Spandana Sphoorty Faces Mixed Technical Trends Amidst Significant Market Challenges

2025-04-02 08:09:38Spandana Sphoorty Financial, a small-cap player in the finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 243.70, showing a slight increase from the previous close of 234.70. Over the past year, the stock has faced significant challenges, with a return of -72.37%, contrasting sharply with the Sensex's gain of 2.72% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. The Relative Strength Index (RSI) presents no signal weekly but is bullish monthly, suggesting some underlying strength. Bollinger Bands and moving averages indicate a bearish sentiment, particularly on a daily basis. In terms of returns, Spandana Sphoorty has struggled significantly compared to the Sen...

Read More

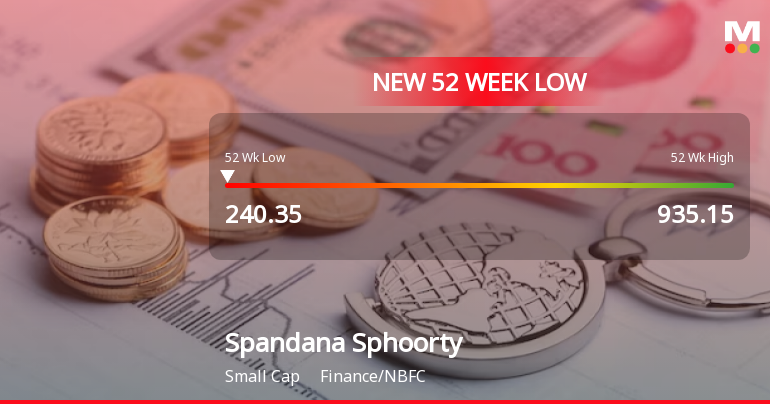

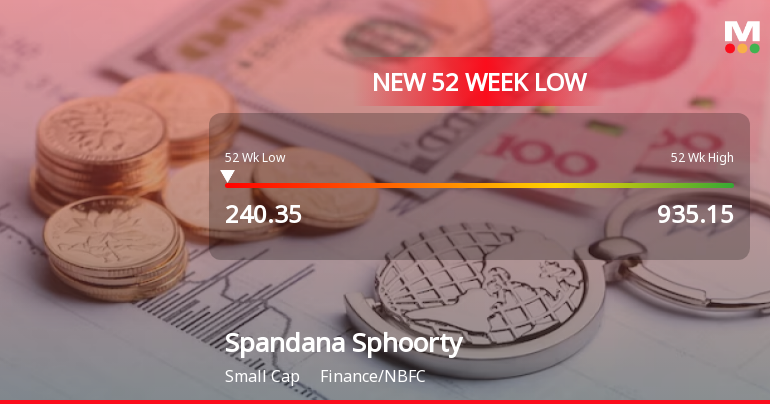

Spandana Sphoorty Financial Reaches All-Time Low Amidst Significant Market Volatility

2025-03-27 09:33:18Spandana Sphoorty Financial has faced significant volatility, reaching an all-time low and experiencing a notable decline over the past four days. The stock is trading below multiple moving averages and has seen a substantial year-over-year drop. Financial metrics indicate serious challenges, including a drastic decline in profitability and reduced promoter confidence.

Read More

Spandana Sphoorty Financial Faces Significant Challenges Amidst Declining Performance Metrics

2025-03-26 15:41:22Spandana Sphoorty Financial has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over the past three days. The company reports a substantial annual drop in operating profit and negative performance in recent quarters, alongside a decrease in promoter stake, indicating ongoing challenges.

Read More

Spandana Sphoorty Financial Stock Hits All-Time Low Amid Ongoing Market Challenges

2025-03-26 15:22:08Spandana Sphoorty Financial, a small-cap NBFC, has faced significant stock volatility, reaching an all-time low and trading close to its 52-week low. The company reported a substantial quarterly loss and a notable decline in operating profit, alongside a decrease in promoter stake, reflecting ongoing market challenges.

Read MoreSpandana Sphoorty Financial Faces Mixed Technical Trends Amid Market Challenges

2025-03-25 08:06:02Spandana Sphoorty Financial, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 264.45, having seen fluctuations with a previous close of 267.50. Over the past year, the stock has faced significant challenges, with a return of -67.7%, contrasting sharply with the Sensex's gain of 7.07% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) presents no signal weekly while being bullish monthly, suggesting varied momentum. Bollinger Bands and moving averages reflect bearish tendencies, particularly on daily metrics. In terms of returns, Spandana Sphoorty has experienced notable vol...

Read MoreSpandana Sphoorty Financial Faces Mixed Technical Trends Amid Market Challenges

2025-03-20 08:03:56Spandana Sphoorty Financial, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 258.00, showing a slight increase from the previous close of 249.85. Over the past year, the stock has faced significant challenges, with a return of -68.49%, contrasting sharply with a 4.77% gain in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. The Relative Strength Index (RSI) presents no signal weekly but is bullish monthly, suggesting some volatility in momentum. Bollinger Bands and moving averages indicate a bearish sentiment, particularly on a daily basis. In terms of returns, Spandana Sphoorty has strug...

Read More

Spandana Sphoorty Financial Faces Declining Performance Amidst Investor Concerns

2025-03-17 09:55:06Spandana Sphoorty Financial has reached a new 52-week low, reflecting ongoing struggles in performance, including a significant one-year return decline. The company has reported negative results for three consecutive quarters, and promoter stake reduction indicates waning confidence. It currently trades below key moving averages, raising concerns about its future.

Read More

Spandana Sphoorty Faces Declining Performance Amid Broader Market Resilience

2025-03-17 09:55:05Spandana Sphoorty Financial has faced notable volatility, reaching a new 52-week low and underperforming its sector. The company has reported negative results for three consecutive quarters, with a significant decline in operating profit. Promoter confidence is also diminishing, as their stake has decreased recently.

Read More

Spandana Sphoorty Financial Faces Significant Challenges Amidst Declining Performance and Promoter Confidence

2025-03-17 09:55:04Spandana Sphoorty Financial has hit a new 52-week low, reflecting significant volatility and underperformance in the finance/NBFC sector. The company has reported negative results for three consecutive quarters, with a substantial decline in profit. Additionally, promoter confidence is waning, as their stake has decreased recently.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025.

Announcement Under Regulation 30 (LODR)- Grant Of Options

06-Apr-2025 | Source : BSEAnnouncement under Regulation 30 (LODR)- Grant of Options

Announcement under Regulation 30 (LODR)-Credit Rating

05-Apr-2025 | Source : BSEIntimation of Credit Rating - Long Term Bank Facilities (reduced limits); Ratings reaffirmed by Care Ratings Limited

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available