | Source : BSENews paper Publication of Postal Ballot results

Closure of Trading Window

31-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Signet Industries Ltd has declared 5% dividend, ex-date: 17 Sep 24

Signet Industries Ltd has announced 10:10 stock split, ex-date: 13 Aug 18

Signet Industries Ltd has announced 5:1 bonus issue, ex-date: 18 Nov 10

No Rights history available