State Bank of India Adjusts Valuation Amid Competitive Banking Landscape

2025-04-03 08:00:12State Bank of India has recently undergone a valuation adjustment, reflecting its current financial standing within the banking sector. The bank's price-to-earnings (PE) ratio stands at 9.49, while its price-to-book value is recorded at 1.59. The PEG ratio is notably low at 0.55, indicating a potentially favorable growth outlook relative to its earnings. Additionally, the bank offers a dividend yield of 1.77%, which may appeal to income-focused investors. In terms of profitability, State Bank of India has a return on equity (ROE) of 16.76% and a return on assets (ROA) of 1.16%. The net non-performing assets (NPA) to book value ratio is at 4.91%, which is a critical metric for assessing asset quality. When compared to its peers, State Bank of India presents a higher valuation relative to several competitors, such as Bank of Baroda and Punjab National Bank, which are positioned more attractively in terms of...

Read MoreState Bank of India Shows Resilience Amid Mixed Long-Term Market Outlook

2025-03-28 09:20:15State Bank of India, a prominent player in the public banking sector, has shown notable activity today, trading at Rs 770.7. This price point aligns with the overall sector performance, reflecting a stable market position. The bank's market capitalization stands at Rs 6,93,889.21 crore, categorizing it as a large-cap entity. In terms of moving averages, State Bank of India is currently above its 5-day, 20-day, and 50-day averages, indicating short-term strength. However, it remains below its 100-day and 200-day moving averages, suggesting a mixed long-term outlook. Performance metrics reveal that over the past year, the stock has gained 3.31%, underperforming the Sensex, which has risen by 5.31%. In contrast, the stock has performed well in the short term, with a 0.66% increase today compared to a slight decline in the Sensex. Over the past month, State Bank of India has surged by 12.97%, significantly ou...

Read MoreState Bank of India Shows Mixed Performance Amidst High Volatility and Sector Trends

2025-03-27 09:25:14State Bank of India, a prominent player in the public banking sector, has experienced notable activity today, aligning its performance with the broader sector trends. The stock has faced a decline over the past three days, with a cumulative drop of 2.44%. Today's trading saw the stock fluctuate within a narrow range of Rs 3.1, reflecting high volatility, with an intraday volatility rate of 72.26%. In terms of moving averages, the stock is currently positioned higher than its 5-day, 20-day, and 50-day averages, yet remains below the 100-day and 200-day averages. This positioning indicates a mixed performance in the short to medium term. Over the past year, State Bank of India has recorded a return of 4.58%, which is slightly below the Sensex's performance of 6.14%. However, its performance over the last month shows a stronger return of 9.06% compared to the Sensex's 3.84%. The bank's market capitalization ...

Read MoreState Bank of India Stock Shows High Volatility Amidst Mixed Performance Trends

2025-03-26 09:25:17State Bank of India, a prominent player in the public banking sector, has experienced notable activity in its stock today. The stock's performance has been in line with the sector, although it has faced a consecutive decline over the past two days, recording a decrease of 1.23%. Trading within a narrow range of Rs 5.55, the stock has exhibited high volatility, with an intraday volatility rate of 36.2%. In terms of moving averages, the stock is currently positioned higher than its 5-day, 20-day, and 50-day moving averages, yet remains below its 100-day and 200-day moving averages. The market capitalization of State Bank of India stands at Rs 6,90,854.84 crore, categorizing it as a large-cap entity. Over the past year, State Bank of India has delivered a performance of 4.60%, while the Sensex has outperformed with a return of 7.78%. In the short term, the stock has shown resilience, with a 1-week performanc...

Read MoreState Bank of India Shows Resilience Amid Mixed Long-Term Performance Trends

2025-03-25 09:20:15State Bank of India, a prominent player in the public banking sector, has shown notable activity today, maintaining performance in line with its sector. The stock has experienced a positive trend, gaining for six consecutive days and achieving an impressive 8.54% return over this period. Today, it opened at Rs 784.4 and has consistently traded at this price. In terms of moving averages, the stock is currently above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. This positioning reflects a mixed short-term performance relative to longer-term trends. Looking at the broader context, State Bank of India has reported a 4.96% increase over the past year, which is below the Sensex's 7.54% performance. However, it has outperformed the Sensex over the past month with a 10.19% increase compared to the Sensex's 4.99%. The bank's market capitalization sta...

Read More

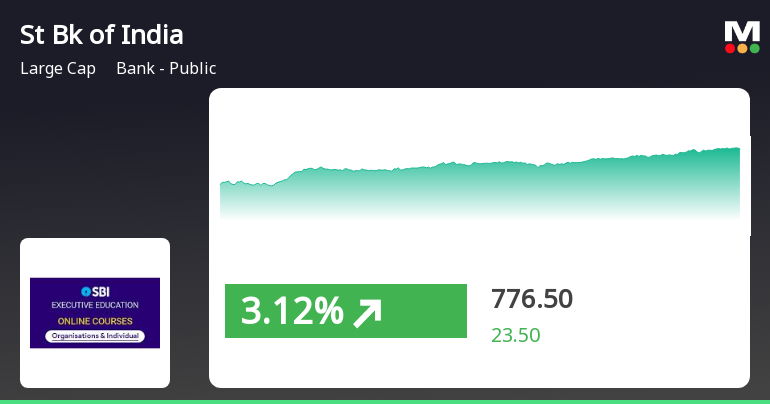

State Bank of India Shows Strong Performance Amid Broader Market Gains

2025-03-24 13:15:21State Bank of India has performed well, gaining 3.16% on March 24, 2025, and outperforming its sector. Over the past five days, it has shown a total return of 7.33%. The stock is above its short-term moving averages, while the broader market, including the Sensex, is also experiencing positive momentum.

Read MoreState Bank of India Shows Increased Trading Activity Amid Mixed Performance Indicators

2025-03-24 09:30:22State Bank of India, a prominent player in the public banking sector, has shown notable activity today, aligning its performance closely with the sector. Over the past five days, the stock has gained 4.95%, reflecting a consistent upward trend. Today, it experienced high volatility, with an intraday fluctuation of 305.71%, indicating significant trading activity. The stock has traded within a narrow range of Rs 5.85, which suggests a concentrated interest among traders. In terms of moving averages, State Bank of India is currently above its 5-day, 20-day, and 50-day averages, yet remains below its 100-day and 200-day averages, highlighting mixed short- to medium-term performance. In the broader context, the bank's one-year performance stands at 1.61%, underperforming the Sensex, which has returned 6.32% over the same period. However, over a longer horizon, State Bank of India has outperformed the Sensex s...

Read MoreState Bank of India Reflects Mixed Performance Amid Broader Banking Sector Trends

2025-03-21 09:20:06State Bank of India, a prominent player in the public banking sector, has shown notable activity today, aligning its performance with the broader sector trends. After experiencing three consecutive days of gains, the stock has seen a slight decline. Currently, it is trading above its 5-day, 20-day, and 50-day moving averages, yet remains below its 100-day and 200-day moving averages, indicating a mixed short-term performance. With a market capitalization of Rs 6,70,819.06 crore, State Bank of India has demonstrated resilience in its year-to-date performance, albeit with a decline of 5.46%, compared to the Sensex's drop of 2.42%. Over the past year, the stock has gained 1.06%, while the Sensex has outperformed with a 4.97% increase. In the short term, the bank's performance over the last month shows a positive trend, with a 4.17% increase, matching the Sensex's growth. Overall, State Bank of India continue...

Read MoreState Bank of India Shows Mixed Technical Trends Amid Market Volatility

2025-03-20 08:00:59State Bank of India, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 745.05, showing a slight increase from the previous close of 737.05. Over the past year, the stock has experienced a high of 912.10 and a low of 679.65, indicating a range of volatility. In terms of technical indicators, the bank's performance is characterized by a mix of signals. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate a mildly bearish trend weekly, contrasting with a bullish stance monthly. Moving averages also reflect a mildly bearish sentiment on a daily basis. When comparing the bank's returns to the Sensex, State Bank of India has demonstrated notable performance over various periods. In the last ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate for the quarter ended 31.03.2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

04-Apr-2025 | Source : BSENewspaper Publication

Announcement under Regulation 30 (LODR)-Newspaper Publication

02-Apr-2025 | Source : BSENotice of General Meeting of shareholders

Corporate Actions

No Upcoming Board Meetings

State Bank of India has declared 1370% dividend, ex-date: 22 May 24

State Bank of India has announced 1:10 stock split, ex-date: 20 Nov 14

No Bonus history available

State Bank of India has announced 1:5 rights issue, ex-date: 28 Jan 08