Supreme Industries Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-04-01 08:02:37Supreme Industries, a prominent player in the plastic products sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,417.40, down from the previous close of 3,455.00. Over the past week, the stock has experienced a slight decline of 0.26%, contrasting with a 0.66% gain in the Sensex. In terms of technical indicators, the weekly MACD and Bollinger Bands signal bearish trends, while the monthly indicators show a mildly bearish stance. The Relative Strength Index (RSI) remains neutral on a weekly basis but indicates bullish momentum over the month. Moving averages and KST also reflect bearish tendencies, suggesting a cautious outlook. Despite the recent challenges, Supreme Industries has shown resilience over longer periods. Over the past three years, the stock has returned 71.04%, significantly outperforming the Sensex's 34.42% retur...

Read MoreSupreme Industries Faces Mixed Technical Trends Amid Market Underperformance

2025-03-28 08:02:50Supreme Industries, a prominent player in the plastic products sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,455.00, showing a slight increase from the previous close of 3,418.50. Over the past year, the stock has experienced a decline of 17.23%, contrasting with a 6.32% gain in the Sensex, highlighting a notable underperformance relative to the broader market. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows bullish signals on both weekly and monthly scales, suggesting some positive momentum. However, the Bollinger Bands and KST indicators indicate a mildly bearish trend, reflecting cautious sentiment among traders. Looking at the company's return over various periods, it has faced challenges, particularly in the year-to-...

Read MoreSupreme Industries Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-27 08:02:39Supreme Industries, a prominent player in the plastic products sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,418.50, down from the previous close of 3,447.70, with a notable 52-week high of 6,482.40 and a low of 3,285.00. Today's trading saw a high of 3,499.70 and a low of 3,401.00. The technical summary indicates a bearish sentiment in the weekly MACD and Bollinger Bands, while the monthly indicators show a mildly bearish trend. The Relative Strength Index (RSI) presents no signal on a weekly basis but remains bullish monthly. Moving averages and KST also reflect bearish tendencies, suggesting a cautious outlook. In terms of performance, Supreme Industries has faced challenges compared to the Sensex. Over the past week, the stock returned -0.34%, while the Sensex gained 2.44%. In the one-month period, the stock's return wa...

Read MoreSurge in Open Interest for Supreme Industries Signals Shift in Market Dynamics

2025-03-26 15:00:34Supreme Industries Ltd, a prominent player in the plastic products sector, has experienced a notable increase in open interest today. The latest open interest stands at 17,832 contracts, reflecting a rise of 2,274 contracts or 14.62% from the previous open interest of 15,558. The trading volume for the day reached 8,984 contracts, contributing to a total futures value of approximately Rs 25,857.38 lakhs and an options value of Rs 1,327,358.43 lakhs, culminating in a total value of Rs 25,992.34 lakhs. The underlying value of the stock is reported at Rs 3,423. In terms of price performance, Supreme Industries is currently trading 4.48% away from its 52-week low of Rs 3,281. The stock has faced consecutive declines over the past two days, with a total return of -1.97% during this period. It is also trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. Additionally, delivery volume has...

Read MoreSurge in Open Interest Signals Shifting Market Dynamics for Supreme Industries Ltd

2025-03-26 14:00:23Supreme Industries Ltd, a prominent player in the plastic products sector, has experienced a significant increase in open interest today. The latest open interest stands at 17,327 contracts, reflecting a rise of 1,769 contracts or 11.37% from the previous open interest of 15,558. The trading volume for the day reached 6,932 contracts, contributing to a total futures value of approximately Rs 19,479.50 lakhs and an options value of around Rs 1,078,942.06 lakhs, culminating in a total value of Rs 19,598.55 lakhs. In terms of price performance, Supreme Industries is currently trading close to its 52-week low, just 4.14% above the low of Rs 3,281. The stock has faced challenges recently, with a decline of 2.31% over the past two days, and it is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. Additionally, delivery volume has decreased significantly, falling by 67.65% compared to ...

Read MoreSupreme Industries Faces Mixed Technical Trends Amid Market Volatility

2025-03-25 08:04:06Supreme Industries, a prominent player in the plastic products sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,500.00, showing a notable increase from the previous close of 3,426.20. Over the past week, the stock reached a high of 3,592.80 and a low of 3,436.10, indicating some volatility in its trading activity. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows bullish trends on both weekly and monthly scales, suggesting some positive momentum. However, the Bollinger Bands and KST indicators indicate a mildly bearish stance on a monthly basis. The Dow Theory presents a mixed picture, with a mildly bullish weekly trend contrasted by a mildly bearish monthly trend. When comparing the company's performance to the Sensex, Suprem...

Read More

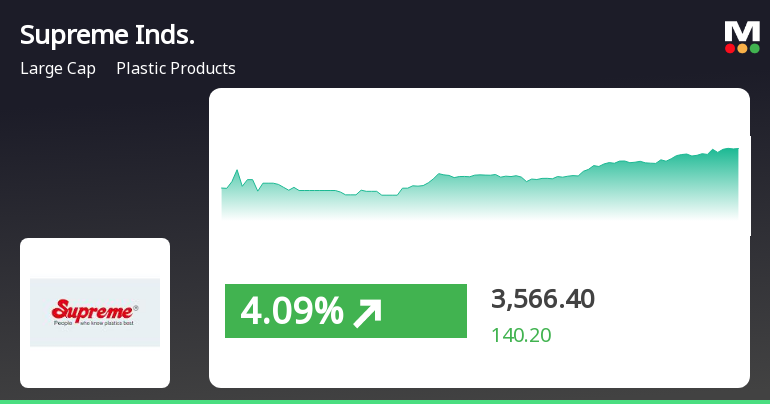

Supreme Industries Shows Mixed Performance Amid Broader Market Resilience

2025-03-24 10:50:19Supreme Industries has experienced a significant rise in its stock price, outperforming its sector. The company is above its short-term moving averages but below its longer-term ones, indicating mixed trends. Meanwhile, the broader market, represented by the Sensex, has shown positive momentum recently.

Read MoreSurge in Open Interest Signals Shift in Market Dynamics for Supreme Industries

2025-03-21 15:00:16Supreme Industries Ltd, a prominent player in the plastic products sector, has experienced a significant increase in open interest today. The latest open interest stands at 16,265 contracts, reflecting a rise of 2,811 contracts or 20.89% from the previous open interest of 13,454. This surge in open interest comes alongside a trading volume of 11,507 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Supreme Industries closed the day 4.2% away from its 52-week low of Rs 3,281, having touched an intraday low of Rs 3,401, which represents a decline of 2.65%. The stock has underperformed its sector by 2%, marking a trend reversal after four consecutive days of gains. The weighted average price suggests that more volume was traded closer to the low price of the day. Additionally, the stock's delivery volume has seen a decline of 30.23% compared to the five-day a...

Read MoreSupreme Industries Sees Significant Surge in Open Interest, Indicating Market Dynamics Shift

2025-03-21 14:00:13Supreme Industries Ltd, a prominent player in the plastic products industry, has experienced a notable increase in open interest today. The latest open interest stands at 15,334 contracts, reflecting a rise of 1,880 contracts or 13.97% from the previous open interest of 13,454. The trading volume for the day reached 8,987 contracts, contributing to a total futures value of approximately Rs 24,491.53 lakhs and an options value of Rs 1,508.63 crores, culminating in a total value of Rs 24,681.73 lakhs. In terms of price performance, Supreme Industries is currently trading 4.36% away from its 52-week low of Rs 3,281. The stock has underperformed its sector by 2.04% today, marking a trend reversal after four consecutive days of gains. The weighted average price indicates that more volume was traded closer to the low price, and while the stock is above its 5-day moving averages, it remains below the 20-day, 50-d...

Read MoreClosure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Acquisition

11-Mar-2025 | Source : BSECompany has signed a MOU with Wavin Industries Limited for acquisition of its Indian Piping Business.

Announcement under Regulation 30 (LODR)-Memorandum of Understanding /Agreements

11-Mar-2025 | Source : BSECompany has signed a MOU with Wavin Industries Limited for acquisition of its Indian Piping Business

Corporate Actions

No Upcoming Board Meetings

Supreme Industries Ltd has declared 500% dividend, ex-date: 30 Oct 24

Supreme Industries Ltd has announced 2:10 stock split, ex-date: 18 Oct 10

Supreme Industries Ltd has announced 1:1 bonus issue, ex-date: 13 Nov 06

No Rights history available