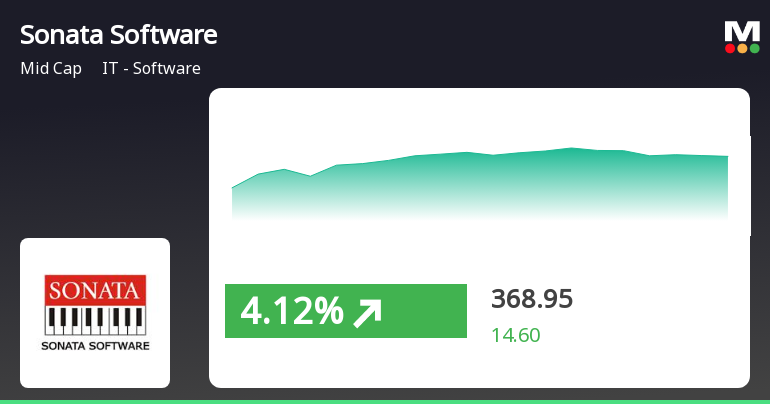

Sonata Software Hits 52-Week Low Amid Broader IT Sector Challenges

2025-04-03 14:35:29Sonata Software reached a new 52-week low today after a brief period of gains, marking a trend reversal. The stock is trading below key moving averages, reflecting a bearish trend. Despite recent challenges, the company maintains strong long-term fundamentals and high institutional holdings, indicating investor confidence.

Read More

Sonata Software's Valuation Adjustment Highlights Financial Strength Amidst Profit Decline

2025-03-27 08:09:04Sonata Software has recently experienced a change in its valuation grade, reflecting an improved assessment of its financial metrics. Key indicators include a Price to Earnings ratio of 23.91 and a robust Return on Capital Employed of 36.35%. The company maintains a low Debt to Equity ratio, indicating financial stability.

Read MoreSonata Software Adjusts Valuation Grade Amid Strong Financial Performance in IT Sector

2025-03-27 08:00:18Sonata Software has recently undergone a valuation adjustment, reflecting its current market position within the IT software industry. The company's price-to-earnings ratio stands at 23.91, while its price-to-book value is noted at 6.81. Additionally, Sonata's enterprise value to EBITDA ratio is 15.57, indicating its operational efficiency relative to its valuation. The company has demonstrated strong financial metrics, including a return on capital employed (ROCE) of 36.35% and a return on equity (ROE) of 30.06%. These figures suggest robust profitability and effective management of shareholder equity. In comparison to its peers, Sonata Software's valuation metrics present a competitive landscape. For instance, while Zensar Technologies holds a fair valuation with a higher PE ratio of 24.63, Cyient also maintains an attractive valuation with a lower PE of 22.23. Notably, Newgen Software is positioned at ...

Read More

Sonata Software Shows Mixed Performance Amid Broader Market Gains and Volatility

2025-03-20 09:30:22Sonata Software has experienced significant trading activity, outperforming its sector and reaching an intraday high. The stock shows mixed trends in relation to moving averages and has demonstrated high volatility. In the broader market, small-cap stocks are leading, while Sonata's long-term performance contrasts with the overall market trend.

Read More

Sonata Software Faces Valuation Shift Amidst Flat Financial Performance and Market Challenges

2025-03-20 08:06:25Sonata Software has recently experienced a change in its valuation grade, reflecting a fair assessment of its financial standing. Key metrics include a PE ratio of 23.24, a price-to-book value of 6.62, and a return on equity of 30.06%, despite flat performance in the latest quarter.

Read MoreSonata Software Adjusts Valuation Amid Competitive IT Software Landscape

2025-03-20 08:00:17Sonata Software has recently undergone a valuation adjustment, reflecting its current standing in the IT software industry. The company's price-to-earnings ratio stands at 23.24, while its price-to-book value is noted at 6.62. Additionally, Sonata's enterprise value to EBITDA ratio is 15.14, and its enterprise value to EBIT is recorded at 18.92. The company also boasts a robust return on capital employed (ROCE) of 36.35% and a return on equity (ROE) of 30.06%, indicating strong operational efficiency. In comparison to its peers, Sonata Software's valuation metrics present a mixed picture. For instance, Zensar Technologies and Happiest Minds share a similar valuation status, while companies like Cyient and Indegene are positioned more favorably. Notably, Sonata's PEG ratio is at 0.00, which contrasts sharply with peers like Zensar, which has a PEG of 4.21. Despite fluctuations in stock performance, includ...

Read More

Sonata Software Hits 52-Week Low Amidst Declining Performance Metrics and Institutional Confidence

2025-03-17 12:35:25Sonata Software has reached a new 52-week low, despite an initial gain during trading. The company has faced a significant decline over the past year, contrasting with broader market performance. While it maintains strong institutional holdings, recent profit drops and weak operating metrics indicate ongoing challenges.

Read More

Sonata Software Adjusts Evaluation Amidst Strong Fundamentals and Market Challenges

2025-03-13 08:07:06Sonata Software has recently adjusted its evaluation based on its market position and performance metrics. The company showcases strong long-term fundamentals, including a notable Return on Equity and consistent sales growth, despite facing challenges in the past year. Institutional holdings reflect a stable investment interest.

Read MoreSonata Software Adjusts Valuation Grade, Highlighting Strong Operational Performance in IT Sector

2025-03-13 08:00:23Sonata Software has recently undergone a valuation adjustment, reflecting its current financial standing within the IT software industry. The company showcases a price-to-earnings (P/E) ratio of 23.01 and a price-to-book value of 6.56, indicating its market valuation relative to its earnings and assets. Additionally, Sonata's enterprise value to EBITDA stands at 14.99, while its enterprise value to EBIT is recorded at 18.73, suggesting a competitive positioning in terms of profitability metrics. The company's return on capital employed (ROCE) is notably high at 36.35%, and its return on equity (ROE) is also impressive at 30.06%, highlighting effective management and operational efficiency. Sonata's dividend yield is at 1.25%, providing a modest return to shareholders. In comparison to its peers, Sonata Software's valuation metrics present a favorable outlook. While companies like Zensar Technologies and C...

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEClosure of Trading Window for the quarter and year ending March 31 2025.

Update On Meeting With Institutional Investor.

24-Mar-2025 | Source : BSEUpdate on meeting with Institutional Investor

Update On Meeting With Institutional Investor.

20-Mar-2025 | Source : BSEUpdate on meeting with Institutional Investor.

Corporate Actions

No Upcoming Board Meetings

Sonata Software Ltd. has declared 440% dividend, ex-date: 26 Jul 24

No Splits history available

Sonata Software Ltd. has announced 1:1 bonus issue, ex-date: 12 Dec 23

No Rights history available