South India Paper Mills Adjusts Valuation Amid Competitive Industry Challenges

2025-03-05 08:00:54South India Paper Mills has recently undergone a valuation adjustment, reflecting its current standing in the competitive paper and paper products industry. The company's price-to-earnings ratio stands at -14.63, indicating challenges in profitability, while its price-to-book value is recorded at 0.73. The enterprise value to EBITDA ratio is 16.76, suggesting a moderate valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of performance metrics, South India Paper Mills shows a return on capital employed (ROCE) of 1.00% and a return on equity (ROE) of -5.00%, highlighting areas for potential improvement. The stock has experienced fluctuations, with a current price of 84.50, a 52-week high of 120.75, and a low of 68.60. When compared to its peers, South India Paper Mills presents a mixed picture. Competitors like Kuantum Papers and Pudumjee Paper boast more favorab...

Read More

South India Paper Mills Reports Financial Results Indicating Significant Performance Shift in December 2024

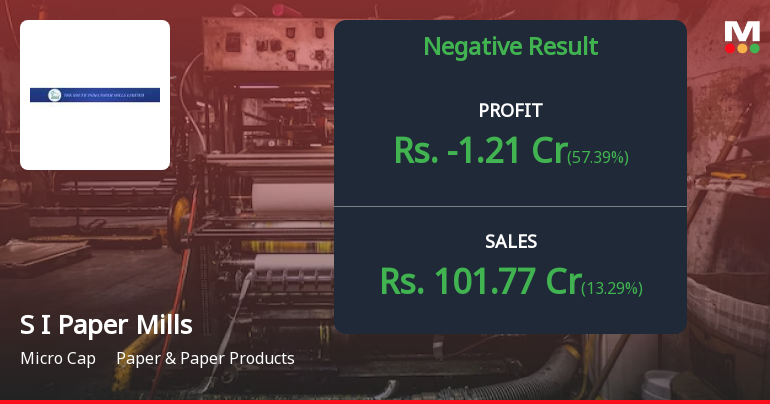

2025-02-13 22:06:37South India Paper Mills has announced its financial results for the quarter ending December 2024, revealing a significant shift in performance. The company's score has notably changed, indicating adjustments in its financial metrics. As a microcap in the Paper & Paper Products industry, it faces a challenging landscape.

Read More

South India Paper Mills Reports Strong Q2 FY24 Sales Amid Long-Term Profitability Concerns

2025-02-10 18:58:23South India Paper Mills has recently experienced a change in evaluation, reflecting its financial metrics and market position. In Q2 FY24, the company reported significant net sales and operating profit figures, though long-term profitability remains a concern. The stock has shown a modest return over the past year.

Read More

South India Paper Mills Reports Strong Q2 FY24 Sales Amid Long-Term Profitability Concerns

2025-01-28 18:52:47South India Paper Mills, a microcap in the Paper & Paper Products sector, recently adjusted its evaluation following positive Q2 FY24 results, with net sales of Rs 101.77 crore and a solid operating profit to interest ratio. However, long-term challenges persist, including declining operating profit growth and low Return on Equity.

Read MoreAnnouncement under Regulation 30 (LODR)-Cessation

31-Mar-2025 | Source : BSECessation - Intimation regarding completion of tenure of Independent Directors of the Company

Announcement under Regulation 30 (LODR)-Change in Directorate

29-Mar-2025 | Source : BSEAppointment of 4 Directors as Additional Directors on the Board in the category of Independent Directors (w.e.f 31st March 2025)

Board Meeting Outcome for Outcome Of Board Meeting Held On 29Th March 2025

29-Mar-2025 | Source : BSEIntimation regarding Appt of Additional Director in the category of Independent Directors & Reconstitution of various Committees

Corporate Actions

No Upcoming Board Meetings

South India Paper Mills Ltd has declared 10% dividend, ex-date: 29 Aug 22

No Splits history available

South India Paper Mills Ltd has announced 1:1 bonus issue, ex-date: 06 Sep 10

No Rights history available