Silver Touch Technologies Faces Mixed Technical Indicators Amid Market Uncertainty

2025-04-02 08:09:18Silver Touch Technologies, a microcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD showing bearish tendencies on a weekly basis while indicating a mildly bearish stance monthly. The Relative Strength Index (RSI) remains neutral, signaling no significant momentum in either direction. Bollinger Bands suggest a mildly bearish trend on a weekly basis, while moving averages also align with this sentiment. The KST and Dow Theory indicate no clear trends, further emphasizing the current market uncertainty. In terms of performance, Silver Touch Technologies has shown resilience compared to the Sensex over various periods. Over the past week, the stock returned 1.89%, contrasting with a decline of 2.55% in the Sensex. In the one-month frame, the stock's return was ...

Read MoreSilver Touch Technologies Faces Bearish Technical Trends Amid Market Volatility

2025-04-01 08:03:23Silver Touch Technologies, a microcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 640.00, down from a previous close of 657.50, with a 52-week high of 869.95 and a low of 621.00. Today's trading saw a high of 653.35 and a low of 623.25, indicating some volatility. The technical summary for Silver Touch reveals a bearish sentiment across several indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly periods. Moving averages indicate a bearish trend on a daily basis, and the KST is bearish on a weekly basis. The Dow Theory presents a mixed view, with a mildly bullish weekly trend contrasted by a mildly bearish monthly outlook. In terms of performance, the company's returns ...

Read MoreSilver Touch Technologies Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-28 08:03:51Silver Touch Technologies, a microcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD and Bollinger Bands signaling bearish trends on both weekly and monthly bases, while the moving averages indicate a mildly bearish stance on a daily timeframe. The stock is currently priced at 657.50, showing a slight increase from the previous close of 647.35. Over the past year, Silver Touch has experienced a stock return of 2.51%, which is notably lower than the Sensex's return of 6.32% during the same period. Year-to-date, the stock has seen a decline of 6.87%, contrasting with the Sensex's minor drop of 0.68%. In terms of performance metrics, the stock reached a 52-week high of 869.95 and a low of 621.00, indicating some volatility. The recent trends suggest that while t...

Read MoreSilver Touch Technologies Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-26 08:04:31Silver Touch Technologies, a microcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 655.40, slightly down from the previous close of 658.70. Over the past year, Silver Touch has shown a return of 4.26%, which is notably lower than the Sensex's return of 7.12% during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators reflect a mildly bearish outlook. The daily moving averages also align with this trend, indicating a consistent pattern in the stock's performance. The Relative Strength Index (RSI) shows no significant signals, suggesting a period of consolidation. When comparing the company's performance to the Sensex, it is evident that while Silver Touch has experienced some fluctuations, it has n...

Read MoreSilver Touch Technologies Faces Technical Trend Shifts Amid Market Volatility

2025-03-24 08:02:48Silver Touch Technologies, a microcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 663.90, showing a notable change from the previous close of 649.85. Over the past year, the stock has reached a high of 869.95 and a low of 621.00, indicating a degree of volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral, with no significant signals detected in both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend weekly, while the monthly trend is sideways. Moving averages also reflect a mildly bearish sentiment on a daily basis. When comparing the company's performance to the Sensex, Silver Touch Technologies ha...

Read MoreSilver Touch Technologies Adjusts Valuation Amid Competitive IT Software Landscape

2025-03-13 08:00:48Silver Touch Technologies, a microcap player in the IT software sector, has recently undergone a valuation adjustment. The company's current price stands at 662.40, reflecting a notable increase from the previous close of 630.05. Over the past year, Silver Touch has experienced a stock return of -2.15%, contrasting with a slight gain of 0.49% in the Sensex. Key financial metrics for Silver Touch include a PE ratio of 43.52 and an EV to EBITDA ratio of 23.63, which position it within a competitive landscape. The company's return on capital employed (ROCE) is reported at 20.47%, while the return on equity (ROE) stands at 15.65%. These figures indicate a solid operational performance relative to its peers. In comparison, companies like NINtec Systems and Ksolves India exhibit higher valuation metrics, with PE ratios of 60.03 and 22.48, respectively. Meanwhile, InfoBeans Technologies presents a more attractiv...

Read MoreSilver Touch Technologies Adjusts Valuation Amid Competitive IT Software Landscape

2025-03-13 08:00:48Silver Touch Technologies, a microcap player in the IT software sector, has recently undergone a valuation adjustment. The company's current price stands at 662.40, reflecting a notable increase from the previous close of 630.05. Over the past year, Silver Touch has experienced a stock return of -2.15%, contrasting with a slight gain of 0.49% in the Sensex. Key financial metrics for Silver Touch include a PE ratio of 43.52 and an EV to EBITDA ratio of 23.63, which position it within a competitive landscape. The company's return on capital employed (ROCE) is reported at 20.47%, while the return on equity (ROE) stands at 15.65%. These figures indicate a solid operational performance relative to its peers. In comparison, companies like NINtec Systems and Ksolves India exhibit higher valuation metrics, with PE ratios of 60.03 and 22.48, respectively. Meanwhile, InfoBeans Technologies presents a more attractiv...

Read More

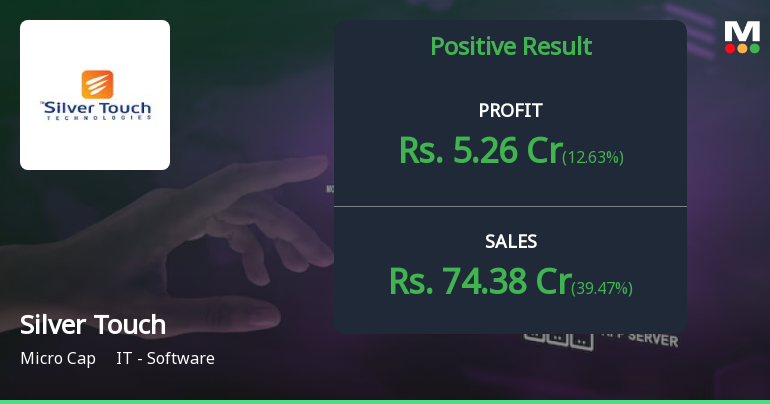

Silver Touch Technologies Reports Strong Q3 Growth Amid Score Adjustment

2025-01-31 22:02:48Silver Touch Technologies has announced its financial results for the quarter ending December 2024, showing significant growth in key metrics. The Profit After Tax for the nine-month period reached Rs 12.98 crore, up 33.13% year-on-year, while quarterly net sales rose to Rs 74.38 crore, reflecting a 39.47% increase. The Debtors Turnover Ratio also improved, reaching 3.27 times.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEEnclosed herewith Certificate under Reg. 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the Fourth Quarter and Financial Year ended 31st March 2025 as received from MUFG Intime India Pvt. Ltd.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Vipul Haridas Thakkar

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Vipul Haridas Thakkar

Corporate Actions

No Upcoming Board Meetings

Silver Touch Technologies Ltd has declared 5% dividend, ex-date: 05 Sep 24

No Splits history available

No Bonus history available

No Rights history available