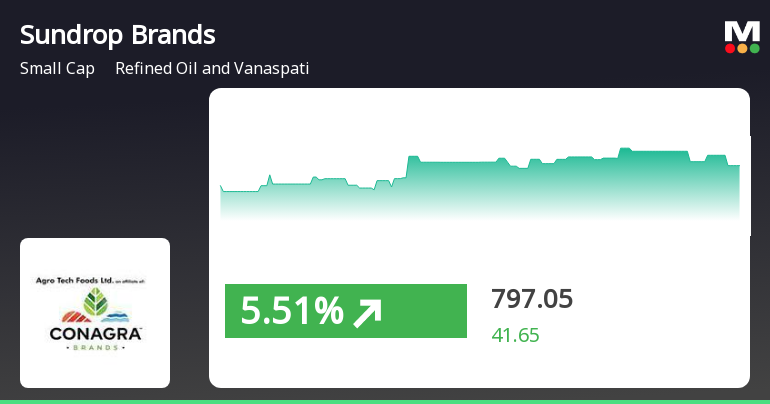

Sundrop Brands Faces Mixed Technical Trends Amid Strong Yearly Performance

2025-04-02 08:08:00Sundrop Brands, a small-cap player in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 814.55, showing a notable increase from the previous close of 755.40. Over the past year, Sundrop Brands has demonstrated a return of 17.26%, significantly outperforming the Sensex, which recorded a return of 2.72% during the same period. In terms of technical indicators, the company exhibits a mixed performance. The MACD signals bearish trends on both weekly and monthly scales, while the RSI shows no signal weekly but indicates bullish momentum monthly. Bollinger Bands and On-Balance Volume (OBV) reflect mildly bearish trends, suggesting some caution in the short term. However, Dow Theory indicates a mildly bullish outlook on both weekly and monthly bases. Sundrop Brands' performance over various time frames re...

Read More

Sundrop Brands Shows Resilience Amid Market Decline, Outperforming Sector Trends

2025-04-01 12:05:23Sundrop Brands, a small-cap company in the refined oil and vanaspati sector, experienced significant activity on April 1, 2025, outperforming the declining market. The stock reached an intraday high and has shown a strong annual return, despite facing challenges over the past three years compared to the Sensex.

Read MoreAgro Tech Foods Faces Technical Challenges Amidst Long-Term Resilience in Market

2025-03-24 08:02:16Agro Tech Foods, a small-cap player in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 812.00, showing a slight increase from the previous close of 808.60. Over the past year, Agro Tech Foods has demonstrated a return of 13.42%, outperforming the Sensex, which recorded a return of 5.87% during the same period. However, the company's performance has faced challenges in shorter time frames. Year-to-date, Agro Tech Foods has seen a decline of 12.69%, while the Sensex has experienced a minor drop of 1.58%. In the last three years, the stock has lagged behind the Sensex, with a return of -2.83% compared to the index's 34.23%. The technical summary indicates a bearish sentiment in various indicators, including MACD and Bollinger Bands on a weekly basis. Despite these trends, the stock's performance ov...

Read MoreAgro Tech Foods Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-17 08:01:09Agro Tech Foods, a player in the refined oil and vanaspati sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 813.65, showing a slight increase from the previous close of 800.05. Over the past year, Agro Tech Foods has demonstrated a notable return of 23.76%, significantly outperforming the Sensex, which recorded a return of 1.47% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal on a weekly basis but is bullish monthly. Bollinger Bands and KST also reflect a mildly bearish stance on a weekly basis, with the monthly KST showing bullish tendencies. Despite recent fluctuations, Agro Tech Foods has shown resilience, particularly over the past year, where it has outperformed the broade...

Read MoreAgro Tech Foods Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-13 08:02:08Agro Tech Foods, a small-cap player in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 800.05, down from a previous close of 820.90, with a 52-week high of 1,151.20 and a low of 646.90. Today's trading saw a high of 824.95 and a low of 800.00. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish outlook for both weekly and monthly assessments. Moving averages on a daily basis align with this bearish sentiment, and the KST presents a mixed view with a bearish weekly trend and a bullish monthly trend. In terms of performance, Agro Tech Foods has experienced varied returns compared to the Sensex. Over the past week, the stock returned -2....

Read MoreAgro Tech Foods Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-13 08:02:08Agro Tech Foods, a small-cap player in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 800.05, down from a previous close of 820.90, with a 52-week high of 1,151.20 and a low of 646.90. Today's trading saw a high of 824.95 and a low of 800.00. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish outlook for both weekly and monthly assessments. Moving averages on a daily basis align with this bearish sentiment, and the KST presents a mixed view with a bearish weekly trend and a bullish monthly trend. In terms of performance, Agro Tech Foods has experienced varied returns compared to the Sensex. Over the past week, the stock returned -2....

Read MoreAgro Tech Foods Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-12 08:02:29Agro Tech Foods, a small-cap player in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 820.90, showing a slight increase from the previous close of 805.00. Over the past year, Agro Tech Foods has demonstrated a return of 18.00%, significantly outperforming the Sensex, which recorded a return of 0.82% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis while remaining bullish monthly. The Relative Strength Index (RSI) presents no signal weekly but is bullish monthly, suggesting some underlying strength. Bollinger Bands and moving averages indicate a mildly bearish stance, reflecting cautious market sentiment. In terms of stock performance relative to the Sensex, Agro Tech Foods has shown resilience over...

Read MoreAgro Tech Foods Faces Technical Trend Shifts Amid Market Sentiment Changes

2025-03-11 08:04:18Agro Tech Foods, a small-cap player in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 805.00, slightly down from the previous close of 811.65. Over the past year, Agro Tech Foods has shown a return of 12.99%, contrasting with a negligible change in the Sensex, which recorded a return of -0.01%. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The daily moving averages also reflect a bearish stance. Notably, the KST indicator presents a mixed picture, being bearish on a weekly basis but bullish monthly. When examining the stock's performance against the Sensex, Agro Tech Foods has faced challenges, particularly in the year-to-date period, where it has returned -13.44% compared to the Sensex...

Read MoreAgro Tech Foods Shows Short-Term Gains Amid Long-Term Performance Challenges

2025-03-04 11:08:05Agro Tech Foods Ltd, a small-cap player in the refined oil and vanaspati industry, has shown notable activity today, with its stock price increasing by 0.95%. This performance stands in contrast to the broader market, as the Sensex experienced a slight decline of 0.11%. Over the past year, Agro Tech Foods has outperformed the Sensex, posting a modest gain of 0.78% compared to the index's loss of 1.18%. Despite this positive short-term trend, the company's longer-term performance reveals challenges. Over the past three years, Agro Tech Foods has seen a decline of 5.60%, while the Sensex has surged by 34.36%. Additionally, the stock's price-to-earnings (P/E) ratio stands at 295.83, significantly higher than the industry average of 17.49, indicating a premium valuation relative to its peers. Technical indicators present a mixed picture, with weekly MACD and moving averages showing bearish signals, while mont...

Read MoreClosure of Trading Window

29-Mar-2025 | Source : BSEIntimation regarding closure of trading window

Announcement under Regulation 30 (LODR)-Newspaper Publication

29-Mar-2025 | Source : BSEIntimation regarding Newspaper Publication of Postal Ballot Notice by remote e-voting

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

28-Mar-2025 | Source : BSEIntimation to the Stock Exchange regarding Notice of Postal Ballot

Corporate Actions

No Upcoming Board Meetings

Sundrop Brands Ltd has declared 30% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available