Suprajit Engineering Faces Technical Shift Amid Declining Profitability and Sales Growth

2025-03-27 08:02:11Suprajit Engineering has experienced a recent adjustment in its evaluation, indicating a shift in technical outlook. Key indicators suggest a more cautious market sentiment, while the company faces challenges in financial performance, particularly in the third quarter. Institutional holdings remain strong, reflecting investor confidence despite these concerns.

Read MoreSuprajit Engineering Faces Bearish Technical Trends Amid Market Volatility

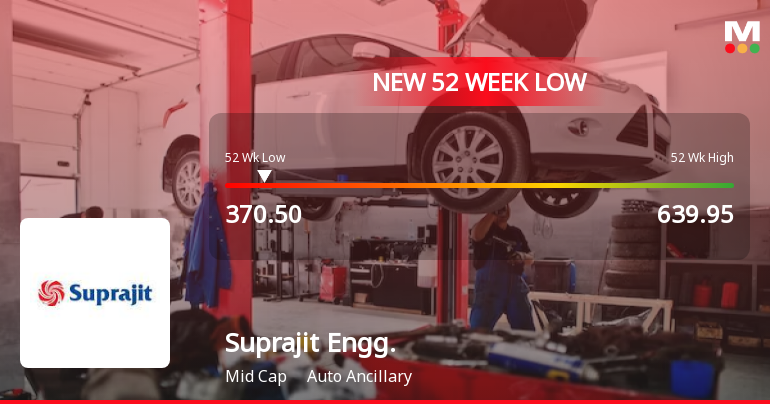

2025-03-27 08:01:37Suprajit Engineering, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 393.00, down from a previous close of 407.10, with a 52-week high of 639.95 and a low of 370.50. Today's trading saw a high of 415.85 and a low of 390.30, indicating some volatility. The technical summary for Suprajit Engineering reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. The KST and Dow Theory indicators align with this sentiment, indicating a consistent bearish trend. In terms of performance, Suprajit Engineering's returns have lagged behind the Sensex over multiple time frames. Over the past year, the sto...

Read More

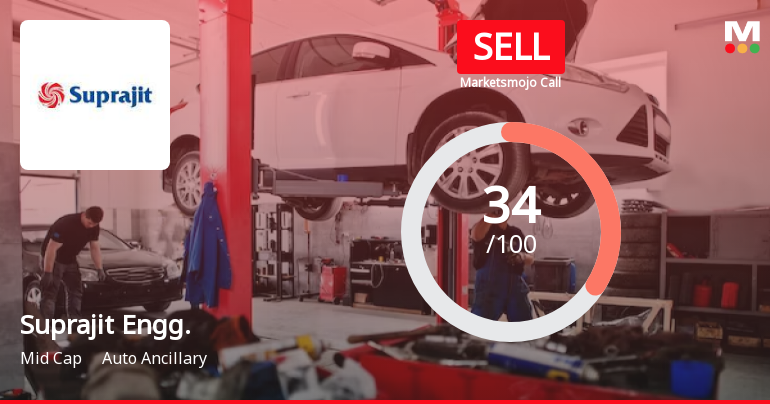

Suprajit Engineering Faces Evaluation Score Adjustment Amid Bearish Market Indicators

2025-03-24 08:02:13Suprajit Engineering, a midcap auto ancillary firm, has recently seen a change in its evaluation score, influenced by technical indicators and market dynamics. Despite a modest return over the past year, the company faces challenges with declining net sales growth and operating profit, alongside an elevated valuation compared to peers.

Read MoreSuprajit Engineering Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-24 08:01:18Suprajit Engineering, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 404.90, showing a notable increase from the previous close of 391.00. Over the past year, Suprajit has experienced a slight return of 0.22%, contrasting with a 5.87% return from the Sensex, indicating a mixed performance relative to the broader market. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, while moving averages also reflect a mildly bearish sentiment. The KST and On-Balance Volume (OBV) metrics further support this cautious outlook. Despite the recent evaluation adjustment, Supraji...

Read More

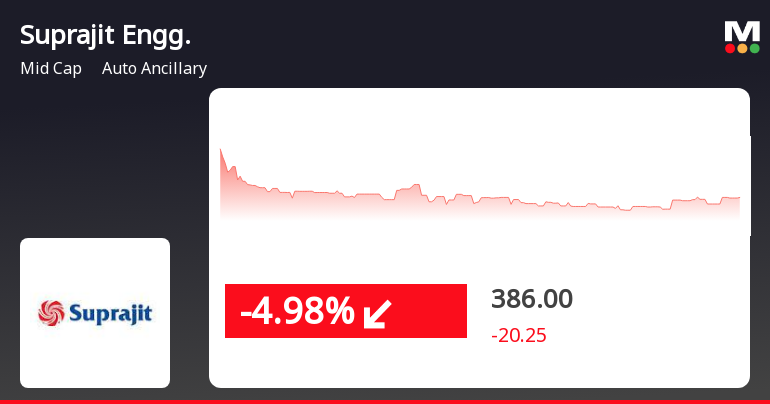

Suprajit Engineering Faces Significant Stock Decline Amidst Competitive Market Challenges

2025-03-03 11:05:17Suprajit Engineering, a midcap auto ancillary firm, has seen a notable decline in its stock, trading near its 52-week low. The company has underperformed its sector and is below key moving averages, reflecting ongoing challenges in a competitive market environment.

Read More

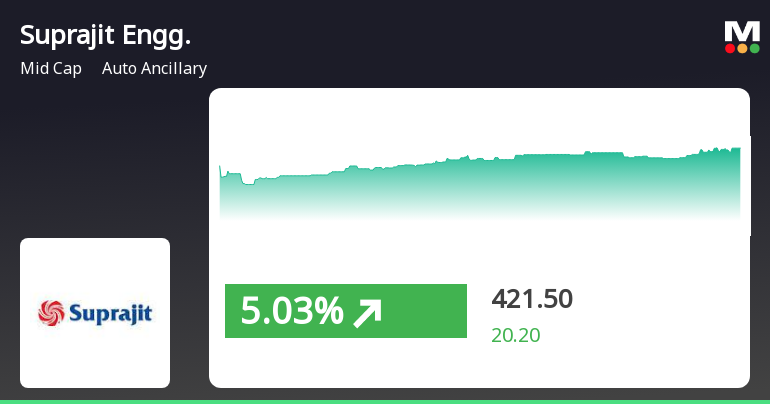

Suprajit Engineering Shows Strong Performance Amidst Broader Market Trends

2025-02-17 15:50:14Suprajit Engineering, a midcap auto ancillary firm, experienced significant trading activity on February 17, 2025, with a notable intraday high. The stock outperformed its sector and showed resilience over the past month, although it remains below several longer-term moving averages, indicating a mixed trend.

Read More

Suprajit Engineering Reports Highest Operating Profit Amid Declining Profit After Tax in December 2024

2025-02-12 17:40:53Suprajit Engineering has announced its financial results for the quarter ending December 2024, reporting the highest operating profit in five quarters. However, the profit after tax for the half-year declined significantly year-on-year, and interest expenses reached a five-quarter high, indicating potential liquidity challenges ahead.

Read More

Suprajit Engineering Faces Significant Volatility Amid Broader Auto Ancillary Sector Challenges

2025-01-27 11:05:19Suprajit Engineering, a midcap auto ancillary firm, has hit a new 52-week low amid significant volatility, reflecting a decline over the past four days. The stock's performance has lagged behind the Sensex over the past year, and it is trading below multiple moving averages, indicating ongoing challenges in the market.

Read MoreCompliance Certificate For The Year Ended March 31 2025 In Respect Of Supriyajith Family Trust.

07-Apr-2025 | Source : BSECompliance Certificate for the year ended March 31 2025 in respect of Supriyajith Family Trust.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

07-Apr-2025 | Source : BSESuprajit Announces Licensing and Technology Transfer Agreement with Blubrake for Next Generation Anti-lock Braking Systems.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

Suprajit Engineering Ltd has declared 125% dividend, ex-date: 18 Feb 25

Suprajit Engineering Ltd has announced 1:5 stock split, ex-date: 18 Mar 10

Suprajit Engineering Ltd has announced 1:1 bonus issue, ex-date: 18 Mar 10

No Rights history available