Sterling Tools Adjusts Evaluation Score Amid Mixed Technical and Valuation Signals

2025-04-02 08:17:43Sterling Tools, a small-cap fasteners company, has recently seen a change in its evaluation score due to various technical and valuation factors. While technical indicators suggest a bearish trend, the company maintains attractive financial metrics, including a favorable price-to-earnings ratio and strong debt servicing capability.

Read MoreSterling Tools Shows Mixed Technical Trends Amid Market Challenges and Resilience

2025-04-02 08:07:29Sterling Tools, a small-cap player in the fasteners industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 321.05, showing a notable shift from its previous close of 305.95. Over the past year, Sterling Tools has faced challenges, with a return of -6.97%, contrasting with a positive return of 2.72% from the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a clear direction monthly. Bollinger Bands and moving averages also reflect a mildly bearish stance, suggesting a cautious market sentiment. Despite recent struggles, Sterling Tools has demonstrated resilience over longer periods, with impressive re...

Read MoreSterling Tools Adjusts Valuation Grade, Highlighting Competitive Position in Fasteners Sector

2025-04-02 08:02:01Sterling Tools, a small-cap player in the fasteners industry, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company currently boasts a price-to-earnings (P/E) ratio of 17.67 and a price-to-book value of 2.42. Its enterprise value to EBITDA stands at 9.77, while the enterprise value to EBIT is recorded at 13.41. Additionally, Sterling Tools shows a PEG ratio of 0.53, indicating a favorable growth outlook relative to its earnings. The company's return on capital employed (ROCE) is at 17.30%, and the return on equity (ROE) is 13.69%, showcasing its efficiency in generating profits from its capital. Despite a challenging year-to-date return of -44.65%, Sterling Tools has demonstrated resilience over a longer horizon, with a three-year return of 122.95% and a five-year return of 146.87%. In comparison to its peers, Sterling Tools stands out with a sign...

Read MoreSterling Tools Faces Technical Trend Shifts Amid Market Volatility and Evaluation Revision

2025-03-25 08:04:35Sterling Tools, a small-cap player in the fasteners industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 345.90, down from a previous close of 357.80, with a notable 52-week high of 744.30 and a low of 303.35. Today's trading saw a high of 365.00 and a low of 344.90, indicating some volatility. The technical summary for Sterling Tools reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish conditions. The KST presents a mixed picture, being bearish weekly but bullish monthly, while the Dow Theory indicates a mildly bullish weekly trend contrasted with a mildly bearish monthly outlook. In terms of performance, Sterling Tools has shown varied returns compared to the Sensex....

Read MoreSterling Tools Faces Mixed Technical Trends Amidst Recent Stock Performance Shifts

2025-03-19 08:03:44Sterling Tools, a small-cap player in the fasteners industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 331.55, showing a notable increase from the previous close of 308.15. Over the past week, Sterling Tools has demonstrated a stock return of 3.80%, outperforming the Sensex, which recorded a return of 1.62%. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) is bullish weekly but shows no signal monthly, suggesting mixed momentum. Bollinger Bands reflect a mildly bearish trend weekly and bearish monthly, while moving averages indicate a bearish outlook on a daily basis. The KST presents a bearish trend weekly but is bullish monthly, indicating some divergence in performance. The Dow Theory ...

Read More

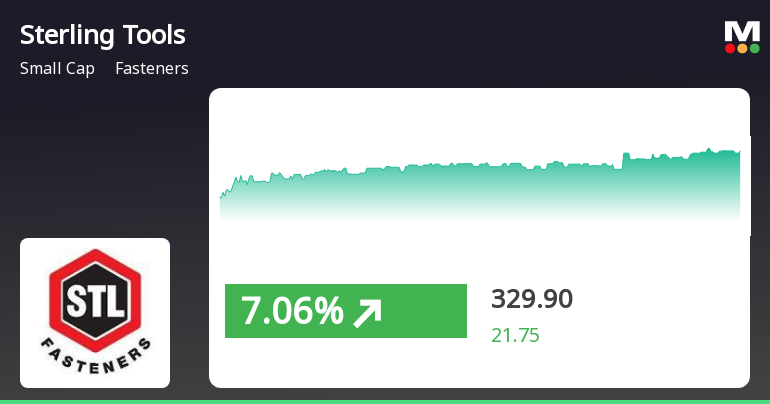

Sterling Tools Shows Resilience Amid Mixed Market Signals and Sector Performance

2025-03-18 14:35:20Sterling Tools Ltd. experienced a notable rebound on March 18, 2025, gaining 7.09% after two days of decline. The stock outperformed its sector, despite mixed signals from moving averages. Over the past month, it faced challenges, but has shown significant growth over the last three years.

Read More

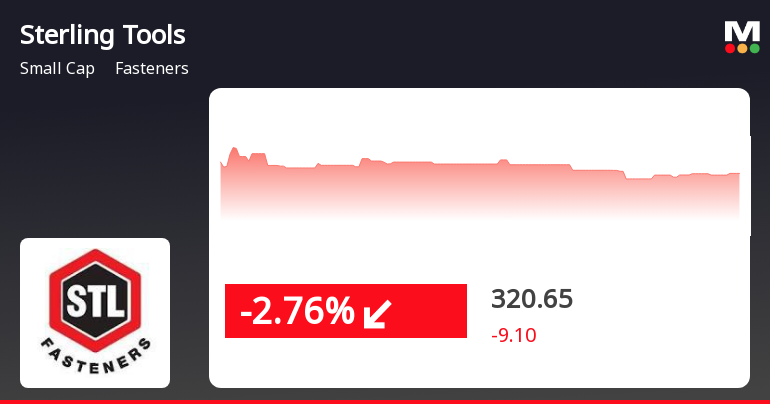

Sterling Tools Faces Significant Volatility Amid Broader Market Decline

2025-03-10 14:35:22Sterling Tools, a small-cap fasteners company, saw a notable decline on March 10, 2025, reversing a four-day gain streak. The stock's volatility is evident with significant intraday fluctuations, and it is currently trading below key moving averages. Year-to-date, it has underperformed compared to the broader market index.

Read More

Sterling Tools Faces Volatility Amidst Strong Financial Performance and Attractive Valuation

2025-03-04 10:14:00Sterling Tools, a small-cap fasteners company, hit a new 52-week low today after six days of decline, though it later showed some recovery. The firm has underperformed the market over the past year, but its financial health remains stable, with significant growth in net sales and profit after tax.

Read MoreSterling Tools Faces Stock Volatility Amidst Industry Challenges and Long-Term Growth Potential

2025-03-03 10:28:38Sterling Tools Ltd., a small-cap player in the fasteners industry, has experienced significant volatility in its stock performance recently. With a market capitalization of Rs 1,136.19 crore, the company currently has a price-to-earnings (P/E) ratio of 18.26, notably lower than the industry average of 38.69. Over the past year, Sterling Tools has seen a decline of 14.67%, contrasting sharply with the Sensex, which has only dipped by 1.19%. The stock's performance has worsened in the short term, with a 5.34% drop today alone, and a staggering 35.81% decrease over the past month. In the week leading up to today, the stock fell by 16.02%, while year-to-date performance shows a decline of 45.86%. Despite these recent challenges, Sterling Tools has demonstrated resilience over longer periods, boasting a three-year performance increase of 107.88% and a five-year rise of 56.10%. However, technical indicators sug...

Read MoreAnnouncement under Regulation 30 (LODR)-Scheme of Arrangement

28-Mar-2025 | Source : BSEIntimation under Regulation 30 of SEBI Reg 2015 regarding the final order passed by Honble National Company Law Tribunal New Delhi Bench regarding approval of Scheme of Amalgamation amongst Haryana Ispat Private Limited (transferror Company) with and into Sterling Tools Limited (Transferee Company).

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Trading Window

Announcement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

13-Mar-2025 | Source : BSEIntimation of cessation of the office of Mr. Abhishek Chawla as Company Secretary and Compliance Officer of the Company w.e.f the closure of business hours of 13th March 2025 pursuant to the resignation tendered by him and as intimated earlier to the exchanges.

Corporate Actions

No Upcoming Board Meetings

Sterling Tools Ltd. has declared 100% dividend, ex-date: 06 Sep 24

Sterling Tools Ltd. has announced 2:10 stock split, ex-date: 09 Jan 17

No Bonus history available

No Rights history available