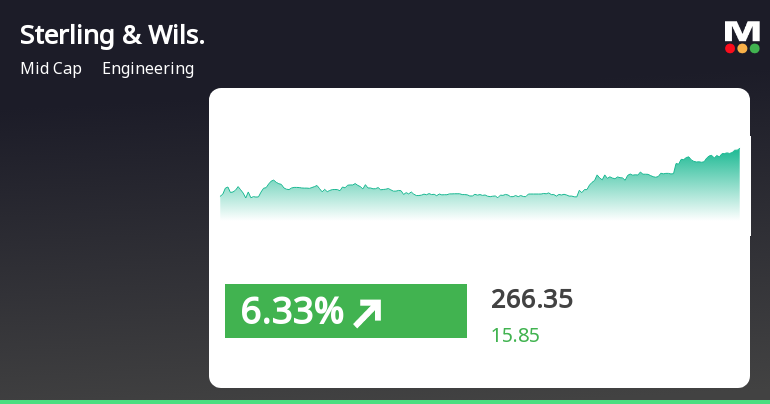

Sterling & Wilson Renewable Energy Shows Resilience Amid Broader Market Decline

2025-04-01 12:35:26Sterling & Wilson Renewable Energy has experienced significant stock activity, outperforming its sector despite a broader market decline. The stock is currently above its short-term moving averages but below longer-term ones. While it has faced declines over the past year and three years, its five-year performance has been notably strong.

Read More

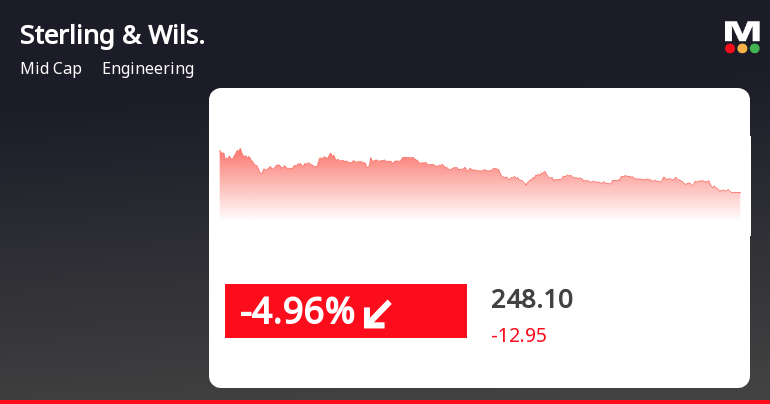

Sterling & Wilson Renewable Energy Faces Significant Challenges Amid Broader Market Decline

2025-03-26 15:35:25Sterling & Wilson Renewable Energy's stock has declined today, reversing a three-day gain streak. It underperformed compared to the engineering sector and reached an intraday low. Over the past month, the stock has decreased, contrasting with the Sensex's gains, while year-to-date performance remains significantly negative.

Read MoreSterling & Wilson Renewable Energy Adjusts Valuation Amidst Mixed Financial Performance

2025-03-24 08:01:03Sterling & Wilson Renewable Energy has recently undergone a valuation adjustment, reflecting shifts in its financial metrics and market position. The company's price-to-earnings ratio stands at 217.07, indicating a significant premium compared to its peers. Additionally, its price-to-book value is recorded at 6.18, while the enterprise value to EBITDA ratio is 44.36. These figures suggest a robust valuation relative to its operational performance. In terms of return on capital employed (ROCE), Sterling & Wilson reported a modest 2.98%, alongside a negative return on equity (ROE) of -5.28%. This performance contrasts with other companies in the engineering sector, where peers like Triveni Turbine and Ircon International exhibit varying valuation metrics, with Triveni showing a notably lower PE ratio of 53.09 and Ircon at 19.73. The stock's recent performance has been mixed, with a notable 15.65% return ove...

Read More

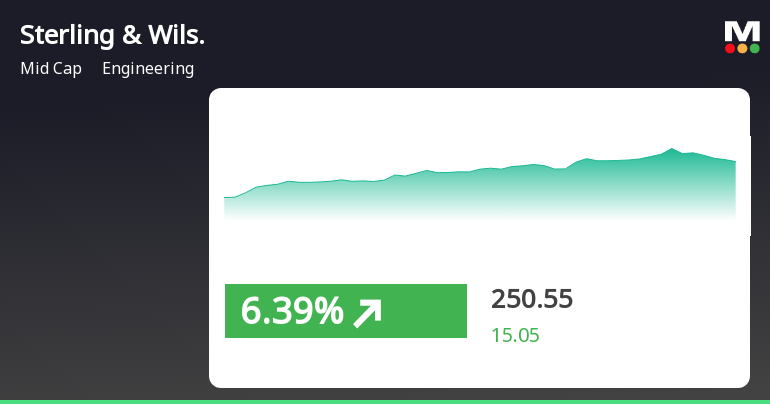

Sterling & Wilson Renewable Energy Shows Short-Term Gains Amid Mixed Market Trends

2025-03-21 09:50:26Sterling & Wilson Renewable Energy experienced significant trading activity, outperforming its sector and reaching an intraday high. The stock's performance indicates mixed short-term momentum, while the broader market, represented by the Sensex, has shown a rebound despite longer-term challenges for both the stock and the index.

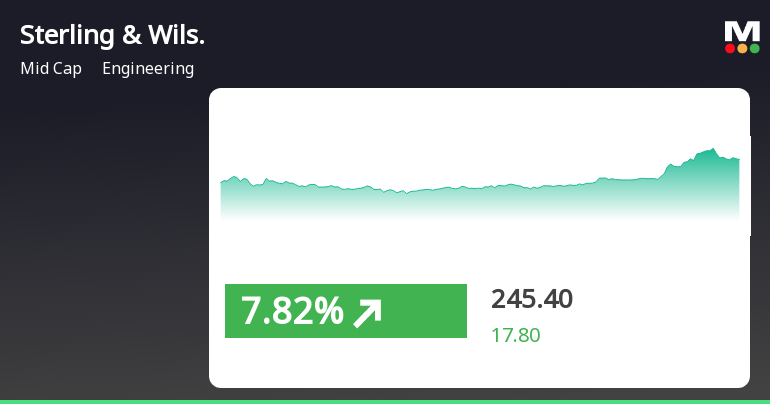

Read MoreSterling & Wilson Renewable Energy Stock Surges, Indicating Strong Market Resilience

2025-03-19 13:00:12Sterling & Wilson Renewable Energy Ltd, a mid-cap player in the engineering sector, has made headlines today as its stock hit the upper circuit limit, reaching an intraday high of Rs 249.95. This marks a significant increase of Rs 15.75, or 6.93%, from the previous trading session. The stock's performance has outpaced its sector by 5.38%, reflecting a strong market position. Throughout the trading day, Sterling & Wilson saw a total traded volume of approximately 64.49 lakh shares, resulting in a turnover of Rs 156.54 crore. The last traded price stood at Rs 243.00, with the stock demonstrating a notable 1D return of 6.31%, compared to a sector return of 0.50% and a Sensex return of 0.34%. The stock has been on a positive trajectory, gaining for the last two days and accumulating a total return of 9.61% during this period. Additionally, the delivery volume has increased by 25.19% against the five-day avera...

Read More

Sterling & Wilson Renewable Energy Shows Volatility Amid Mixed Long-Term Performance Trends

2025-03-19 11:50:29Sterling & Wilson Renewable Energy has seen notable activity, achieving consecutive gains and reaching an intraday high. The stock has displayed high volatility and mixed performance against various moving averages. In the broader market, small-cap stocks are leading, while the Sensex remains below key moving averages.

Read More

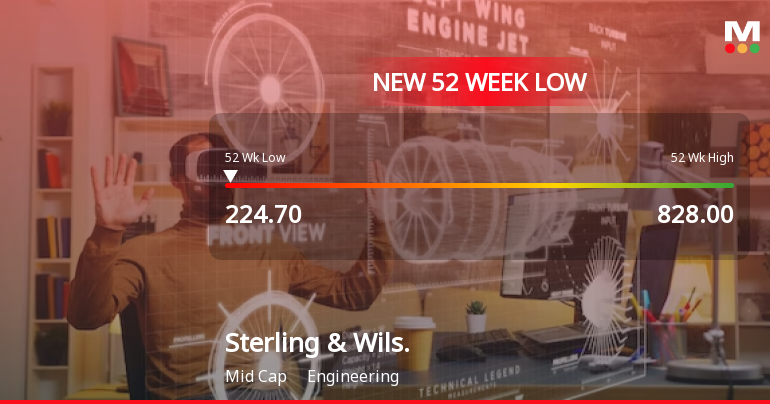

Sterling & Wilson Renewable Energy Faces Challenges Amid Significant Stock Decline

2025-03-17 11:09:40Sterling & Wilson Renewable Energy has hit a new 52-week low, reflecting a significant decline over the past year. Despite a recent slight recovery and strong quarterly profit growth, the company faces ongoing challenges, including weak long-term fundamentals, high debt levels, and a low return on equity.

Read More

Sterling & Wilson Faces Significant Challenges Amid Broader Market Gains

2025-03-13 09:50:00Sterling & Wilson Renewable Energy has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over the past four days. The company's performance contrasts sharply with the broader market, highlighting challenges such as negative growth in operating profits and a high debt-to-EBITDA ratio.

Read More

Sterling & Wilson Faces Challenges Amid Significant Stock Volatility and Weak Fundamentals

2025-03-13 09:49:59Sterling & Wilson Renewable Energy has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over the past year. The company's fundamentals show weaknesses, including negative growth in operating profits and a high Debt to EBITDA ratio, while a substantial portion of promoter shares are pledged.

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEPlease find attached a copy of the Press Release captioned SWREL achieves a breakthrough in Wind EPC; Announces 3 New Solar/ Hybrid Projects

Closure of Trading Window

28-Mar-2025 | Source : BSEThis is to inform you that pursuant to the code of conduct to Regulate Monitor and Report Trading By Insiders (the code) of the Company and SEBI (Prohibition of Insider Trading) Regulations 2015 as amended from time to time the Trading Window for dealing in the Securities of the Company by the Designated Persons and their immediate relatives shall remain closed from Tuesday April 01 2025 until 48 hours after the declaration of the Audited Financial Results of the Company for the quarter and financial year ending March 31 2025( said results). The date of the Board Meeting of the Company for consideration and declaration of the said results will be intimated in due course. Kindly take the above information on records.

Closure of Trading Window

28-Mar-2025 | Source : BSEThis is to inform you that pursuant to the Code of Conduct to Regulate Monitor and Report Trading by Insiders (the Code) of the Company and the SEBI (Prohibition of Insider Trading) Regulations 2015 as amended from time to time the Trading Window for dealing in the Securities of the Company by the Designated Persons and their immediate relatives shall remain closed from Tuesday April 01 2025 until 48 hours after the declaration of the Audited Financial Results of the Company for the quarter and financial year ending March 31 2025 ( said results). The date of the Board Meeting of the Company for consideration and declaration of the said results will be intimated in due course. Kindly take the above information on records.

Corporate Actions

No Upcoming Board Meetings

Sterling & Wilson Renewable Energy Ltd has declared 600% dividend, ex-date: 24 Feb 20

No Splits history available

No Bonus history available

No Rights history available