Sumitomo Chemical India Outperforms Sector with Strong Price Momentum and Growth Trends

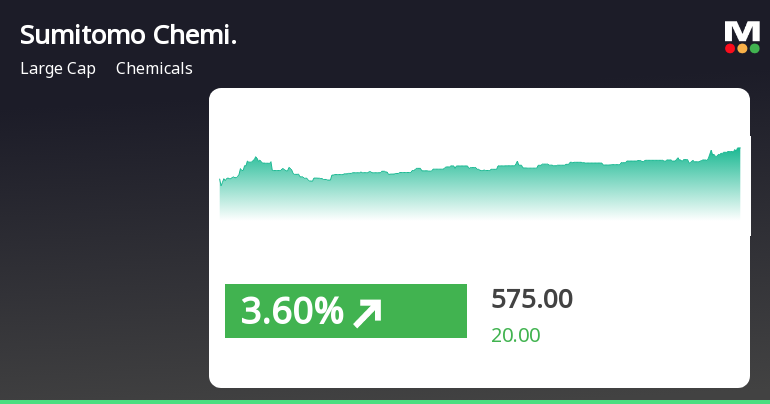

2025-04-02 15:35:25Sumitomo Chemical India experienced significant trading activity on April 2, 2025, outperforming its sector and reaching an intraday high. The stock has shown strong momentum, trading above key moving averages, and has delivered substantial gains over various timeframes, significantly exceeding the performance of the Sensex.

Read MoreSumitomo Chemical India Shows Mixed Technical Trends Amid Strong Market Performance

2025-04-01 08:03:32Sumitomo Chemical India, a prominent player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 558.75, showing a notable increase from the previous close of 529.30. Over the past year, the company has demonstrated a robust performance, with a return of 60.84%, significantly outpacing the Sensex's return of 5.11% during the same period. In terms of technical indicators, the weekly MACD is bullish, while the monthly outlook presents a mildly bearish trend. The Bollinger Bands indicate a bullish stance on both weekly and monthly assessments, suggesting a favorable market environment. The KST shows a mildly bullish trend weekly and bullish monthly, further supporting the stock's positive momentum. The company's performance over various time frames highlights its resilience, particularly in the one-month period wher...

Read More

Sumitomo Chemical India Outperforms Market Amid Broader Volatility and Strong Returns

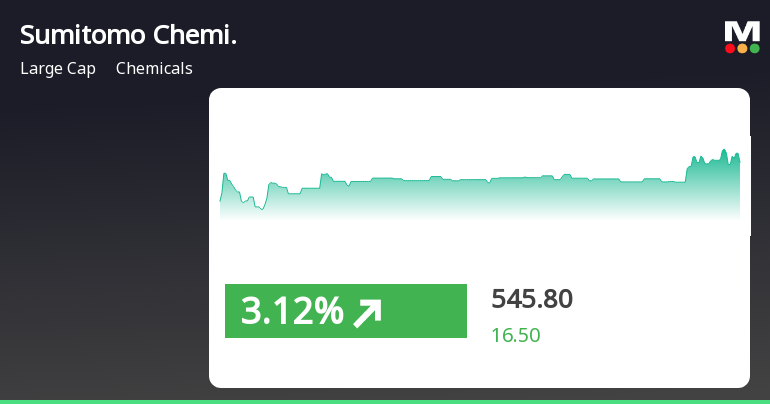

2025-03-28 13:35:23Sumitomo Chemical India has demonstrated strong performance, gaining 3.25% on March 28, 2025, and outperforming its sector. The stock is trading above all key moving averages and has surged nearly 20% over the past month, achieving a remarkable 58.46% return over the past year amid broader market volatility.

Read MoreSumitomo Chemical India Shows Mixed Technical Trends Amid Strong Yearly Performance

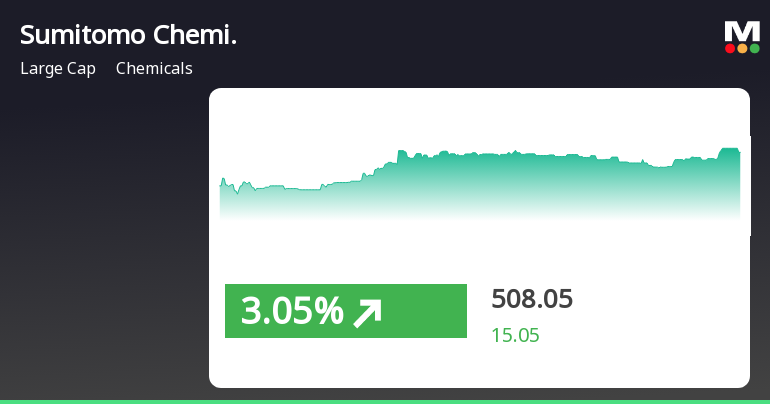

2025-03-21 08:03:07Sumitomo Chemical India, a prominent player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 524.90, showing a notable increase from the previous close of 511.30. Over the past year, the stock has demonstrated a robust performance, achieving a return of 51.07%, significantly outpacing the Sensex, which recorded a return of 5.89% in the same period. In terms of technical indicators, the company's weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Interestingly, the Bollinger Bands suggest a bullish stance on both weekly and monthly charts, indicating potential volatility. The On-Balance Volume (OBV) also reflects a bullish trend, supporting the stock's positive momentum. ...

Read More

Sumitomo Chemical India Shows Resilience Amid Fluctuating Market Conditions

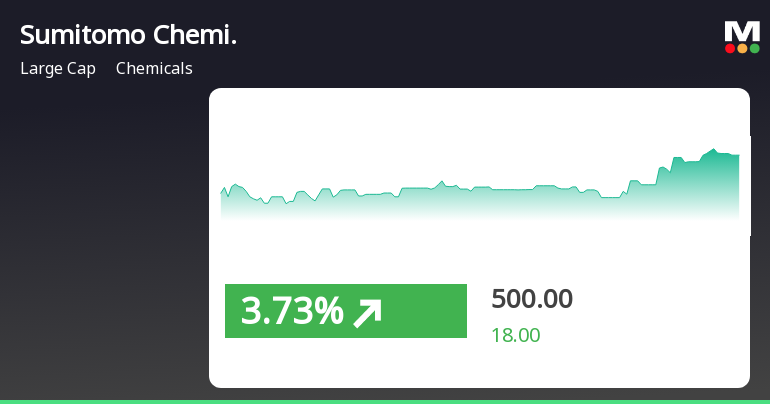

2025-03-19 15:05:25Sumitomo Chemical India has experienced significant activity, outperforming its sector and showing a consistent upward trend over the past three days. The stock is currently above its short-term moving averages, indicating a mixed trend. The broader market is also seeing positive movement, particularly among mid-cap stocks.

Read More

Sumitomo Chemical India Shows Resilience Amid Fluctuating Market Conditions

2025-03-06 11:35:26Sumitomo Chemical India has experienced significant gains, marking its fourth consecutive day of increases with an 8.41% total return over this period. The stock is currently above its short-term moving averages, reflecting mixed momentum, while small-cap stocks lead the broader market amid a fluctuating environment.

Read More

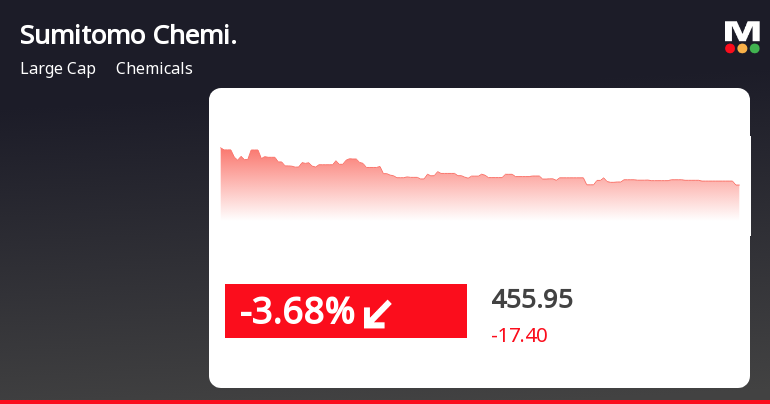

Sumitomo Chemical India Faces Continued Stock Decline Amid Broader Market Trends

2025-02-28 10:35:22Sumitomo Chemical India has faced a significant decline in stock performance, falling for four consecutive days and experiencing a total drop over this period. The stock is trading below multiple moving averages, reflecting ongoing challenges in the market compared to its sector and the broader index.

Read More

Sumitomo Chemical India Faces Market Challenges Amid Declining Financial Performance in November 2023

2025-02-14 18:36:48Sumitomo Chemical India has experienced a recent evaluation adjustment, influenced by its financial performance amid challenging market conditions. In Q3 FY24-25, the company reported net sales of Rs 641.92 crore and a decline in operating profit, while maintaining a return on equity of 17.8%.

Read More

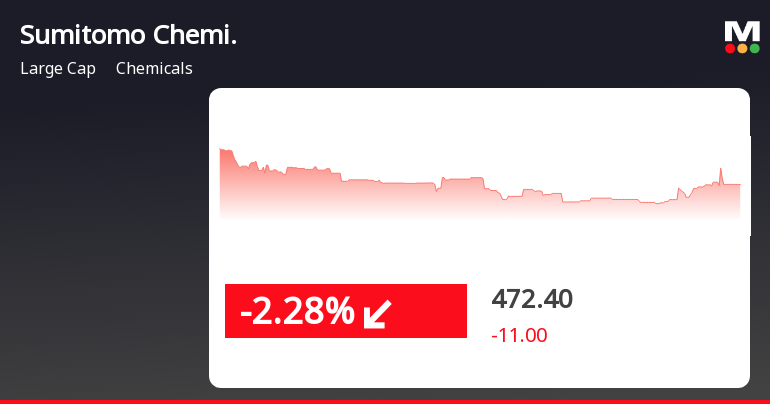

Sumitomo Chemical India Faces Continued Decline Amid Sector Volatility in February 2025

2025-02-14 12:35:40Sumitomo Chemical India has faced a significant decline, marking six consecutive days of losses and a total drop of 12.84%. Despite slightly outperforming its sector, the stock is trading below key moving averages, reflecting ongoing challenges in the volatile chemicals market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (DP) Regulations 2018 for the quarter ended 31st March 2025.

Integrated Filing (Financial)

04-Mar-2025 | Source : BSEIntegrated Filing (Financial).

Announcement under Regulation 30 (LODR)-Credit Rating

03-Feb-2025 | Source : BSECRISIL Limited has reaffirmed credit rating to the Companys Bank facilities.

Corporate Actions

No Upcoming Board Meetings

Sumitomo Chemical India Ltd has declared 9% dividend, ex-date: 19 Jul 24

No Splits history available

No Bonus history available

No Rights history available