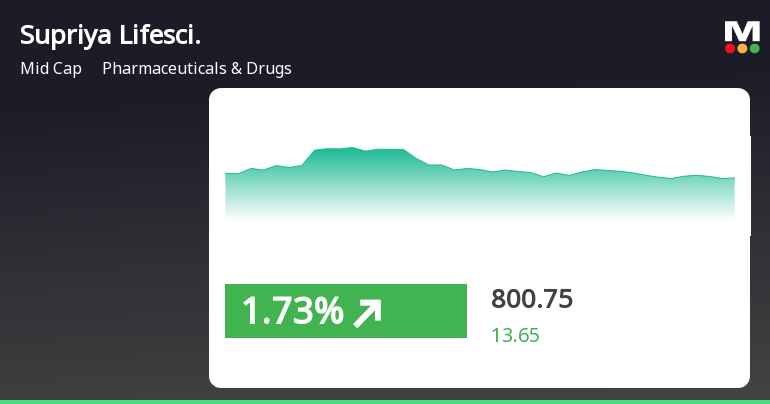

Supriya Lifescience Achieves 52-Week High Amid Strong Financial Performance

2025-04-03 09:40:05Supriya Lifescience has reached a new 52-week high, reflecting strong performance with a notable increase in net sales and robust operational efficiency. The company boasts a solid return on equity and low debt levels, contributing to its impressive one-year performance compared to the broader market.

Read More

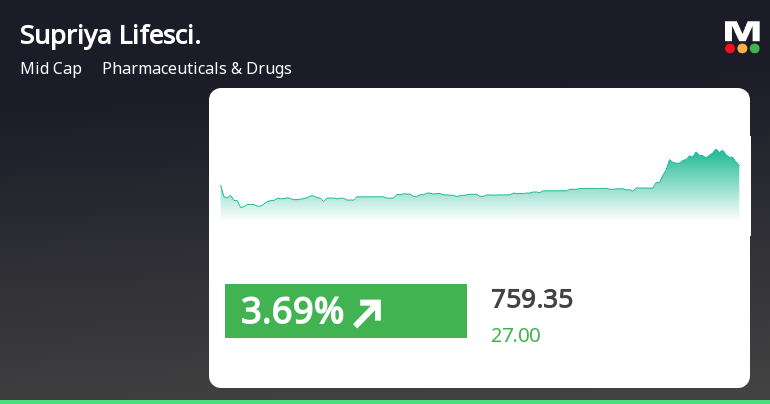

Supriya Lifescience Achieves All-Time High Amid Strong Market Dynamics and Outperformance

2025-04-03 09:35:31Supriya Lifescience, a midcap pharmaceutical company, reached a new all-time high of Rs. 841.7, reflecting a significant performance boost. The stock has gained 13.93% over two days and shows strong technical indicators, outperforming the broader market and demonstrating a remarkable 113.45% increase over the past year.

Read More

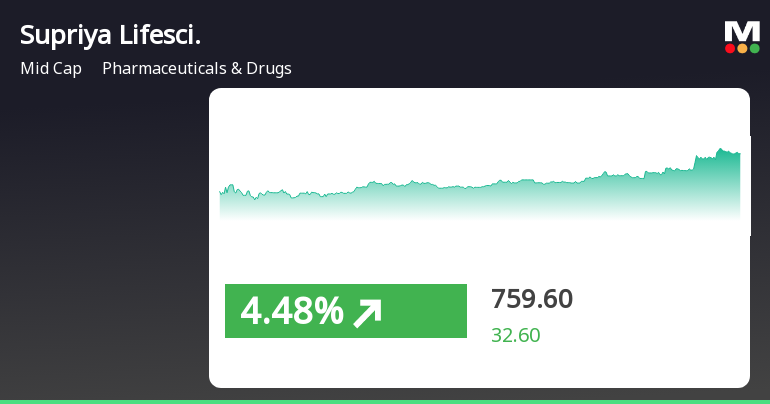

Supriya Lifescience Stock Reaches All-Time High Amid Strong Market Momentum

2025-04-03 09:32:19Supriya Lifescience, a midcap pharmaceutical company, has reached an all-time high stock price, outperforming its sector significantly. The stock has gained 13.8% over two days and shows strong market momentum, with impressive year-on-year net sales growth and consistent positive quarterly results, reflecting robust management efficiency.

Read MoreSupriya Lifescience Shows Mixed Technical Trends Amid Strong Market Performance

2025-04-03 08:06:29Supriya Lifescience, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 787.10, showing a notable increase from the previous close of 732.35. Over the past year, Supriya Lifescience has demonstrated impressive performance, with a return of 114.88%, significantly outpacing the Sensex's return of 3.67% during the same period. The technical summary indicates a mixed outlook, with the MACD showing a bullish trend on a monthly basis, while the weekly perspective remains mildly bearish. The Bollinger Bands and daily moving averages suggest a bullish sentiment, while the KST and Dow Theory present a more cautious view on a weekly basis. In terms of market performance, Supriya Lifescience has outperformed the Sensex across various time frames, including a remarkable 31.51% return over the ...

Read More

Supriya Lifescience Shows Strong Rebound Amid Broader Midcap Market Momentum

2025-04-02 11:50:24Supriya Lifescience has experienced notable trading activity, reversing a three-day decline with a significant intraday high. The stock demonstrated considerable volatility and is currently positioned above multiple moving averages. Over the past month and year, it has outperformed the broader market, reflecting strong growth trends.

Read MoreSupriya Lifescience Shows Mixed Technical Trends Amid Strong Market Resilience

2025-04-02 08:10:04Supriya Lifescience, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 732.35, slightly down from its previous close of 735.00. Over the past year, Supriya Lifescience has demonstrated significant resilience, achieving a remarkable return of 105.92%, in stark contrast to the Sensex's modest gain of 2.72%. In terms of technical indicators, the company's performance shows a mixed picture. The Moving Averages indicate a bullish sentiment on a daily basis, while the MACD reflects a mildly bearish trend on both weekly and monthly scales. The Bollinger Bands, however, suggest a mildly bullish outlook over the same periods. Notably, the stock has experienced a 52-week high of 835.35 and a low of 330.50, showcasing its volatility and potential for recovery. In the short term, Supriya Lifes...

Read More

Supriya Lifescience Outperforms Sector Amid Broader Midcap Market Rally

2025-03-24 15:05:27Supriya Lifescience has demonstrated strong performance, gaining 5.12% on March 24, 2025, and outperforming its sector. The stock has seen a consecutive gain over two days, accumulating 16.59%. It is trading above multiple moving averages, reflecting robust momentum amid a rising broader market.

Read MoreSupriya Lifescience Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-24 08:03:01Supriya Lifescience, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 727.00, showing a notable increase from the previous close of 646.95. Over the past year, Supriya Lifescience has demonstrated impressive performance, with a return of 116.76%, significantly outpacing the Sensex, which recorded a return of 5.87% during the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD shows a mildly bearish trend on a weekly basis while indicating bullish momentum monthly. The Bollinger Bands and moving averages suggest a bullish stance, reinforcing the stock's positive trajectory. However, the KST and Dow Theory present a more cautious view, with mildly bearish signals on a weekly basis. The company's performance over various time frames highlights ...

Read MoreSupriya Lifescience Adjusts Valuation Grade Amid Strong Market Performance and Competitive Landscape

2025-03-24 08:01:12Supriya Lifescience, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 727.00, reflecting a notable increase from the previous close of 646.95. Over the past year, Supriya Lifescience has demonstrated a strong performance, with a return of 116.76%, significantly outpacing the Sensex's return of 5.87% during the same period. Key financial metrics for Supriya Lifescience include a PE ratio of 33.53 and an EV to EBITDA ratio of 23.21, indicating a robust market position. The company's return on capital employed (ROCE) is reported at 25.02%, while the return on equity (ROE) stands at 19.26%. These figures suggest effective management and operational efficiency. In comparison to its peers, Supriya Lifescience's valuation metrics highlight a competitive landscape. For instance, Emcure Pharma and ERIS Lifescience are positi...

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

01-Apr-2025 | Source : BSEEnclosed herewith details of Analyst/Institutional Investor Meetings.

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation for closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

25-Mar-2025 | Source : BSEEnclosed herewith Newspaper Publication for Postal Ballot.

Corporate Actions

No Upcoming Board Meetings

Supriya Lifescience Ltd has declared 40% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available