Sudarshan Chemical Faces Market Dynamics Amidst Modest Sales Growth and Bearish Signals

2025-03-20 08:07:49Sudarshan Chemical Industries, a major entity in the Dyes & Pigments sector with a market cap of Rs 7,934 crore, has experienced a recent evaluation adjustment. Despite a strong annual return, the company faces challenges with modest net sales growth and limited operating profit, indicating potential concerns for its financial sustainability.

Read MoreSudarshan Chemical Shows Mixed Technical Trends Amid Strong Long-Term Performance

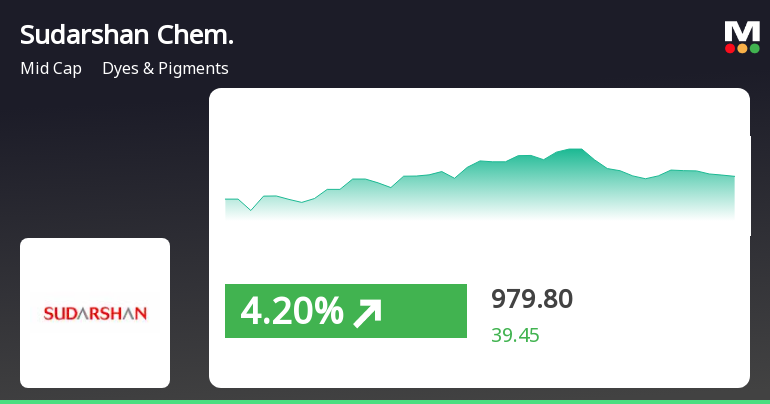

2025-03-20 08:02:29Sudarshan Chemical Industries, a midcap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 1009.75, showing a notable increase from the previous close of 981.30. Over the past year, Sudarshan Chemical has demonstrated a strong performance, with a return of 73.21%, significantly outpacing the Sensex's return of 4.77% during the same period. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis while remaining bullish monthly. The Relative Strength Index (RSI) shows no signals for both weekly and monthly evaluations. Bollinger Bands reflect a mildly bearish stance weekly, contrasting with a bullish monthly outlook. Moving averages also suggest a mildly bearish trend on a daily basis. The KST and Dow Theory indicators present mixed signals, with weekly bea...

Read MoreSudarshan Chemical Industries Outperforms Market with Strong Long-Term Growth Metrics

2025-03-19 18:00:29Sudarshan Chemical Industries, a mid-cap player in the Dyes & Pigments industry, has shown significant activity in the stock market today, with a notable increase of 2.90%. This performance stands in contrast to the Sensex, which rose by only 0.20%. Over the past year, Sudarshan Chemical Industries has delivered an impressive return of 73.21%, significantly outperforming the Sensex's 4.77% gain during the same period. In terms of market metrics, the company currently holds a market capitalization of Rs 7,621.00 crore and a price-to-earnings (P/E) ratio of 61.50, which is considerably higher than the industry average P/E of 31.38. This suggests that the stock is trading at a premium compared to its peers. While the stock has faced some challenges in the short term, with a year-to-date performance of -10.40%, its long-term trajectory remains strong, evidenced by a remarkable 186.45% increase over the past f...

Read More

Sudarshan Chemical Faces Operational Efficiency Concerns Amidst Market Position Strength

2025-03-10 08:06:53Sudarshan Chemical Industries, a key player in the Dyes & Pigments sector, has recently experienced an evaluation adjustment. The company, with a market cap of Rs 7,936 crore, represents 37.90% of the industry. Despite flat quarterly performance, it has achieved a 72.78% return over the past year.

Read MoreSudarshan Chemical Industries Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-10 08:01:24Sudarshan Chemical Industries, a midcap player in the Dyes & Pigments sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1010.00, showing a notable increase from the previous close of 940.35. Over the past year, Sudarshan has demonstrated impressive performance, with a return of 72.78%, significantly outpacing the Sensex, which recorded a mere 0.29% during the same period. The company's technical indicators present a mixed picture. While the MACD shows a bullish trend on a monthly basis, the weekly outlook remains bearish. The Bollinger Bands and KST also reflect contrasting signals, with the monthly indicators suggesting a more favorable environment. The moving averages indicate a mildly bullish sentiment on a daily basis, suggesting some positive momentum. In terms of stock performance, Sudarshan has shown resilience, particular...

Read More

Sudarshan Chemical Industries Shows Resilience Amid Broader Market Decline

2025-03-07 09:45:55Sudarshan Chemical Industries has demonstrated strong performance in the Dyes & Pigments sector, gaining 6.13% on March 7, 2025, and outperforming its sector. The stock has shown a robust upward trend over the past four days, with a notable annual return of 69.50%, contrasting with the Sensex's minimal gain.

Read MoreSudarshan Chemical Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-06 08:01:49Sudarshan Chemical Industries, a midcap player in the Dyes & Pigments sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 913.80, showing a notable increase from the previous close of 858.00. Over the past year, Sudarshan Chemical has demonstrated a significant return of 59.55%, contrasting sharply with the Sensex's minimal gain of 0.07% during the same period. In terms of technical indicators, the company exhibits a mixed performance. The MACD shows bearish signals on a weekly basis while being mildly bearish monthly. The Relative Strength Index (RSI) indicates no clear signal for both weekly and monthly assessments. Bollinger Bands present a mildly bearish outlook weekly but shift to bullish on a monthly basis. Moving averages suggest a mildly bullish trend daily, while the KST reflects bearish weekly and bullish monthly signals....

Read More

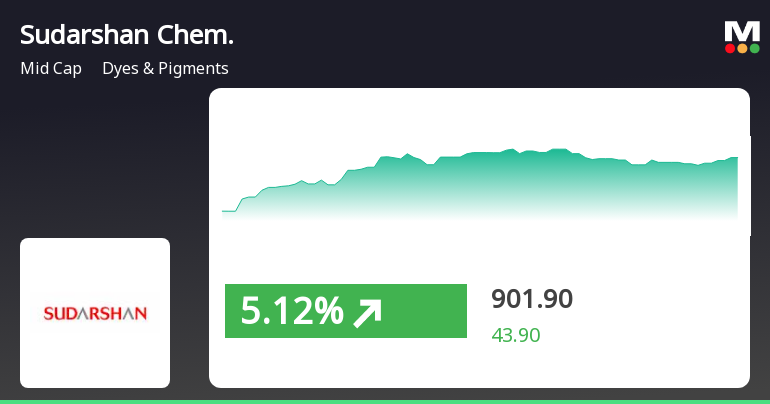

Sudarshan Chemical Industries Shows Resilience Amid Broader Market Trends and Small-Cap Gains

2025-03-05 09:45:46Sudarshan Chemical Industries has experienced notable activity, gaining 5.48% on March 5, 2025, and outperforming its sector. The stock has increased 8.93% over two days, reaching an intraday high of Rs 894. Despite mixed longer-term momentum, it shows resilience amid broader market trends.

Read MoreSudarshan Chemical Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-05 08:02:17Sudarshan Chemical Industries, a midcap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 858.00, showing a notable increase from the previous close of 820.70. Over the past year, Sudarshan Chemical has demonstrated a strong performance with a return of 45.74%, significantly outpacing the Sensex, which recorded a mere 1.19% return during the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals on both weekly and monthly charts, indicating a neutral momentum. The Bollinger Bands present a bearish trend on a weekly basis but are mildly bullish monthly. Moving averages suggest a mildly bullish stance on a daily basis, contrasting with the bearish signals from the KST and Dow Theory indi...

Read MoreIntimation Of Receipt Of No Objection Of Stock Exchanges - Reclassification Under Reg 31A Of SEBI Listing Regulations 2015

05-Apr-2025 | Source : BSEPlease refer to the enclosed disclosure

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Manan Ajay Rathi

Closure of Trading Window

31-Mar-2025 | Source : BSEIntimation of closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Sudarshan Chemical Industries Ltd has declared 50% dividend, ex-date: 26 Jul 24

Sudarshan Chemical Industries Ltd has announced 2:10 stock split, ex-date: 30 Sep 14

Sudarshan Chemical Industries Ltd has announced 1:1 bonus issue, ex-date: 30 Sep 14

No Rights history available