Surya Roshni Shows Mixed Technical Trends Amid Market Volatility and Resilience

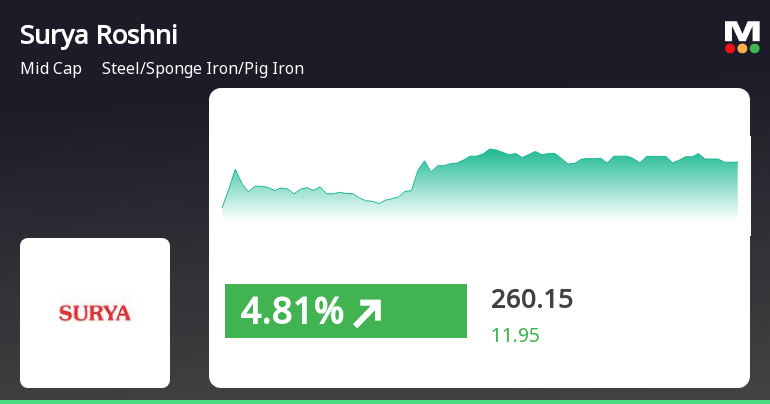

2025-04-02 08:03:34Surya Roshni, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 259.25, showing a notable increase from the previous close of 245.15. Over the past year, Surya Roshni has experienced a 52-week high of 371.30 and a low of 212.75, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and moving averages also reflect a mildly bearish trend, indicating a cautious market sentiment. Notably, the KST shows a mixed signal with a mildly bullish weekly trend contrasted by a mildly bearish monthly trend. When comparing the company's performance to the Sensex, Surya Roshni has demonstrated resilience over various time frames. In the pa...

Read More

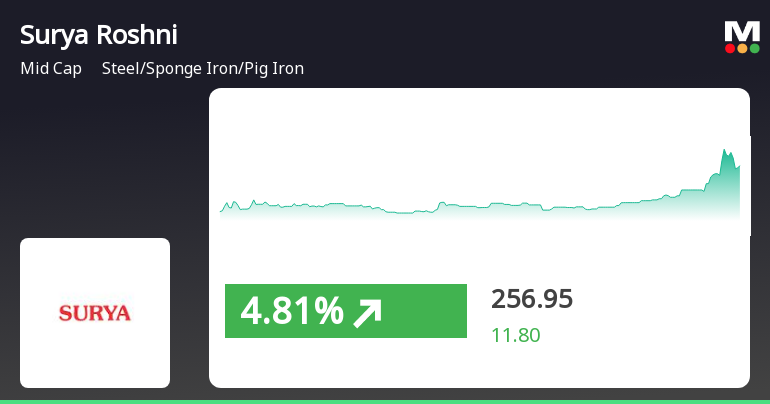

Surya Roshni's Strong Performance Highlights Resilience Amid Broader Market Decline

2025-04-01 14:30:20Surya Roshni, a midcap player in the Steel industry, experienced notable trading activity on April 1, 2025, outperforming its sector. The stock has shown a mixed trend in moving averages and has significantly outperformed the broader market over the past month and three years.

Read MoreSurya Roshni Faces Technical Trend Shifts Amid Market Volatility and Declining Performance

2025-04-01 08:01:18Surya Roshni, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 245.15, having closed at 250.00 previously. Over the past year, Surya Roshni has experienced a decline of 3.96%, contrasting with a 5.11% gain in the Sensex during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly metrics indicate a mildly bearish trend. The daily moving averages also reflect a bearish outlook. Notably, the KST and OBV indicators present a mixed picture, with weekly readings showing bearish tendencies and monthly readings leaning mildly bearish. Surya Roshni's performance over various time frames reveals significant volatility. The stock has seen a remarkable return of 1429.80% over the past five years, compared to ...

Read MoreSurya Roshni Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-28 08:01:15Surya Roshni, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 250.00, showing a slight increase from the previous close of 243.90. Over the past year, Surya Roshni has experienced a stock return of 0.20%, while the Sensex has returned 6.32% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis and a mildly bearish trend monthly. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands also reflect a mildly bearish stance on both timeframes. Moving averages suggest a mildly bearish trend on a daily basis, while the KST indicates a bearish trend weekly and mildly bearish monthly. Interestingly, the Dow Theory presents a mildly bullish outlook weekly, with no trend observed month...

Read MoreSurya Roshni Faces Bearish Technical Trends Amidst Mixed Long-Term Performance

2025-03-27 08:01:14Surya Roshni, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 243.90, down from a previous close of 250.30, with a 52-week high of 371.30 and a low of 212.75. Today's trading saw a high of 255.15 and a low of 243.40. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, Bollinger Bands and KST also reflect bearish conditions on a weekly basis, with mild bearishness on a monthly scale. Moving averages further support this trend, indicating bearish momentum. In terms of performance, Surya Roshni's stock return over the past year stands at -4.02%, contrasting with a 6.65% return from the Sensex. However, over a three-year period, the company has shown...

Read MoreSurya Roshni's Technical Indicators Reflect Mixed Market Sentiment Amidst Strong Performance

2025-03-25 08:02:02Surya Roshni, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 259.50, showing a notable increase from the previous close of 248.20. Over the past week, Surya Roshni has demonstrated a strong performance with a return of 13.22%, significantly outpacing the Sensex, which returned 5.14% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and moving averages also indicate a mildly bearish trend, highlighting some caution in the market. The KST shows a mixed signal with a mildly bullish weekly trend but a bearish monthly view. Looking at the company's performance over various time frames, Surya Roshni has delivered impressive returns over ...

Read More

Surya Roshni Shows Strong Short-Term Gains Amid Broader Market Resilience

2025-03-24 10:05:22Surya Roshni, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has experienced notable gains, outperforming its sector and achieving consecutive increases over five days. The stock's performance reflects volatility, with a year-to-date decline contrasting its significant five-year growth. The broader market shows positive trends, particularly in small-cap stocks.

Read More

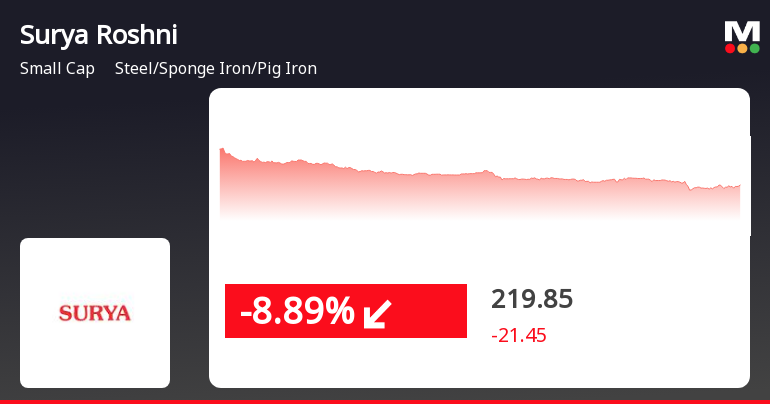

Surya Roshni Faces Significant Volatility Amidst Sustained Downward Trend in Market

2025-02-28 11:35:17Surya Roshni, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has hit a new 52-week low, reflecting significant volatility. The stock has underperformed its sector and is trading below key moving averages, indicating ongoing challenges and a notable decline over the past year compared to the broader market.

Read More

Surya Roshni Faces Significant Stock Decline Amidst Industry Challenges in October 2023

2025-02-14 12:15:35Surya Roshni, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has seen its stock price decline significantly, reaching a new 52-week low. The stock has underperformed its sector and exhibited high volatility, trading below multiple moving averages, reflecting ongoing challenges in the market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEcertificate for the month ended March 2025

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

03-Apr-2025 | Source : BSEOrder amounting to Rs. 116.15 Crores received from GAIL India Limited

General Updates

01-Apr-2025 | Source : BSEAchieved ever highest sales volume in March 2025

Corporate Actions

No Upcoming Board Meetings

Surya Roshni Ltd has declared 50% dividend, ex-date: 29 Nov 24

Surya Roshni Ltd has announced 5:10 stock split, ex-date: 06 Oct 23

Surya Roshni Ltd has announced 1:1 bonus issue, ex-date: 01 Jan 25

No Rights history available