Suven Life Sciences Outperforms Sector Amid Broader Market Decline

2025-04-01 12:35:23Suven Life Sciences has demonstrated notable performance, gaining 7.1% on April 1, 2025, and outperforming its sector. The stock has shown consecutive gains over two days and reached an intraday high. Despite a broader market decline, small-cap stocks are performing well, with Suven's monthly performance significantly exceeding the Sensex.

Read MoreSuven Life Sciences Shows Resilience Amid Mixed Technical Trend Indicators

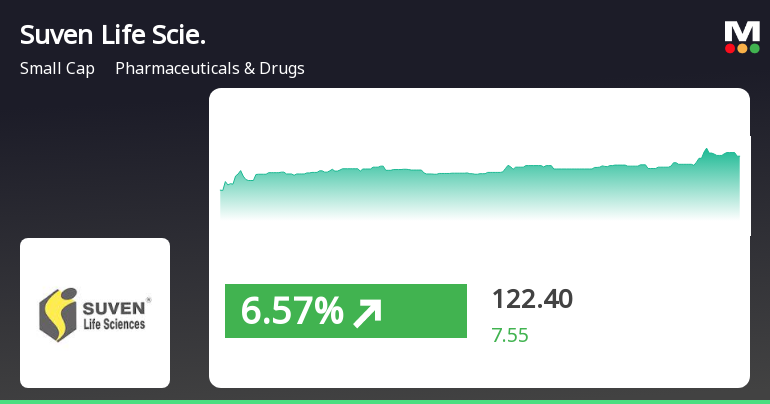

2025-03-07 08:02:15Suven Life Sciences, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 122.00, showing a slight increase from the previous close of 119.50. Over the past year, Suven Life Sciences has demonstrated a notable return of 15.53%, significantly outperforming the Sensex, which recorded a modest gain of 0.34% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish stance on a monthly scale. Daily moving averages reflect a bearish sentiment, while the On-Balance Volume (OBV) suggests bullish momentum in both weekly and monthly eva...

Read MoreSuven Life Sciences Faces Mixed Technical Trends Amid Market Volatility

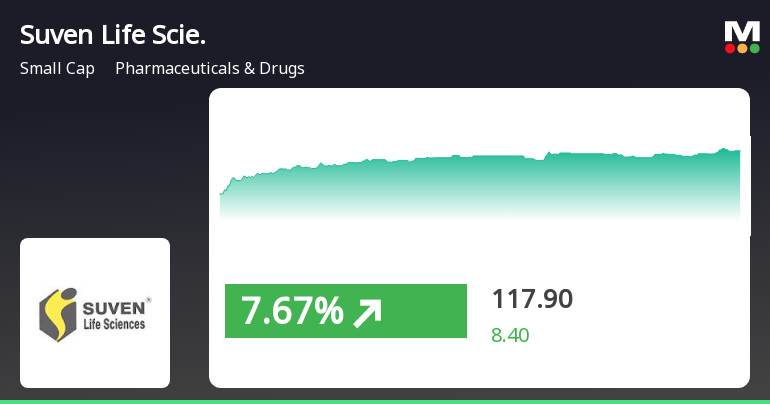

2025-03-05 08:01:36Suven Life Sciences, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 117.00, showing a notable increase from the previous close of 109.50. Over the past year, Suven has reached a high of 169.00 and a low of 83.27, indicating significant volatility. The technical summary reveals a bearish sentiment in the weekly MACD and KST indicators, while the monthly metrics show a mildly bearish trend for both. The Bollinger Bands present a mixed picture, with a mildly bearish outlook on the weekly scale and a bullish stance monthly. Moving averages indicate a bearish trend on a daily basis, suggesting caution in the short term. In terms of performance, Suven Life Sciences has shown resilience compared to the Sensex. Over the past week, the stock returned 2.86%, contrasting with a decline of...

Read More

Suven Life Sciences Shows Resilience Amidst Market Challenges and Small-Cap Gains

2025-03-04 14:35:23Suven Life Sciences has experienced notable trading activity, achieving a two-day gain of 14.94%. Despite recent declines, the stock has shown impressive long-term growth, increasing by over 631% in the past decade, significantly outperforming the Sensex. The stock remains above its 5-day moving average.

Read MoreSuven Life Sciences Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-03 08:01:30Suven Life Sciences, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 103.10, down from a previous close of 108.00, with a 52-week high of 169.00 and a low of 83.27. Today's trading saw a high of 107.95 and a low of 102.70. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly periods. Moving averages on a daily basis align with this bearish trend, further supported by the KST, which is bearish weekly but bullish monthly. The Dow Theory and On-Balance Volume (OBV) metrics present a mildly bearish outlook on a weekly basis, contrasting with a bullish monthly OBV. In terms of performance, ...

Read MoreSuven Life Sciences Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-02 08:01:29Suven Life Sciences, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 103.10, down from a previous close of 108.00, with a 52-week high of 169.00 and a low of 83.27. Today's trading saw a high of 107.95 and a low of 102.70. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. The KST presents a mixed picture, being bearish weekly but bullish monthly, while the Dow Theory and OBV indicate mildly bearish trends on a weekly basis. In terms of performance, Suven Life Sciences has faced challenges compared to the Sensex. Over the past week, the stock retu...

Read MoreSuven Life Sciences Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-01 08:01:27Suven Life Sciences, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 103.10, down from a previous close of 108.00, with a 52-week high of 169.00 and a low of 83.27. Today's trading saw a high of 107.95 and a low of 102.70. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly evaluations. Moving averages are bearish on a daily basis, and the KST presents a mixed picture with a bearish weekly trend and a bullish monthly outlook. In terms of performance, Suven Life Sciences has experienced notable fluctuations compared to the Sensex. Over the past week, the stock returned -11.99%, wh...

Read MoreSuven Life Sciences Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-02-25 10:31:16Suven Life Sciences, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 115.05, slightly above the previous close of 115.00. Over the past year, Suven has demonstrated a stock return of 8.38%, outperforming the Sensex, which recorded a return of 2.07% in the same period. In terms of technical metrics, the weekly MACD and Bollinger Bands indicate bearish tendencies, while the monthly KST shows a bullish signal. The moving averages on a daily basis also reflect bearish sentiment. Notably, the stock has experienced a 52-week high of 169.00 and a low of 83.27, showcasing significant volatility. When comparing returns, Suven Life Sciences has shown resilience over longer periods, with a remarkable 628.86% return over the last decade, significantly surpassing the Sensex...

Read MoreSuven Life Sciences Navigates Mixed Market Trends Amid Stock Resilience

2025-02-25 09:57:18Suven Life Sciences, a small-cap player in the Pharmaceuticals & Drugs industry, has shown notable activity today, reflecting a 0.74% increase in its stock price. The company's market capitalization stands at Rs 2,508.00 crore, with a price-to-earnings (P/E) ratio of -17.50, significantly lower than the industry average of 35.69. Over the past year, Suven Life Sciences has outperformed the Sensex, achieving a 9.14% increase compared to the Sensex's 2.21%. In the short term, the stock has also demonstrated resilience, with a 3.90% gain over the past week, while the Sensex declined by 1.59%. However, the stock has faced challenges in the longer term, with a year-to-date performance of -9.95%, contrasting with the Sensex's -4.33%. Technical indicators present a mixed picture, with weekly metrics showing bearish trends in MACD and Bollinger Bands, while monthly indicators reflect a mildly bullish outlook in K...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECertificate in terms of Reg. 74 (5) of SEBI (DP) Regulations

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of closure of trading window

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

26-Mar-2025 | Source : BSEDisclosure under Regulation 30 of SEBI LODR Regulations regarding order passed by Income Tax Department

Corporate Actions

No Upcoming Board Meetings

Suven Life Sciences Ltd has declared 150% dividend, ex-date: 14 Feb 19

Suven Life Sciences Ltd has announced 1:2 stock split, ex-date: 23 Mar 07

Suven Life Sciences Ltd has announced 1:1 bonus issue, ex-date: 23 Mar 07

Suven Life Sciences Ltd has announced 1:2 rights issue, ex-date: 17 Oct 22