Stove Kraft Faces Mixed Technical Trends Amidst Strong Long-Term Performance

2025-04-02 08:09:45Stove Kraft, a small-cap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 730.30, showing a notable change from its previous close of 707.60. Over the past year, Stove Kraft has demonstrated a significant return of 66.03%, outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis while remaining mildly bearish on a monthly scale. The Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages indicate a bearish trend on a daily basis, while the KST reflects a bearish stance weekly but a bullish one monthly. In terms of stock performance, Stove Kraft has faced challenges year-to-date, with a return of -16.06%, compar...

Read MoreStove Kraft Ltd Shows Resilience Amid Broader Market Decline and Mixed Indicators

2025-04-01 18:00:31Stove Kraft Ltd, a small-cap player in the consumer durables sector, has shown significant activity in today's trading session, with a rise of 3.21%. This performance stands in contrast to the broader market, as the Sensex declined by 1.80%. Over the past year, Stove Kraft has outperformed the Sensex, delivering a remarkable return of 66.03% compared to the index's 2.72%. Despite today's gains, the stock has faced challenges in the short term, with a weekly decline of 3.83% and a year-to-date drop of 16.06%. The company's current market capitalization is Rs 2,380.00 crore, and it operates with a price-to-earnings (P/E) ratio of 60.81, which is above the industry average of 56.94. Technical indicators present a mixed picture, with the MACD showing bearish signals on a weekly basis, while monthly indicators suggest a mildly bullish outlook. Moving averages indicate a bearish trend in the short term. Overall...

Read MoreStove Kraft Adjusts Valuation Grade Amid Stronger Financial Standing in Consumer Durables Sector

2025-04-01 08:00:47Stove Kraft, a small-cap player in the consumer durables sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's PE ratio stands at 58.92, while its price-to-book value is noted at 5.13. Additionally, Stove Kraft's EV to EBITDA ratio is 17.93, and its EV to sales ratio is 1.79, indicating its operational efficiency and revenue generation capabilities. In terms of profitability, the company reports a return on capital employed (ROCE) of 10.31% and a return on equity (ROE) of 8.70%. The PEG ratio is recorded at 1.06, suggesting a balanced growth perspective relative to its earnings. The dividend yield is modest at 0.35%. When compared to its peers, Stove Kraft's valuation appears more favorable, especially against companies like V I P Industries, which is currently facing challenges with a loss-making status, and Hindware Home, which...

Read More

Stove Kraft Faces Mixed Technical Indicators Amid Strong Yearly Performance

2025-03-28 08:07:59Stove Kraft, a small-cap consumer durables company, has recently seen a change in its evaluation, reflecting a shift in technical trends. Despite a strong annual return of 76.16%, the company faces challenges with flat quarterly performance and modest long-term growth, alongside cautious financial metrics.

Read MoreStove Kraft Experiences Mixed Technical Signals Amid Market Volatility

2025-03-28 08:04:05Stove Kraft, a small-cap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 725.00, down from a previous close of 737.95, with a notable 52-week high of 976.75 and a low of 410.10. Today's trading saw a high of 743.70 and a low of 725.00, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows bearish tendencies on a weekly basis while being mildly bearish monthly. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands present a bearish outlook weekly, contrasting with a bullish stance monthly. Moving averages suggest a mildly bullish trend on a daily basis, while the KST reflects bearish weekly and bullish monthly trends. Dow Theory indicates a mildly bearish position for bo...

Read MoreStove Kraft Experiences Valuation Grade Change Amid Mixed Financial Metrics and Market Challenges

2025-03-05 08:01:05Stove Kraft, a small-cap player in the consumer durables sector, has recently undergone a valuation adjustment, reflecting changes in its financial metrics. The company's price-to-earnings ratio stands at 59.76, while its price-to-book value is noted at 5.20. Additionally, Stove Kraft's enterprise value to EBITDA ratio is 18.16, and its enterprise value to EBIT is recorded at 32.79. The PEG ratio is 1.07, and the dividend yield is relatively modest at 0.35%. In terms of return on capital employed (ROCE) and return on equity (ROE), the latest figures are 10.31% and 8.70%, respectively. When compared to its peers, Stove Kraft's valuation metrics present a mixed picture. For instance, V I P Industries is currently classified as risky, with a higher PE ratio but facing losses, while Hindware Home is viewed more favorably despite also being loss-making. Stove Kraft's stock performance has shown volatility, w...

Read MoreStove Kraft Experiences Valuation Adjustment Amid Strong Yearly Stock Performance

2025-02-24 12:57:56Stove Kraft, a small-cap player in the consumer durables sector, has recently undergone a valuation adjustment. The company's current price stands at 779.00, reflecting a notable shift from its previous close of 792.25. Over the past year, Stove Kraft has demonstrated a robust stock return of 53.09%, significantly outperforming the Sensex, which recorded a return of 1.96% during the same period. Key financial metrics for Stove Kraft include a PE ratio of 65.97 and an EV to EBITDA ratio of 19.85, indicating a premium valuation relative to its peers. The company's return on capital employed (ROCE) is reported at 10.31%, while the return on equity (ROE) stands at 8.70%. In comparison, competitors such as V I P Industries and Hindware Home have faced challenges, with V I P Industries classified as loss-making and Hindware Home also struggling to maintain profitability. Despite the recent valuation adjustment,...

Read More

Stove Kraft Shows Strong Performance Amidst Mixed Short-Term Trends in Consumer Durables

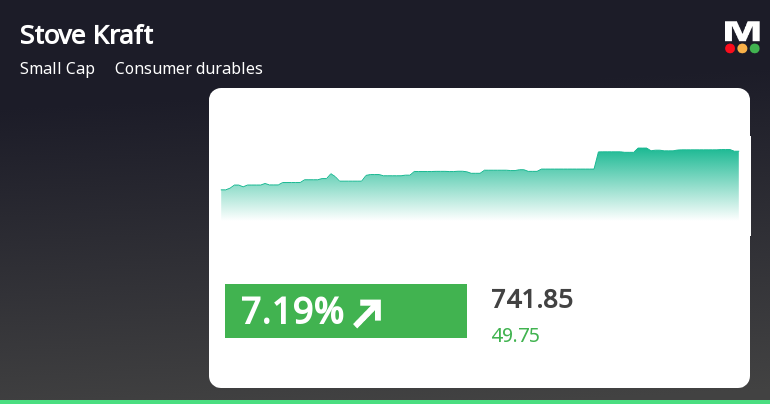

2025-02-19 11:35:29Stove Kraft, a small-cap consumer durables company, experienced notable trading activity on February 19, 2025, with a significant intraday high. The stock outperformed its sector, although it has faced challenges over the past month, contrasting with the overall market's stability.

Read More

Stove Kraft Faces Significant Challenges Amid Broader Consumer Durables Decline in February 2025

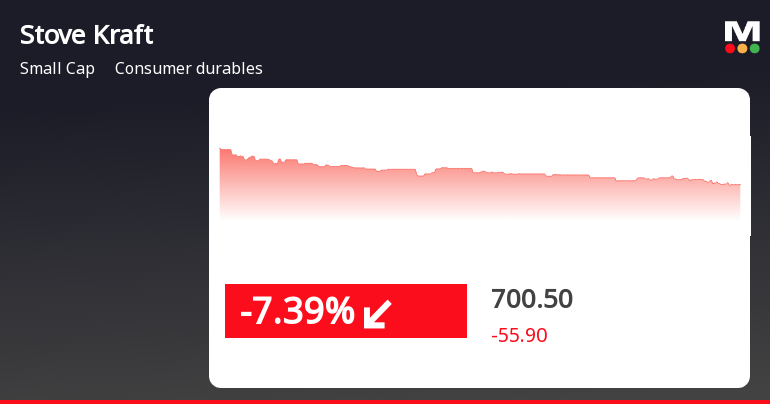

2025-02-14 15:35:24Stove Kraft, a small-cap consumer durables company, saw a notable decline of 7.39% on February 14, 2025, underperforming the sector. The stock is currently below all major moving averages and has dropped 17.63% over the past month, reflecting ongoing challenges in the market environment.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations2018.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

03-Apr-2025 | Source : BSEInvestor Meet

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

26-Mar-2025 | Source : BSECancellation of Investor Meet

Corporate Actions

No Upcoming Board Meetings

Stove Kraft Ltd has declared 25% dividend, ex-date: 13 Sep 24

No Splits history available

No Bonus history available

No Rights history available