Sinclairs Hotels Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-04-01 08:00:30Sinclairs Hotels has recently undergone a valuation adjustment, reflecting its current standing in the competitive landscape of the hotel, resort, and restaurant industry. The company’s price-to-earnings ratio stands at 26.99, while its price-to-book value is recorded at 3.77. Other key financial metrics include an EV to EBIT ratio of 30.03 and an EV to EBITDA ratio of 21.79, indicating its operational performance relative to its enterprise value. In terms of returns, Sinclairs Hotels has faced challenges, with a year-to-date return of -33.45%, contrasting with a slight decline in the Sensex of -0.93% during the same period. Over the past five years, however, the company has shown significant growth, achieving a return of 363.49%, outperforming the Sensex, which recorded a return of 159.65%. When compared to its peers, Sinclairs Hotels presents a mixed picture. While it holds a higher valuation in terms o...

Read MoreSinclairs Hotels Experiences Valuation Grade Change Amid Competitive Industry Dynamics

2025-03-17 08:00:42Sinclairs Hotels, a microcap player in the hotel, resort, and restaurant industry, has recently undergone a valuation adjustment. The company's current price stands at 83.60, down from a previous close of 86.50, with a 52-week high of 145.00 and a low of 73.25. Key financial metrics reveal a PE ratio of 27.59 and an EV to EBITDA of 22.34, indicating a competitive positioning within its sector. In comparison to its peers, Sinclairs Hotels shows a relatively higher PE ratio than Kamat Hotels and Advani Hotels, which have lower valuations. However, it lags behind HLV and Robust Hotels, which exhibit higher EV to EBITDA ratios. The company's return metrics illustrate a challenging performance, with a year-to-date decline of 31.95%, contrasting with the Sensex's drop of 5.52% over the same period. Despite this, Sinclairs Hotels has demonstrated significant growth over longer time frames, with a 10-year return o...

Read MoreSinclairs Hotels Adjusts Valuation Grade Amidst Competitive Industry Dynamics

2025-03-06 08:00:58Sinclairs Hotels, a microcap player in the hotel, resort, and restaurant industry, has recently undergone a valuation adjustment reflecting its current market standing. The company's price-to-earnings ratio stands at 29.66, while its price-to-book value is noted at 4.14. Other key metrics include an EV to EBIT ratio of 33.39 and an EV to EBITDA ratio of 24.22, indicating a robust operational performance relative to its valuation. In comparison to its peers, Sinclairs Hotels presents a unique position. While it is categorized as very expensive, competitors like HLV and Kamat Hotels are rated as attractive, showcasing a diverse range of valuations within the sector. Notably, Sinclairs Hotels has a return on capital employed (ROCE) of 23.72% and a return on equity (ROE) of 13.96%, which are significant indicators of its financial health. The company's stock performance has shown variability, with a year-to-d...

Read More

Sinclairs Hotels Faces Sustained Decline Amid Broader Industry Challenges

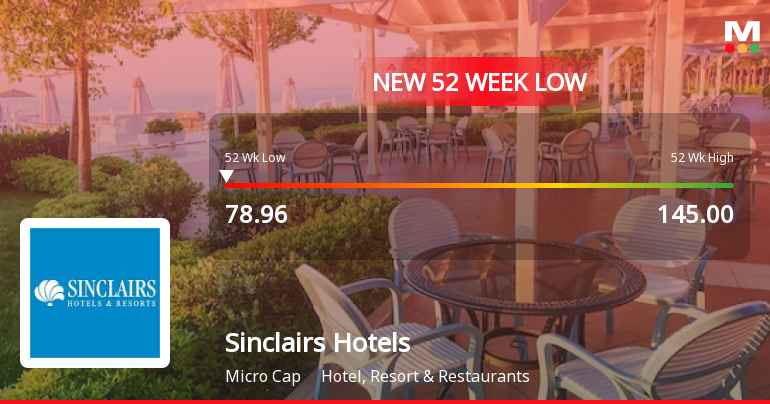

2025-03-03 10:07:56Sinclairs Hotels has faced significant volatility, hitting a new 52-week low and experiencing consecutive losses over the past six days. The company's stock has declined sharply over the past year, underperforming compared to the broader market, and is trading below key moving averages, indicating ongoing challenges.

Read More

Sinclairs Hotels Hits New Low Amid Broader Industry Challenges and Volatility

2025-02-28 12:35:25Sinclairs Hotels has reached a new 52-week low, reflecting a significant decline over the past week and year-to-date. The stock has shown high volatility during trading, falling below key moving averages. The broader Hotel, Resort & Restaurants sector is also experiencing challenges, contributing to the company's struggles.

Read MoreSinclairs Hotels Faces Short-Term Volatility Amid Long-Term Growth Potential

2025-02-28 10:25:08Sinclairs Hotels, a microcap player in the Hotel, Resort & Restaurants industry, has experienced significant volatility in its stock performance. As of today, the company's market capitalization stands at Rs 414.80 crore, with a price-to-earnings (P/E) ratio of 28.14, notably lower than the industry average of 66.00. Over the past year, Sinclairs Hotels has seen a decline of 34.05%, contrasting sharply with the Sensex, which has gained 1.99% during the same period. Today's trading session reflects a drop of 5.07%, while the Sensex fell by 1.17%. The stock's performance over the past week and month also shows a downward trend, with losses of 12.90% and 12.09%, respectively. Despite these short-term challenges, Sinclairs Hotels has demonstrated resilience over longer time frames, boasting a remarkable 104.99% increase over three years and an impressive 181.95% rise over five years. Technical indicators sugg...

Read More

Sinclairs Hotels Faces Persistent Bearish Trend Amid Significant Market Volatility

2025-02-17 14:10:47Sinclairs Hotels has faced significant volatility, hitting a new 52-week low of Rs. 80 after eight consecutive days of decline. The stock has underperformed its sector and is trading below all major moving averages, reflecting ongoing challenges in the market, with a year-over-year decline of 35.37%.

Read More

Sinclairs Hotels Hits 52-Week Low Amid Sustained Sector Underperformance

2025-02-12 10:06:54Sinclairs Hotels has hit a new 52-week low, reflecting significant volatility and a 13.67% decline over the past five days. The stock is trading below all major moving averages, and its performance has dropped 32.54% over the past year, contrasting with the broader market's gains.

Read More

Sinclairs Hotels Reports Q3 FY24-25 Results Amidst Financial Performance Shift

2025-01-31 15:32:34Sinclairs Hotels has announced its financial results for the quarter ending January 2025, revealing a significant change in performance metrics for Q3 FY24-25. The company's score has been adjusted, indicating that financial expectations were not met, prompting stakeholders to monitor future developments closely.

Read MoreBoard Meeting Outcome for Outcome Of Board Meeting

27-Mar-2025 | Source : BSEOutcome of Board Meeting

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

01-Feb-2025 | Source : BSENewspaper Advertisement of Unaudited Financial Results for quarter ended December 31 2024 is enclosed

Corporate Actions

No Upcoming Board Meetings

Sinclairs Hotels Ltd has declared 50% dividend, ex-date: 11 Jul 24

Sinclairs Hotels Ltd has announced 2:10 stock split, ex-date: 17 Jun 20

Sinclairs Hotels Ltd has announced 1:1 bonus issue, ex-date: 29 Jan 24

No Rights history available