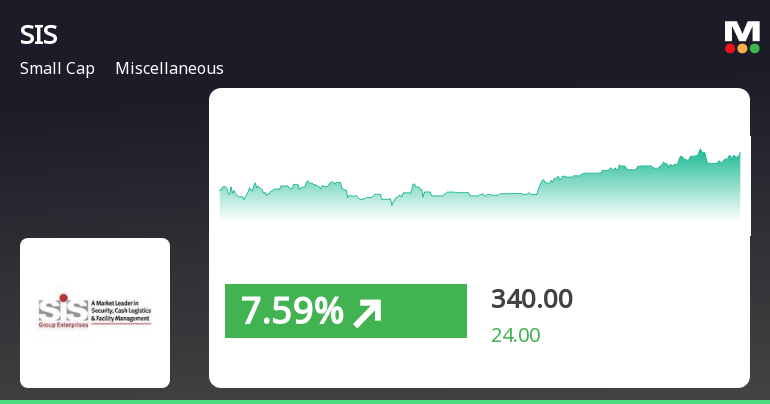

SIS Stock Evaluation Revision Highlights Mixed Technical Trends Amid Market Fluctuations

2025-03-27 08:03:38SIS, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 330.45, down from a previous close of 342.00, with a 52-week range between 289.20 and 484.00. Today's trading saw a high of 339.10 and a low of 328.20. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. The Relative Strength Index (RSI) has not signaled any significant movement in either timeframe. Bollinger Bands and moving averages suggest a mildly bearish stance, particularly on the daily chart. Additionally, the KST and OBV metrics reflect bearish trends on a monthly basis, with a mildly bullish outlook on the weekly for OBV. In terms of performance, SIS has shown notable returns compared to the Sense...

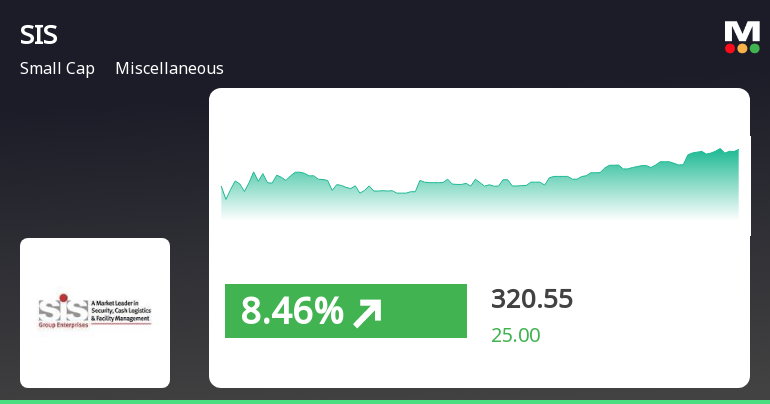

Read MoreSIS Stock Shows Mixed Technical Signals Amid Market Challenges and Recent Resilience

2025-03-26 08:04:27SIS, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 342.00, showing a slight increase from the previous close of 339.10. Over the past year, SIS has faced challenges, with a notable decline of 22.33% compared to a 7.12% gain in the Sensex, highlighting a significant underperformance relative to the broader market. In terms of technical indicators, the weekly MACD suggests a mildly bullish trend, while the monthly perspective indicates bearish momentum. The Relative Strength Index (RSI) shows no clear signals on both weekly and monthly charts, indicating a lack of strong directional movement. Bollinger Bands and moving averages also reflect a mildly bearish stance on a daily basis, further emphasizing the stock's current challenges. Despite these technical signals, SIS has demonstrated ...

Read MoreSIS Experiences Technical Indicator Shifts Amidst Mixed Market Signals

2025-03-25 08:05:42SIS, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock currently trades at 339.10, showing a notable increase from its previous close of 316.00. Over the past week, SIS has experienced a high of 341.40 and a low of 324.10, indicating some volatility in its trading range. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. Similarly, the Bollinger Bands and moving averages indicate a mildly bearish stance on both weekly and daily charts. The KST and OBV metrics present a bearish outlook on a monthly basis, with no significant trends observed in the weekly timeframe. In terms of performance, SIS has shown a strong return of 14.97% over the past week, significantly outperforming the Sen...

Read More

SIS Ltd Experiences Notable Stock Surge Amid Broader Market Gains

2025-03-24 15:20:23SIS Ltd, a small-cap company in the miscellaneous sector, experienced notable activity on March 24, 2025, with a significant gain. The stock has shown a strong upward trend over the past three days, outperforming its sector. However, its long-term performance reflects a decline compared to the broader market.

Read More

SIS Ltd Experiences Notable Stock Surge Amid High Volatility and Market Rebound

2025-03-21 11:05:25SIS Ltd, a small-cap company in the miscellaneous sector, has seen notable stock activity, gaining 8.19% today and achieving a two-day gain of 9.14%. Despite this, the stock has experienced high volatility and remains below several long-term moving averages. The broader market shows a rebound, with small-cap stocks leading.

Read MoreSIS Ltd Opens Strong with 11.69% Gain, Outperforming Sector Amid Mixed Trends

2025-03-21 09:35:16SIS Ltd, a small-cap company in the miscellaneous industry, has shown significant activity today, opening with a notable gain of 11.69%. This surge has allowed the stock to outperform its sector by 5.35%. Over the past two days, SIS has demonstrated a positive trend, accumulating a total return of 7.61%. During intraday trading, SIS reached a high of Rs 330.15, reflecting an increase of 11.71%. However, while the stock's performance today stands at 6.14%, it contrasts with a decline of 4.87% over the past month, compared to a modest gain of 1.43% in the Sensex. In terms of technical indicators, SIS is currently positioned above its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day moving averages. The stock is classified as high beta, with an adjusted beta of 1.35, indicating that it tends to experience larger fluctuations compared to the broader market. Despite today's gain...

Read More

SIS Ltd Faces Continued Volatility Amid Weak Long-Term Growth Outlook

2025-03-19 15:37:02SIS Ltd has faced notable volatility, reaching a new 52-week low and underperforming its sector. The stock has declined over the past three days and shows a significant year-over-year drop. Despite strong management efficiency and low debt levels, the long-term growth outlook remains weak.

Read More

SIS Ltd Faces Significant Volatility Amid Broader Market Resilience and Strong Management Efficiency

2025-03-18 12:06:08SIS Ltd has faced notable volatility, reaching a new 52-week low and underperforming its sector. Despite a strong management efficiency and positive financial metrics, the company's one-year return remains negative, contrasting with broader market gains. Technical indicators suggest ongoing concerns about its long-term growth potential.

Read More

SIS Ltd Faces Significant Stock Volatility Amidst Ongoing Financial Challenges

2025-03-17 14:37:27SIS Ltd has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. Over the past year, the stock has declined substantially, while the company has faced challenges with negative operating profit growth. Despite this, SIS shows strong operational metrics and effective debt management.

Read MoreAnnouncement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

09-Apr-2025 | Source : BSEThe Nomination and Remuneration Committee of the Company has considered and approved the allotment of 74102 Equity Shares of Rs. 5 Each under the Employee Stock Option Plan of the Company.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018

Intimation Regarding The Income Tax Order

03-Apr-2025 | Source : BSEDisclosure regarding the order received from the Assessment Unit Income Tax Department.

Corporate Actions

No Upcoming Board Meetings

SIS Ltd has declared 40% dividend, ex-date: 03 Mar 20

SIS Ltd has announced 5:10 stock split, ex-date: 15 Jan 20

No Bonus history available

No Rights history available