Suryaamba Spinning Mills Faces Volatility Amid Declining Profits and Sector Outperformance

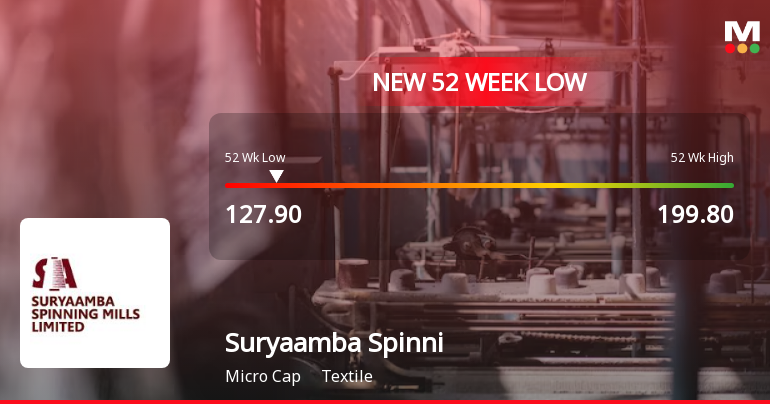

2025-03-04 10:06:02Suryaamba Spinning Mills, a microcap textile company, reached a new 52-week low today, experiencing significant volatility during trading. Over the past year, the stock has declined, contrasting with the broader market. Despite challenges in operating profits, it maintains a strong operating profit to interest ratio and competitive valuation among peers.

Read More

Suryaamba Spinning Mills Faces Significant Volatility Amidst Challenging Market Conditions

2025-03-03 11:35:31Suryaamba Spinning Mills, a microcap in the textile sector, has faced notable trading volatility, opening significantly lower and underperforming its sector. The stock has shown persistent downward trends, trading below multiple moving averages and nearing its 52-week low, reflecting broader challenges within the industry.

Read More

Suryaamba Spinning Mills Faces Volatility Amidst Market Recovery Signals

2025-02-28 09:37:25Suryaamba Spinning Mills, a microcap textile company, reached a new 52-week low today after a challenging year, with a notable performance drop. Despite initial losses, the stock rebounded, showing volatility and a recent positive trend, currently trading above key moving averages, indicating potential momentum shifts.

Read More

Suryaamba Spinning Mills Reports Strong Q3 Metrics Amid Long-Term Profit Decline

2025-02-14 09:35:11Suryaamba Spinning Mills, a microcap textile company, recently adjusted its evaluation amid changing market conditions. The firm reported strong third-quarter financial metrics, including a high operating profit to interest ratio and peak net sales. However, it has faced long-term challenges, with declining operating profit growth over five years.

Read More

Suryaamba Spinning Mills Reports Strong Financial Results, Indicating Improved Profitability Trends in December 2024

2025-02-12 15:50:31Suryaamba Spinning Mills has announced its financial results for the quarter ending December 2024, showcasing significant improvements. The company achieved its highest operating profit to interest ratio in five quarters, with net sales reaching Rs 55.45 crore and notable increases in both Profit Before Tax and Profit After Tax.

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

09-Apr-2025 | Source : BSEIntimation of Credit Rating under Regulation 30 of SEBI (LODR) Regulations 2015

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI(Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window for the quarter and year ended on 31.03.2025

Corporate Actions

No Upcoming Board Meetings

Suryaamba Spinning Mills Ltd has declared 10% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available