Steelcast Shows Resilience Amid Mixed Technical Indicators and Market Dynamics

2025-04-02 08:00:17Steelcast, a small-cap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 980.00, slightly down from the previous close of 986.10. Over the past year, Steelcast has demonstrated significant resilience, achieving a return of 50.16%, which notably outpaces the Sensex's return of 2.72% during the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly MACD shows a similar trend. However, the Relative Strength Index (RSI) indicates bearish momentum on both weekly and monthly scales. The Bollinger Bands suggest a mildly bullish outlook, aligning with the daily moving averages, which are also bullish. The KST presents a mixed picture, being bullish weekly but mildly bearish monthly. Steelcast's performance over various time frames highlights its strong recov...

Read MoreSteelcast Shows Resilience with Positive Technical Trends Amid Market Dynamics

2025-03-27 08:00:05Steelcast, a small-cap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 972.05, slightly down from the previous close of 977.10. Over the past year, Steelcast has demonstrated significant resilience, with a remarkable return of 54.38%, outperforming the Sensex, which recorded a return of 6.65% in the same period. The technical summary indicates a generally positive outlook, with weekly and monthly MACD readings showing bullish trends. While the Relative Strength Index (RSI) does not signal any immediate momentum, the Bollinger Bands suggest a bullish stance on a monthly basis. Daily moving averages also reflect a bullish trend, although the KST and On-Balance Volume (OBV) metrics present a mixed picture, indicating some volatility in the short term. In terms of performance, Steelcast has sho...

Read More

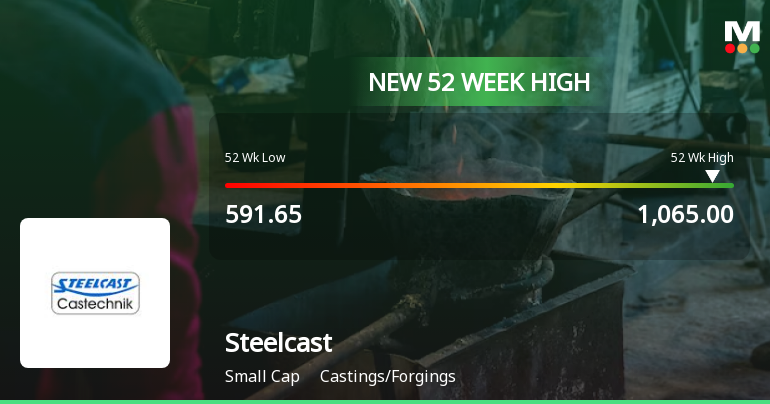

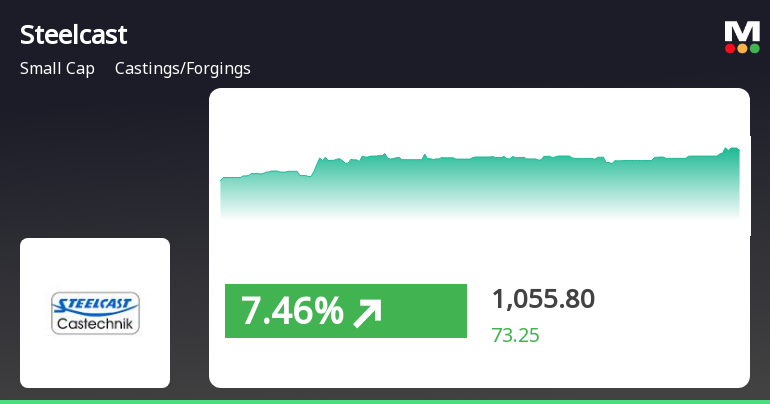

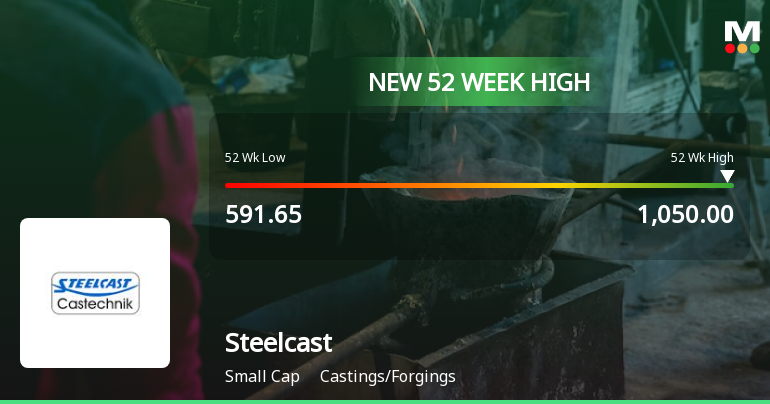

Steelcast Achieves 52-Week High Amid Broader Market Rally and Strong Technical Indicators

2025-03-20 09:35:15Steelcast has reached a new 52-week high of Rs. 1065, coinciding with a broader market rally. The stock has shown resilience with consecutive gains over the past two days and impressive annual returns of 60.87%. It is currently trading above key moving averages, indicating a strong upward trend.

Read MoreSteelcast Shows Mixed Technical Trends Amid Strong Yearly Performance and Market Dynamics

2025-03-20 08:00:05Steelcast, a small-cap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1040.20, showing a notable increase from the previous close of 996.25. Over the past year, Steelcast has demonstrated impressive performance, with a return of 62.67%, significantly outpacing the Sensex, which recorded a return of 4.77% during the same period. The technical summary indicates a mixed outlook, with the MACD and Bollinger Bands showing bullish signals on both weekly and monthly charts. However, the RSI and KST metrics present a more cautious view, indicating bearish trends on the weekly and monthly scales. The moving averages also reflect a bullish sentiment on a daily basis, while the On-Balance Volume (OBV) shows a mildly bullish trend weekly but leans bearish monthly. In terms of stock performance, Steelc...

Read MoreSteelcast Shows Mixed Technical Signals Amid Strong Long-Term Performance Trends

2025-03-19 08:00:03Steelcast, a small-cap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 996.25, having seen fluctuations with a previous close of 1026.30 and a 52-week high of 1,063.40. Today's trading range has been between a low of 970.50 and a high of 1038.65. In terms of technical indicators, the weekly and monthly MACD and Bollinger Bands are showing bullish signals, suggesting a positive momentum in the stock's performance. However, the KST and OBV indicators present a mixed picture, with some mildly bearish signals on a weekly and monthly basis. The Dow Theory indicates a bullish trend on a weekly basis, while the monthly trend remains neutral. When comparing Steelcast's performance to the Sensex, the company has demonstrated significant returns over various periods. Over the past year, Steelcast has...

Read More

Steelcast Achieves Record High Amid Strong Market Performance and Sector Outperformance

2025-03-17 12:15:14Steelcast, a small-cap company in the castings and forgings sector, reached a new all-time high, reflecting a strong upward trend over recent days. The stock has significantly outperformed its sector and has shown impressive long-term growth, notably exceeding the performance of the Sensex.

Read More

Steelcast Achieves 52-Week High Amid Strong Market Performance and Sector Outperformance

2025-03-17 10:05:29Steelcast has reached a new 52-week high of Rs. 1041, reflecting strong performance in the castings and forgings sector. The stock has significantly outperformed its sector and the broader market over the past year, indicating a robust position amidst favorable market conditions.

Read More

Steelcast Achieves All-Time High Stock Price, Signaling Strong Market Momentum

2025-03-17 09:55:10Steelcast has reached an all-time high stock price of Rs. 1012.9, marking a significant achievement for the company. The stock has shown strong momentum, outperforming its sector and the Sensex over various time frames, with notable gains over the past month and year.

Read MoreSteelcast Shows Mixed Technical Signals Amid Strong Historical Performance Trends

2025-03-13 08:00:02Steelcast, a small-cap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 970.25, showing a notable increase from the previous close of 949.80. Over the past year, Steelcast has demonstrated impressive performance, with a return of 57.71%, significantly outpacing the Sensex, which recorded a mere 0.49% return during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a positive outlook, while the daily moving averages also reflect a bullish sentiment. However, the weekly KST and OBV indicate a more cautious stance, suggesting mixed signals in the short term. The RSI shows bearish tendencies on a weekly basis, yet remains neutral on a monthly scale. Steelcast's performance over various time frames highlights its resilience, particularly in the three-ye...

Read MoreReceipt Of Cautionary Email / Letter From Exchanges

09-Apr-2025 | Source : BSEReceipt of Cautionary Email / Letter from Exchanges

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of closure of Trading Window as per the SEBI (Prohibition of Insider Trading) Regulations 2015

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

02-Mar-2025 | Source : BSEIntimation of Analyst / Institutional Investor meeting under the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Steelcast Ltd has declared 36% dividend, ex-date: 07 Feb 25

Steelcast Ltd has announced 5:10 stock split, ex-date: 25 Jul 12

Steelcast Ltd has announced 1:1 bonus issue, ex-date: 25 Jul 12

No Rights history available