SMS Pharmaceuticals Reports Strong Short-Term Performance Amid Long-Term Growth Challenges

2025-04-02 08:06:19SMS Pharmaceuticals has recently experienced a change in its evaluation, reflecting a nuanced view of its market position. The company reported positive financial performance for Q3 FY24-25, maintaining consistent results over eight quarters, but faces challenges in long-term growth indicators amid a competitive landscape.

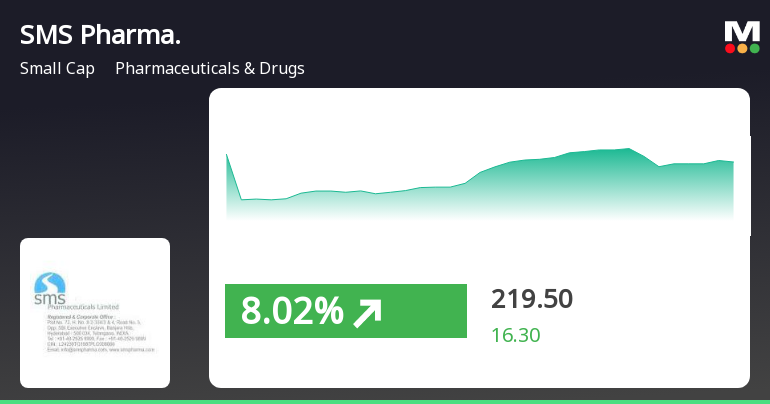

Read MoreTechnical Indicators Show Mixed Signals for SMS Pharmaceuticals Amid Market Performance Shifts

2025-03-26 08:02:05SMS Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 219.05, down from a previous close of 227.65, with a 52-week high of 398.00 and a low of 176.00. Today's trading saw a high of 230.00 and a low of 218.00. The technical summary indicates a mixed performance across various metrics. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no significant signals for both weekly and monthly evaluations. Bollinger Bands reflect a mildly bearish stance weekly, contrasting with a bullish outlook monthly. Moving averages indicate a mildly bearish trend on a daily basis, while the KST and Dow Theory suggest a mildly bullish trend on a weekly basis, with a bearish outlo...

Read More

SMS Pharmaceuticals Adjusts Evaluation Amidst Stable Financial Performance and Market Positioning

2025-03-25 08:04:25SMS Pharmaceuticals has recently experienced a change in its evaluation, reflecting a shift in technical trends to a more stable position. The company has shown strong financial performance over the past eight quarters, with solid metrics and a low debt-equity ratio, while maintaining resilience in its stock performance.

Read MoreSMS Pharmaceuticals Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-25 08:02:26SMS Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 227.65, showing a notable increase from the previous close of 217.15. Over the past year, SMS Pharmaceuticals has demonstrated a strong performance, with a return of 24.74%, significantly outpacing the Sensex's 7.07% return during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish conditions on both weekly and monthly charts, suggesting some volatility but overall positive momentum. The daily moving averages, however, reflect a mildly bearish trend, indicating mixed signals in the short term. The company's performance over various time frames highlight...

Read MoreSMS Pharmaceuticals Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:01:31SMS Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 211.60, showing a notable increase from the previous close of 191.60. Over the past year, SMS Pharmaceuticals has demonstrated a return of 18.25%, significantly outperforming the Sensex, which recorded a return of 4.77% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands suggest a mildly bearish stance on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish trend on a daily basis, while the KST shows a bearish weekly trend but a bullish monthly outlook...

Read More

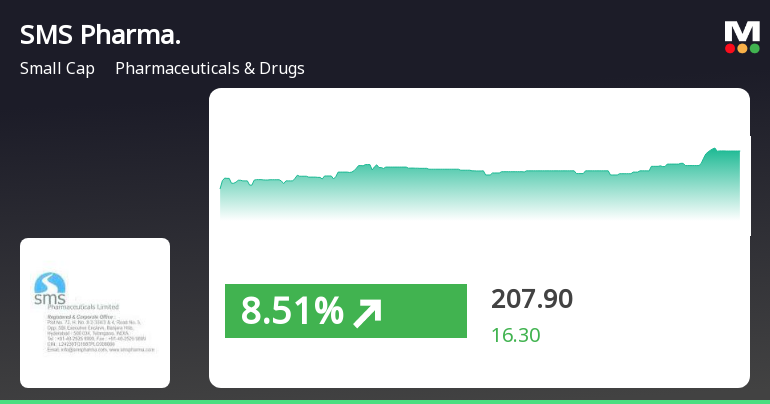

SMS Pharmaceuticals Outperforms Sector Amid Broader Market Gains and Mixed Momentum

2025-03-19 13:05:15SMS Pharmaceuticals has experienced notable activity, gaining 8.53% on March 19, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, with a total return of 9.16%. In the broader market, mid-cap stocks are leading, while the Sensex remains below its 50-day moving average.

Read More

SMS Pharmaceuticals Sees Notable Stock Surge Amid High Volatility and Sector Outperformance

2025-02-21 09:50:14SMS Pharmaceuticals has seen notable trading activity, with a significant rise in stock value today, outperforming its sector. The stock has gained consistently over the past three days, reflecting high volatility during the session. Its performance contrasts with the broader market trends observed in the Sensex.

Read MoreSMS Pharmaceuticals Shows Strong Trading Activity Amid Market Volatility

2025-02-21 09:35:03SMS Pharmaceuticals has shown significant activity in today's trading session, opening with a notable gain of 9.25%. The stock has outperformed its sector by 3.07%, reflecting a strong performance relative to industry peers. Over the past three days, SMS Pharmaceuticals has demonstrated a positive trend, accumulating a total return of 13.15%. Today, the stock reached an intraday high of Rs 222, indicating heightened investor engagement. However, it has also experienced high volatility, with an intraday fluctuation of 5.5%, suggesting a dynamic trading environment. In terms of moving averages, SMS Pharmaceuticals is currently positioned above its 5-day and 20-day moving averages, yet remains below the 50-day, 100-day, and 200-day moving averages, indicating mixed signals in its longer-term trend. In the broader market context, SMS Pharmaceuticals recorded a 1-day performance of 6.32%, contrasting with t...

Read More

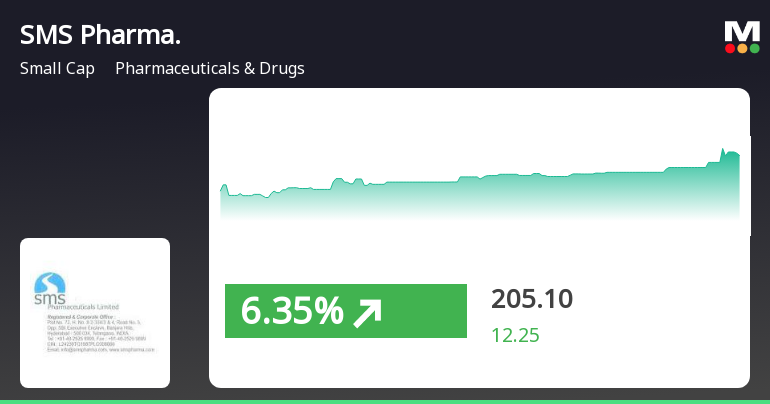

SMS Pharmaceuticals Outperforms Sector Amid Recent Stock Surge and Volatility

2025-02-20 12:20:14SMS Pharmaceuticals has seen a significant increase in stock performance, outperforming its sector. The stock experienced notable intraday volatility, reaching a high of Rs 205.6 and a low of Rs 189. Despite recent gains, it remains below several key moving averages and has faced a decline over the past month.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI(DP) Regulations 2018 for the quarter ended 31st March 2025

Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received the Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011 on March 28 2025 for Potluri Laboratories Pvt Ltd

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 28 2025 for Hima Bindu Potluri

Corporate Actions

No Upcoming Board Meetings

SMS Pharmaceuticals Ltd has declared 40% dividend, ex-date: 23 Sep 24

SMS Pharmaceuticals Ltd has announced 1:10 stock split, ex-date: 17 Dec 15

No Bonus history available

No Rights history available