Steel Strips Wheels Adjusts Evaluation Amid Mixed Performance Indicators and Market Trends

2025-04-02 08:10:04Steel Strips Wheels has recently adjusted its evaluation, reflecting changes in its technical outlook amid mixed performance indicators. The company maintains a strong return on capital employed and an attractive valuation compared to peers, despite a challenging year marked by stock fluctuations and slight profit growth.

Read MoreSteel Strips Wheels Faces Mixed Technical Signals Amid Market Evaluation Revision

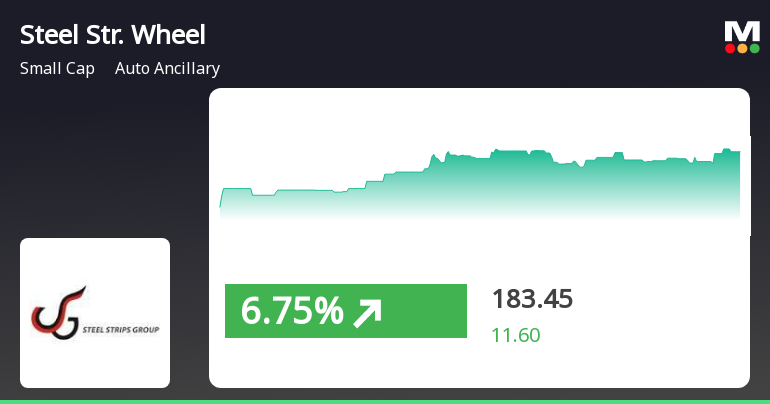

2025-04-02 08:01:01Steel Strips Wheels, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 188.45, showing a notable increase from the previous close of 181.55. Over the past year, the stock has experienced a decline of 19.41%, contrasting with a modest gain of 2.72% in the Sensex during the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. The Bollinger Bands and moving averages both reflect a mildly bearish stance, suggesting caution in the short term. Notably, the KST indicates a bearish trend on both weekly and monthly charts, while the RSI shows no significant signals. In terms of returns, Steel Strips Wheels has demonstrated resilience over longer periods, with a re...

Read More

Steel Strips Wheels Faces Cautious Outlook Amid Technical Indicator Adjustments

2025-03-28 08:01:30Steel Strips Wheels has recently experienced an evaluation adjustment reflecting changes in its technical indicators, which now suggest a more cautious outlook. Key metrics indicate bearish conditions, while the company's management efficiency remains strong. The stock is trading at a fair value compared to its peers amid these challenges.

Read MoreSteel Strips Wheels Faces Technical Challenges Amid Mixed Market Indicators

2025-03-28 08:00:19Steel Strips Wheels, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD and Bollinger Bands signaling bearish trends on both weekly and monthly bases. The daily moving averages also align with this sentiment, indicating a challenging environment for the stock. In terms of performance metrics, Steel Strips Wheels has experienced fluctuations in its stock price, currently standing at 181.05, down from a previous close of 188.15. The stock has seen a 52-week high of 247.75 and a low of 167.50, highlighting significant volatility. Today's trading range has been between 177.20 and 187.65, further emphasizing the stock's instability. When comparing the company's returns to the Sensex, Steel Strips Wheels has faced notable challenges. Over the past year, th...

Read More

Steel Strips Wheels Adjusts Evaluation Amidst Mixed Financial Performance and Market Trends

2025-03-20 08:02:54Steel Strips Wheels, an auto ancillary small-cap company, has recently seen a change in its evaluation, reflecting a shift in market sentiment. Despite a challenging year with a -23.90% return, the company has shown management efficiency with a 16.13% ROCE and a fair valuation compared to peers.

Read MoreSteel Strips Wheels Faces Mixed Technical Indicators Amid Strong Historical Performance

2025-03-20 08:00:27Steel Strips Wheels, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD and KST showing bearish signals on both weekly and monthly charts. Meanwhile, the Bollinger Bands and moving averages indicate a mildly bearish stance, suggesting a cautious outlook in the near term. Despite these technical trends, Steel Strips Wheels has demonstrated notable performance in comparison to the Sensex over various time frames. Over the past week, the stock has returned 7.84%, significantly outperforming the Sensex, which returned 1.92%. In the one-month period, the stock also showed a positive return of 4.52%, while the Sensex experienced a slight decline. However, the year-to-date performance reflects a decline of 6.68%, compared to a 3.44% drop in the Sensex. Look...

Read More

Steel Strips Wheels Shows Positive Momentum Amid Broader Market Gains

2025-03-18 14:00:20Steel Strips Wheels has experienced significant activity, outperforming its sector and achieving consecutive gains over two days. While currently above its short-term moving averages, it remains below longer-term averages. In the broader market, the Sensex has risen, with small-cap stocks leading the gains.

Read More

Steel Strips Wheels Faces Volatility Amid Broader Market Resilience and Declining Performance

2025-03-17 10:35:18Steel Strips Wheels has faced notable volatility, reaching a 52-week low and underperforming its sector. The stock has declined over six consecutive days, while the broader market, including the Sensex and BSE Mid Cap index, shows resilience. The company maintains strong management efficiency despite recent challenges.

Read More

Steel Strips Wheels Faces Continued Decline Amidst Sector Volatility and Market Challenges

2025-03-03 14:20:15Steel Strips Wheels has faced notable volatility, hitting a new 52-week low after four consecutive days of decline. Despite an initial gain, the stock's performance aligns with a bearish trend, trading below key moving averages and reflecting a significant year-over-year decline compared to the broader market.

Read MoreDisclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 - SSWL Receives Business Award Of USD 5.00 Million (INR 43.00 Crores)

09-Apr-2025 | Source : BSESSWL has been awarded Steel Wheels business valued at USD 5.00 million over business life of 5 years from a global OEM based out of Southern Hemisphere. Details in the letter attached.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEIn compliance with regulation 74(5) of SEBI (DP) Regulations 2018 please find enclosed certificate for the quarter ended March 31 2025.

SSWL Clocks Highest Ever Monthly Sales In March 25 (Up By 27% YOY) Highest Ever Sales In Aluminium Segment (Up By 50 % YOY By Volume) Monthly Sales In Commercial Vehicles Segment (Up By 32% YOY By Volume)

01-Apr-2025 | Source : BSESSWL achieved Net turnover of Rs. 433.70 Crs in March-25 Vs. Rs. 340.72 Crs in March-24 recording a growth of 24.29% YOY and achieved Gross turnover of Rs. 529.15 Crs in March-25 Vs Rs. 415.05 Crs in March-24 thereby recording a growth of 27.49% YOY.

Corporate Actions

No Upcoming Board Meetings

Steel Strips Wheels Ltd has declared 100% dividend, ex-date: 23 Sep 24

Steel Strips Wheels Ltd has announced 1:5 stock split, ex-date: 10 Nov 22

No Bonus history available

No Rights history available