SML ISUZU Faces Financial Challenges Amidst Declining Profit and High Debt Concerns

2025-04-03 08:05:00SML ISUZU has recently experienced a significant evaluation adjustment, reflecting changes in its financial trends. The company reported a notable decline in profit after tax for Q3 FY24-25, ending a streak of positive results. Concerns about debt management persist, despite a strong return on capital employed.

Read MoreSML ISUZU Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-04-03 08:03:08SML ISUZU, a small-cap player in the auto-trucks industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1643.95, slightly down from the previous close of 1669.05. Over the past year, SML ISUZU has experienced a notable decline of 18.60%, contrasting with a modest gain of 3.67% in the Sensex during the same period. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly MACD indicates a mildly bearish stance. The Bollinger Bands present a bullish outlook on a weekly basis, although the monthly perspective leans mildly bearish. The On-Balance Volume (OBV) reflects bullish sentiment in both weekly and monthly assessments. When examining the company's performance against the Sensex, SML ISUZU has shown impressive returns over longer periods, with a staggering 438.21% increase over five years co...

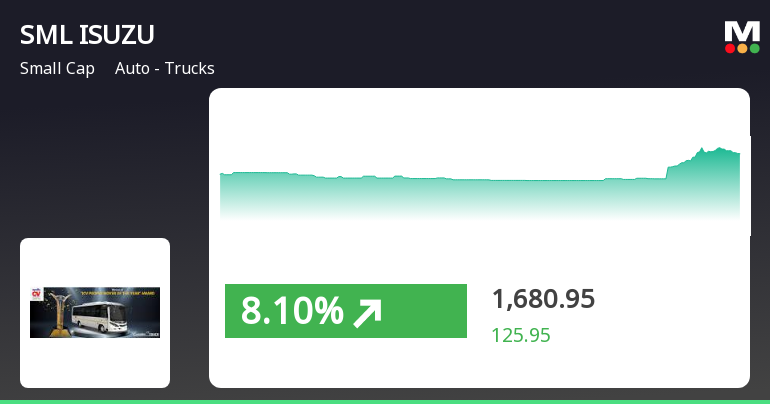

Read MoreSML ISUZU Stock Hits Upper Circuit Limit Amid Significant Trading Activity

2025-04-02 10:00:50SML ISUZU Ltd, a small-cap player in the Auto - Trucks industry, has made headlines today as its stock hit the upper circuit limit, reaching an impressive intraday high of Rs 1724.55. The stock experienced a notable change of Rs 109.1, reflecting a percentage increase of 6.96%. Throughout the trading session, SML ISUZU's stock fluctuated, recording a low of Rs 1504.1. The total traded volume stood at approximately 1.41 lakh shares, contributing to a turnover of Rs 23.19 crore. Despite this positive movement, the stock underperformed its sector by 1.34%, and its 1D return was recorded at -2.80%. In terms of price dynamics, the stock's weighted average price indicated that more volume was traded closer to its low price. Additionally, while the stock remains above its 5-day, 20-day, 50-day, and 100-day moving averages, it is currently below its 200-day moving average. Overall, SML ISUZU's performance tod...

Read More

SML ISUZU Exhibits Strong Performance Amid Broader Market Challenges and Volatility

2025-04-01 14:35:17SML ISUZU has demonstrated notable performance, gaining 10.29% on April 1, 2025, and outperforming its sector. The stock opened significantly higher and reached an intraday high, despite experiencing fluctuations. It is currently trading above multiple moving averages, indicating strong short-term performance amid broader market challenges.

Read More

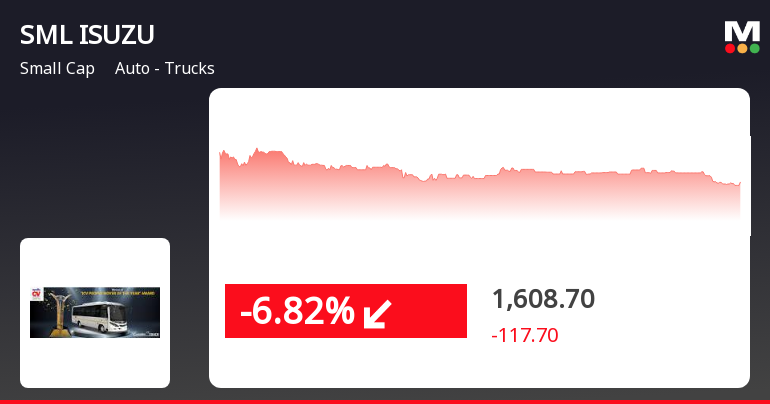

SML ISUZU Faces Notable Decline After Strong Weekly Performance Amid Broader Market Gains

2025-03-25 15:35:19SML ISUZU, a small-cap auto-trucks company, saw a notable decline today after six days of gains, reaching an intraday low. Despite this downturn, the stock has shown strong weekly and monthly performance, significantly outperforming the broader market, while also indicating mixed signals in its moving averages.

Read More

SML ISUZU Faces Financial Challenges Amid Shift in Market Sentiment and Valuation

2025-03-24 08:02:51SML ISUZU has experienced a recent evaluation adjustment reflecting changes in its financial metrics and market position. The revision indicates a shift in technical trends and highlights concerns regarding its debt servicing capabilities, despite previously demonstrating long-term growth in operating profit. Recent financial performance has lagged behind market trends.

Read MoreSML ISUZU Adjusts Valuation Grade Amid Strong Performance and Competitive Metrics

2025-03-24 08:00:30SML ISUZU, a small-cap player in the auto-trucks industry, has recently undergone a valuation adjustment, reflecting changes in its financial metrics. The company's current price stands at 1,654.30, showing a notable increase from the previous close of 1,432.45. Over the past week, SML ISUZU has demonstrated a strong stock return of 50.73%, significantly outperforming the Sensex, which returned 4.17% in the same period. Key financial indicators for SML ISUZU include a price-to-earnings (PE) ratio of 19.78 and an EV to EBITDA ratio of 12.26. The company also boasts a robust return on capital employed (ROCE) of 29.55% and a return on equity (ROE) of 36.62%. These metrics highlight SML ISUZU's strong market position and operational efficiency. In comparison to its peers, SML ISUZU's valuation metrics suggest a competitive stance within the auto-trucks sector. While the company has shown impressive returns ov...

Read More

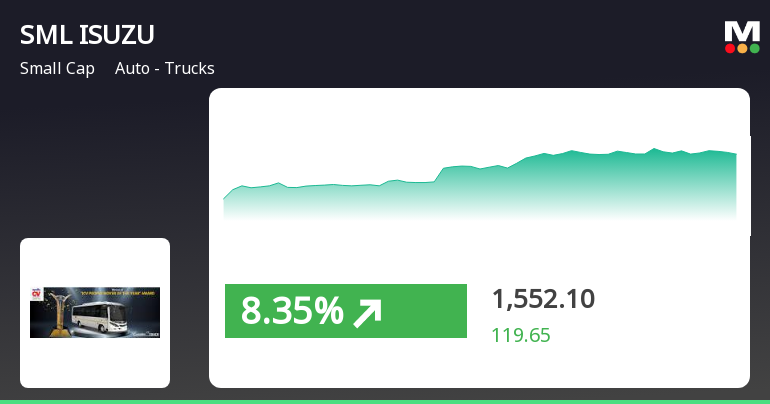

SML ISUZU Surges Amid Small-Cap Market Strength and High Volatility

2025-03-21 10:05:18SML ISUZU, a small-cap auto-trucks company, has experienced notable stock activity, outperforming its sector significantly. The stock has shown a strong upward trend over the past week and reached an intraday high today. Despite previous challenges, it has demonstrated resilience with a year-to-date increase.

Read MoreSML ISUZU Experiences Mixed Technical Trends Amidst Market Volatility and Strong Performance

2025-03-21 08:01:33SML ISUZU, a small-cap player in the auto-trucks industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1432.45, showing a notable increase from the previous close of 1248.00. Over the past week, SML ISUZU has reached a high of 1465.00 and a low of 1250.85, indicating volatility in its trading activity. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) shows no signal on a weekly basis but indicates bearish conditions monthly. Bollinger Bands reflect a bullish trend weekly, contrasting with a mildly bearish stance monthly. Moving averages and KST also present a mixed picture, with daily trends leaning mildly bearish and weekly trends showing mild bullishness. When comparing the company's perfor...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for quarter ended March 2025

Announcement under Regulation 30 (LODR)-Monthly Business Updates

01-Apr-2025 | Source : BSESales figure for the month of March 2025

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of trading window for the declaration of Audited Financial Results of the Company for the fourth quarter and financial year ending on 31st March 2025 from 26th March 2025 (Wednesday) till further communication in this regard

Corporate Actions

No Upcoming Board Meetings

SML ISUZU Ltd has declared 160% dividend, ex-date: 06 Sep 24

No Splits history available

No Bonus history available

SML ISUZU Ltd has announced 19:50 rights issue, ex-date: 09 Feb 10