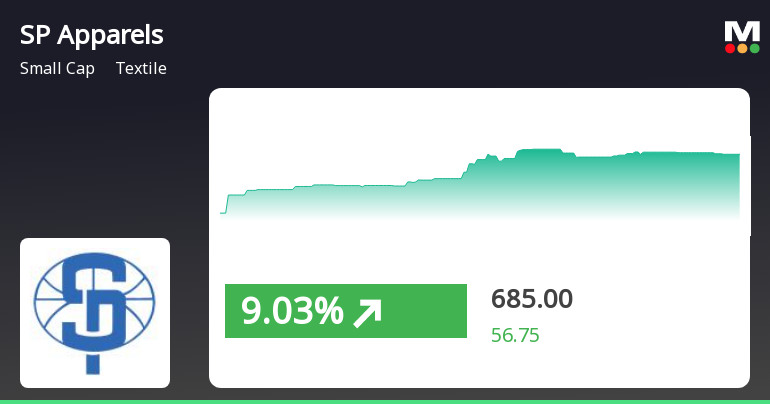

SP Apparels Experiences Valuation Grade Change Amid Competitive Textile Sector Dynamics

2025-04-01 08:00:38SP Apparels, a small-cap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently boasts a price-to-earnings (P/E) ratio of 18.36 and an enterprise value to EBITDA ratio of 11.28, indicating a competitive position within its sector. Additionally, its return on capital employed (ROCE) stands at 11.13%, while return on equity (ROE) is recorded at 10.79%. In comparison to its peers, SP Apparels demonstrates a more favorable valuation profile. For instance, Lux Industries and Ganesha Ecosphere are positioned at higher P/E ratios of 23.69 and 39.31, respectively, while Kitex Garments commands an even steeper valuation. Conversely, Sanathan Textile, which shares an attractive valuation, has a P/E of 21.77, highlighting the competitive landscape within the textile sector. Despite recent fluctuations in stock price, with a c...

Read More

SP Apparels Shows Volatility Amid Broader Market Resilience and Sector Outperformance

2025-03-27 11:05:23SP Apparels, a small-cap textile company, rebounded on March 27, 2025, after four days of decline, showing significant intraday volatility. Despite today's gains, the stock remains below key moving averages and has seen a weekly decline, contrasting with the overall positive performance of the Sensex.

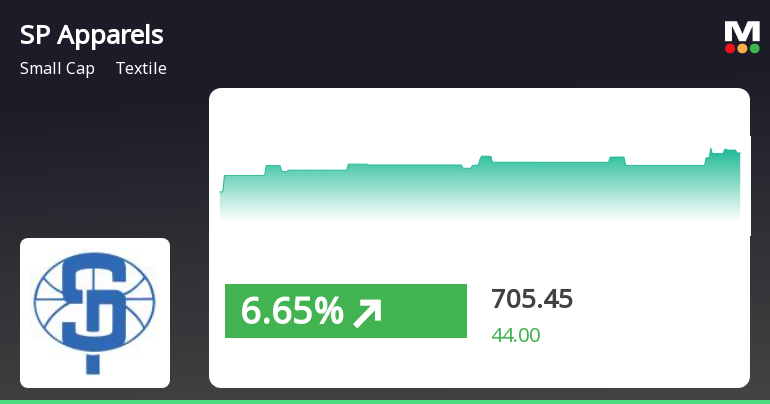

Read MoreSP Apparels Adjusts Valuation Grade Amid Competitive Textile Market Landscape

2025-03-25 08:00:56SP Apparels, a small-cap player in the textile industry, has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics and market position. The company currently boasts a price-to-earnings (P/E) ratio of 18.68 and an enterprise value to EBITDA ratio of 11.45, indicating a competitive standing within its sector. Additionally, SP Apparels has a return on capital employed (ROCE) of 11.13% and a return on equity (ROE) of 10.79%, showcasing its operational efficiency. In comparison to its peers, SP Apparels presents a more favorable valuation profile. For instance, Lux Industries and Ganesha Ecosphere are positioned at higher P/E ratios of 24.84 and 40.51, respectively, while other competitors like Kitex Garments and Cantabil Retail also reflect elevated valuations. This context highlights SP Apparels' relative attractiveness in the market. Despite recent fluctuations in sto...

Read More

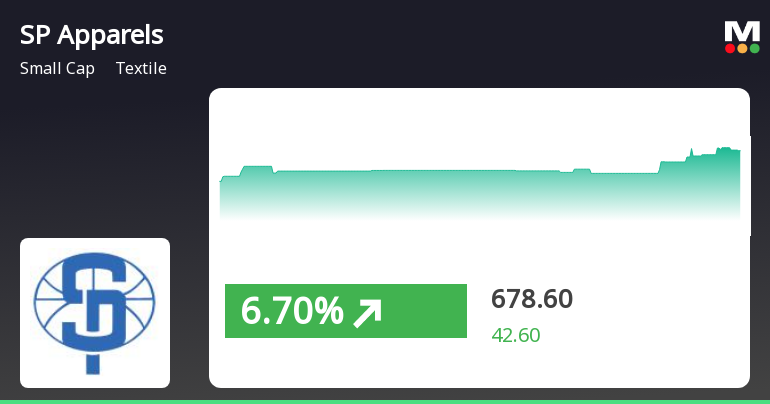

SP Apparels Shows Strong Short-Term Gains Amid Broader Market Rally

2025-03-18 15:00:58SP Apparels Ltd., a small-cap textile company, has experienced significant trading activity, outperforming the broader market. Despite initial losses, the stock rebounded to an intraday high, reflecting a positive short-term trend. Over the past year, it has delivered substantial returns compared to the Sensex.

Read More

SP Apparels Shows Signs of Trend Reversal Amid Broader Market Gains

2025-03-17 15:05:22SP Apparels, a small-cap textile company, experienced a notable increase on March 17, 2025, following two days of decline. Despite this uptick, the stock remains below key moving averages and has faced recent declines. However, it has shown resilience over the past year compared to the broader market.

Read MoreSP Apparels Adjusts Valuation Grade, Reflecting Competitive Strength in Textile Sector

2025-03-13 08:00:45SP Apparels, a small-cap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (P/E) ratio of 17.55 and an enterprise value to EBITDA ratio of 10.85, indicating a competitive position within its sector. Additionally, SP Apparels has a return on capital employed (ROCE) of 11.13% and a return on equity (ROE) of 10.79%, showcasing its operational efficiency. In comparison to its peers, SP Apparels stands out with a more favorable valuation profile. For instance, while Lux Industries and SG Mart maintain higher P/E ratios of 21.58 and 33.83 respectively, SP Apparels offers a more attractive PEG ratio of 1.32. Other competitors, such as Ganesha Ecosphe and Kitex Garments, are positioned at higher valuation levels, further emphasizing SP Apparels' relative strength in the market. Despite rec...

Read MoreSP Apparels Adjusts Valuation Grade, Reflecting Competitive Strength in Textile Sector

2025-03-13 08:00:45SP Apparels, a small-cap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (P/E) ratio of 17.55 and an enterprise value to EBITDA ratio of 10.85, indicating a competitive position within its sector. Additionally, SP Apparels has a return on capital employed (ROCE) of 11.13% and a return on equity (ROE) of 10.79%, showcasing its operational efficiency. In comparison to its peers, SP Apparels stands out with a more favorable valuation profile. For instance, while Lux Industries and SG Mart maintain higher P/E ratios of 21.58 and 33.83 respectively, SP Apparels offers a more attractive PEG ratio of 1.32. Other competitors, such as Ganesha Ecosphe and Kitex Garments, are positioned at higher valuation levels, further emphasizing SP Apparels' relative strength in the market. Despite rec...

Read More

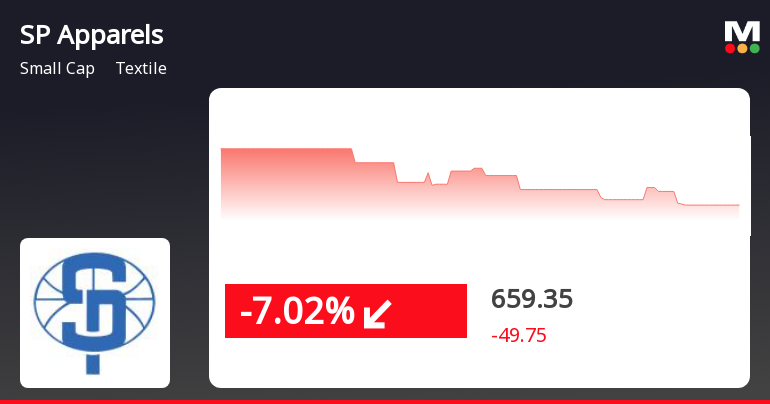

SP Apparels Faces Significant Decline Amid Broader Market Caution in Textile Sector

2025-03-12 11:50:22SP Apparels, a small-cap textile company, faced a notable decline on March 12, 2025, underperforming against the broader market. The stock has consistently traded below key moving averages and has experienced significant drops over various time frames, reflecting challenging conditions in the textile sector and overall market sentiment.

Read MoreSP Apparels Faces Ongoing Market Challenges Amid Significant Stock Volatility

2025-03-11 09:35:14SP Apparels Ltd., a small-cap player in the textile industry, has experienced significant volatility today, opening with a loss of 5.83%. The stock has underperformed its sector by 4.2%, reflecting broader challenges in the market. Over the past three days, SP Apparels has seen a consecutive decline, accumulating a total drop of 14.79% in returns. Today, the stock reached an intraday low of Rs 648, where it has remained throughout the trading session. This performance is indicative of a broader trend, as SP Apparels is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting ongoing weakness in its price momentum. In terms of relative performance, SP Apparels has declined by 1.88% today, contrasting with the Sensex, which has only dipped by 0.53%. Over the past month, the stock has faced a notable decline of 18.95%, while the Sensex has decreased by just 3.37%. T...

Read MoreAnnouncement under Regulation 30 (LODR)-Cessation

28-Mar-2025 | Source : BSECompany hereby informed that Mr. V. Sakthivel is retiring and ceasing to be an Independent Director of the Company w.e.f 30.03.2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Trading window Closure from April 1 2025 and will be open after 48 hours from the date of declaration of Financial result for the quarter ended March 31 2025.

Announcement under Regulation 30 (LODR)-Change in Management

12-Mar-2025 | Source : BSERevised Disclosure under Regulation 30 of SEBI (LODR) Regulation 2015 of Change in Management filed with BSE dated March 7 2025.

Corporate Actions

No Upcoming Board Meetings

SP Apparels Ltd. has declared 30% dividend, ex-date: 15 Sep 23

No Splits history available

No Bonus history available

No Rights history available