Sundaram Finance Adjusts Evaluation Amid Mixed Technical Indicators and Strong Fundamentals

2025-04-02 08:34:45Sundaram Finance has recently adjusted its evaluation, reflecting its current market position and performance indicators. The company reported strong financial results, including record net sales and profits, while maintaining a solid long-term fundamental strength, evidenced by a consistent Return on Equity and notable institutional holdings.

Read MoreSundaram Finance Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-04-02 08:07:58Sundaram Finance, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 4,513.00, down from a previous close of 4,580.10, with a notable 52-week high of 5,528.85 and a low of 3,738.85. Today's trading saw a high of 4,590.20 and a low of 4,471.45. In terms of technical indicators, the weekly MACD remains bullish, while the monthly outlook shows a mildly bearish trend. The Bollinger Bands indicate a mildly bullish stance on both weekly and monthly bases, and daily moving averages also reflect a mildly bullish trend. However, the KST presents a mixed picture with a bullish weekly signal contrasted by a mildly bearish monthly signal. Notably, the Dow Theory and On-Balance Volume show no discernible trends at this time. When comparing the company's performance to the Sensex, Sundaram Financ...

Read More

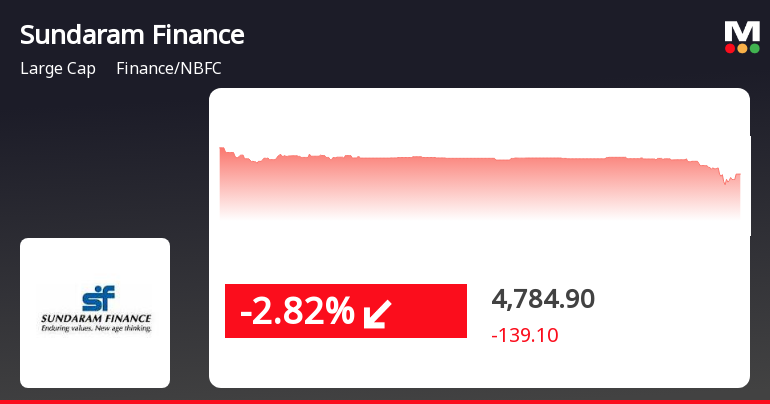

Sundaram Finance Faces Short-Term Setback Amid Strong Long-Term Growth Trends

2025-03-27 13:35:26Sundaram Finance saw a decline in stock performance on March 27, 2025, underperforming its sector. Despite this, the company remains strong relative to its moving averages and has shown significant long-term growth, outperforming the Sensex over the past year and in multi-year periods.

Read More

Sundaram Finance Shows Strong Financial Performance Amid Shift in Market Sentiment

2025-03-25 08:22:59Sundaram Finance has recently experienced a change in evaluation, reflecting a shift in its technical trends. The company reported impressive Q3 FY24-25 results, with record net sales and strong operational metrics. Its consistent performance has led to significant institutional holdings, indicating confidence from larger investors.

Read More

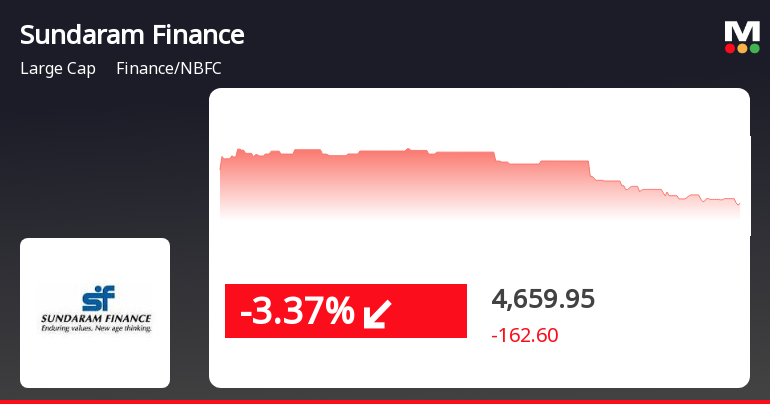

Sundaram Finance Faces Volatility Amidst Broader Market Gains and Long-Term Growth Trends

2025-03-24 15:35:25Sundaram Finance saw a decline on March 24, 2025, following two days of gains, with significant intraday volatility. While it underperformed compared to the Sensex, the stock has shown resilience over the past year and remains above key moving averages, indicating a generally positive long-term trend.

Read MoreSundaram Finance Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-24 08:02:15Sundaram Finance, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,924.00, showing a notable increase from the previous close of 4,855.00. Over the past year, Sundaram Finance has demonstrated strong performance, with a return of 22.25%, significantly outpacing the Sensex's return of 5.87% during the same period. The technical summary indicates a mixed outlook, with weekly indicators such as MACD and Bollinger Bands signaling bullish trends, while monthly metrics present a more cautious stance. The stock's moving averages also reflect a bullish sentiment on a daily basis, suggesting positive momentum in the short term. In terms of historical performance, Sundaram Finance has shown remarkable growth over various time frames, including a staggering 315.05% return over the past five years co...

Read MoreSundaram Finance Shows Strong Market Resilience Amid Broader Financial Trends

2025-03-21 18:00:08Sundaram Finance, a prominent player in the finance and non-banking financial company (NBFC) sector, has shown significant activity today, reflecting its robust market position. The company boasts a market capitalization of Rs 55,025.00 crore, categorizing it as a large-cap entity. In terms of performance metrics, Sundaram Finance has outperformed the Sensex across various time frames. Over the past year, the stock has delivered a remarkable return of 22.25%, significantly surpassing the Sensex's 5.87% gain. The stock's performance over the last day, week, month, and year-to-date also indicates a strong upward trend, with daily gains of 1.42% and weekly gains of 7.14%. The technical indicators present a mixed picture, with the MACD showing bullish signals on a weekly basis but mildly bearish on a monthly basis. The stock's moving averages are bullish on a daily basis, while the Bollinger Bands reflect b...

Read More

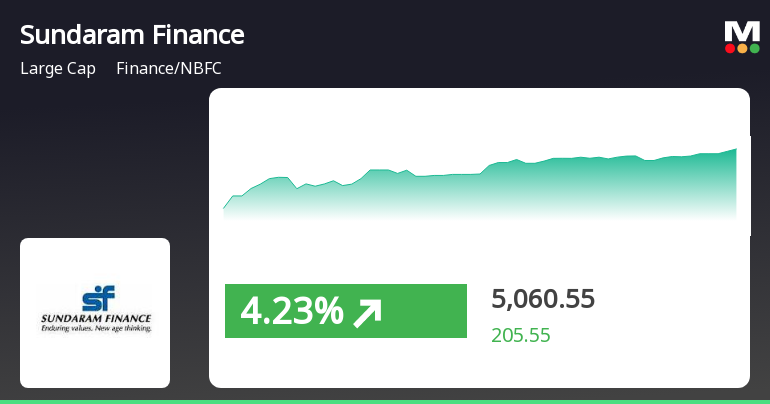

Sundaram Finance Outperforms Sector with Strong Stock Performance and Gains

2025-03-21 10:05:28Sundaram Finance has demonstrated strong performance, gaining 3.51% on March 21, 2025, and outperforming its sector. The stock has shown consistent gains over the past two days and has significantly outperformed the Sensex over various timeframes, highlighting its robust position in the finance/NBFC sector.

Read More

Sundaram Finance Reports Strong Financial Metrics Amidst Market Evaluation Adjustments

2025-03-18 08:21:37Sundaram Finance has recently adjusted its evaluation, reflecting strong financial performance in Q3 FY24-25, with net sales of Rs 2,190.31 crore and a profit after tax of Rs 455.47 crore. The company shows solid long-term fundamentals, consistent returns, and high institutional holdings, despite trading at a premium.

Read MoreResults Press Release for September 30 2024

04-Nov-2024 | Source : BSESundaram Finance Ltd has informed BSE about :

1. Result Press Release for the period ended September 30 2024

Appointment/Re-appointment of employees in the Senior Management Category

04-Nov-2024 | Source : BSESundaram Finance Ltd has informed BSE regarding Appointment/Re-appointment of employees in the Senior Management Category.

Standalone & Consolidated Financial Results Limited Review Report for September 30 2024

04-Nov-2024 | Source : BSESundaram Finance Ltd has informed BSE about :

1. Standalone Financial Results for the period ended September 30 2024

2. Consolidated Financial Results for the period ended September 30 2024

3. Standalone Limited Review for the period ended September 30 2024

4. Consolidated Limited Review for the period ended September 30 2024

5. Standalone Cash Flow Statement for the period ended September 30 2024

6. Consolidated Cash Flow Statement for the period ended September 30 2024

Corporate Actions

No Upcoming Board Meetings

Sundaram Finance Ltd has declared 140% dividend, ex-date: 07 Feb 25

No Splits history available

Sundaram Finance Ltd has announced 1:1 bonus issue, ex-date: 13 Dec 12

No Rights history available