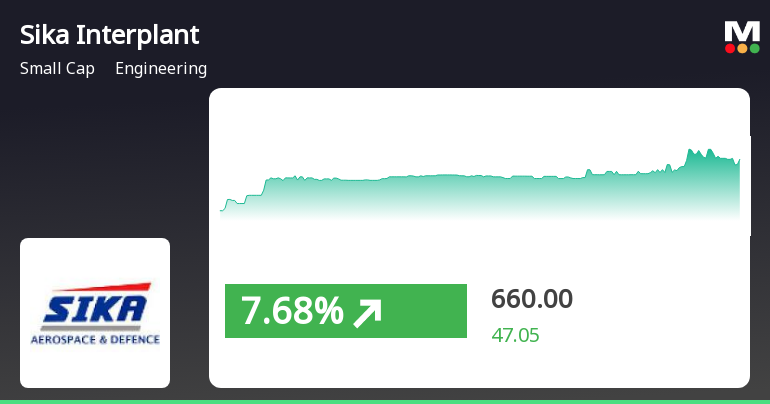

Sika Interplant Systems Shows Strong Reversal Amid Broader Market Volatility

2025-04-03 12:45:16Sika Interplant Systems experienced notable activity, reversing a two-day decline with a significant intraday high. The stock demonstrated high volatility and is trading above multiple moving averages, reflecting strong short- to medium-term performance. Over the past month and year, it has significantly outperformed the broader market indices.

Read MoreSika Interplant Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:04:39Sika Interplant Systems, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 635.00, slightly down from its previous close of 639.95. Over the past year, Sika Interplant has demonstrated significant resilience, with a remarkable return of 87.61%, far surpassing the Sensex's modest gain of 2.72% during the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal on a weekly basis but leans bearish monthly. Bollinger Bands suggest a mildly bullish sentiment in both weekly and monthly assessments. Moving averages reflect a mildly bearish stance on a daily basis, while the KST shows a bullish weekly trend but a mildly bearish monthly perspective. Notably, Sika Interpl...

Read More

Sika Interplant Systems Faces Technical Shift Amid Strong Financial Performance

2025-04-02 08:03:44Sika Interplant Systems has experienced a recent evaluation adjustment due to changes in its technical trends. Despite a strong annual return of 87.61% and a 15.35% increase in net profit, the stock's valuation appears high, with a Price to Book Value ratio of 11.6, indicating a premium compared to peers.

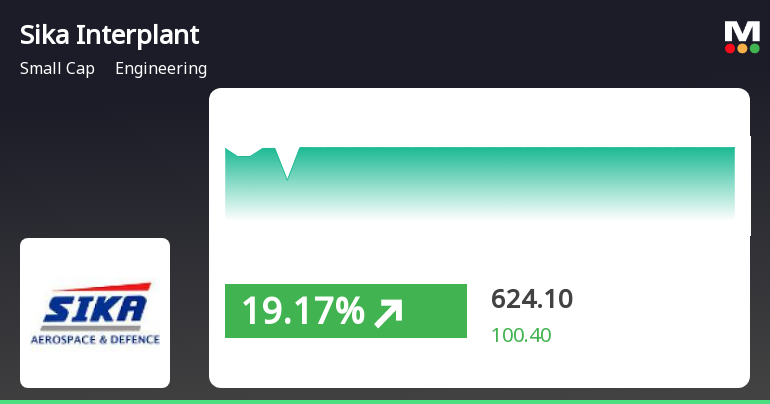

Read MoreSika Interplant Systems Ltd Achieves Remarkable 19.17% Surge Amid Strong Buying Activity

2025-03-25 09:35:17Sika Interplant Systems Ltd is currently witnessing significant buying activity, with the stock showing a remarkable performance compared to the broader market. Today, the stock surged by 19.17%, significantly outperforming the Sensex, which only gained 0.42%. Over the past week, Sika Interplant has recorded a 20.60% increase, while the Sensex rose by 3.99%. This upward trend is evident over multiple time frames, with a one-month gain of 21.18% against the Sensex's 4.97%, and an impressive annual performance of 117.94% compared to the Sensex's 7.52%. The stock has been on a consecutive gain streak for the last three days, accumulating a total return of 21.43% during this period. It opened today with a gap up of 19.17% and reached an intraday high of Rs 624.1. Additionally, Sika Interplant is trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating strong momentum. The buyin...

Read More

Sika Interplant Systems Achieves Notable Stock Surge Amid Strong Market Trends

2025-03-25 09:35:14Sika Interplant Systems has seen notable activity, with a significant stock increase today, outperforming its sector. The stock has gained consistently over three days, achieving a total return of 21.43%. It is trading above key moving averages, reflecting strong performance in the engineering sector amidst a positive broader market.

Read More

Sika Interplant Systems Shows Stabilization Amid Strong Profit Growth and Premium Valuation

2025-03-25 08:03:18Sika Interplant Systems has recently experienced a change in evaluation, indicating a shift in its technical trend. The company reported a 15.35% increase in net profit for the quarter ending December 2024 and achieved record net sales of Rs 37.98 crore, reflecting consistent positive performance over recent quarters.

Read MoreSika Interplant Systems Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:02:27Sika Interplant Systems, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 523.70, showing a slight increase from the previous close of 523.50. Over the past year, Sika Interplant has demonstrated significant performance, with a remarkable return of 82.88%, compared to a modest 7.07% return from the Sensex. The technical summary indicates a mixed outlook, with the MACD showing bullish signals on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents a bearish stance on a monthly basis, yet there are bullish indicators from the Bollinger Bands on both weekly and monthly charts. Moving averages reflect a mildly bearish trend daily, while the KST shows a mildly bullish trend weekly. In terms of stock performance, Sika Interplant has outperf...

Read More

Sika Interplant Systems Shows Strong Short-Term Gains Amid Mixed Technical Indicators

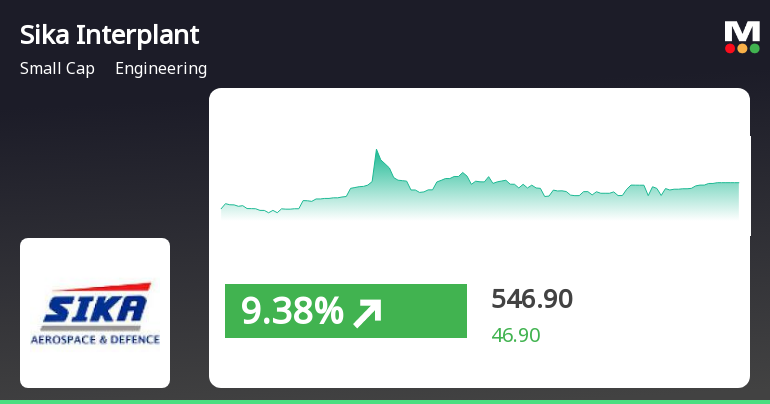

2025-03-17 10:05:14Sika Interplant Systems has seen a notable rise in stock performance, gaining 9.77% on March 17, 2025, and achieving a total return of 15.67% over two days. Despite this surge, the stock remains below key moving averages, indicating a mixed technical outlook amid broader market gains.

Read MoreSika Interplant Systems Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-06 08:01:08Sika Interplant Systems, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2419.20, showing a slight increase from the previous close of 2400.00. Over the past year, Sika Interplant has demonstrated a notable performance, with a return of 50.32%, significantly outperforming the Sensex, which recorded a mere 0.07% return in the same period. In terms of technical indicators, the MACD reflects a bearish stance on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages also suggest a mildly bearish trend on a daily basis, while the KST remains bearish weekly and mildly bearish monthly...

Read MoreClosure of Trading Window

03-Apr-2025 | Source : BSEClosure of Trading Window

Appointment As Radiant Power Corp Authorized Repair Station

03-Apr-2025 | Source : BSEAppointment as Radiant Power Corp Authorized Repair Station

Announcement under Regulation 30 (LODR)-Updates on Acquisition

10-Mar-2025 | Source : BSEUpdates On Acquisition

Corporate Actions

No Upcoming Board Meetings

Sika Interplant Systems Ltd has declared 100% dividend, ex-date: 06 Sep 24

Sika Interplant Systems Ltd has announced 2:10 stock split, ex-date: 17 Mar 25

No Bonus history available

No Rights history available