Syncom Formulations Shows Strong Performance Amid Broader Market Gains

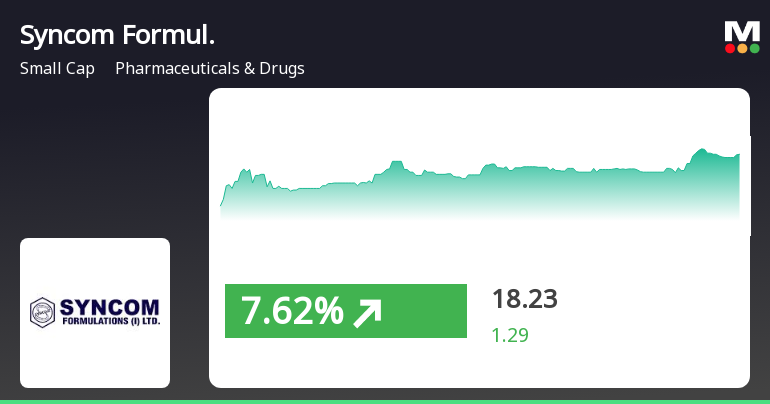

2025-03-24 12:05:23Syncom Formulations (India) has experienced notable gains, outperforming its sector and achieving a total return of 17.29% over the past five days. The stock is currently above its short-term moving averages, while the broader market, including the Sensex and mid-cap stocks, has also shown positive trends.

Read MoreSyncom Formulations Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:03:37Syncom Formulations (India), a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 15.64, showing a slight increase from the previous close of 15.33. Over the past year, Syncom has demonstrated a notable return of 29.47%, significantly outperforming the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows a bullish signal on a weekly basis, but no signal is indicated for the monthly timeframe. Bollinger Bands reflect a mildly bearish trend weekly, contrasting with a bullish stance monthly. Moving averages indicate a bearish trend on a daily basis, while the KST and Dow Theory metrics present a mixed picture, with weekly re...

Read MoreSyncom Formulations Experiences Technical Trend Shift Amid Strong Long-Term Performance

2025-03-12 08:02:21Syncom Formulations (India), a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a technical trend adjustment. The company's current price stands at 16.06, slightly down from the previous close of 16.13. Over the past year, Syncom has shown a notable stock return of 20.12%, significantly outperforming the Sensex, which recorded a return of just 0.82% during the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD reflects a mildly bearish stance. The Bollinger Bands indicate a bearish trend on a weekly basis, contrasting with a bullish outlook on a monthly basis. Moving averages also suggest a bearish trend, and the KST aligns with this sentiment on a weekly basis, while showing a mildly bearish trend monthly. Looking at the company's performance over various time frames, Syncom has delivered impressive returns over the long term, p...

Read MoreSyncom Formulations Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-11 08:03:41Syncom Formulations (India), a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 16.13, down from a previous close of 17.12, with a 52-week high of 27.94 and a low of 11.00. Today's trading saw a high of 17.35 and a low of 16.00. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signals for both weekly and monthly evaluations. Bollinger Bands reflect a bearish stance weekly but indicate bullishness monthly. Moving averages are bearish on a daily basis, while the KST shows a bearish trend weekly and a bullish trend monthly. The Dow Theory and On-Balance Volume (OBV) both suggest a mildly bearish outlook on a mont...

Read MoreSyncom Formulations Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-06 08:02:03Syncom Formulations (India), a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 15.77, showing a slight increase from the previous close of 15.25. Over the past year, Syncom has demonstrated a notable return of 17.16%, significantly outperforming the Sensex, which recorded a mere 0.07% return in the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands present a mildly bearish outlook on a weekly basis, contrasting with a bullish stance on a monthly basis. Daily moving averages reflect a bearish trend, and the KST is bearish on a weekly basis, with a mildly bearish monthly outlook. The company's perf...

Read MoreSyncom Formulations Shows Resilience Amid Market Volatility in Pharmaceuticals Sector

2025-03-05 18:00:23Syncom Formulations (India) Ltd, a small-cap player in the Pharmaceuticals & Drugs sector, has shown significant activity today, with its stock rising by 3.41%. This uptick comes against a backdrop of a 1.01% increase in the Sensex, highlighting the stock's relative strength in the market today. Over the past year, Syncom Formulations has delivered a performance of 17.16%, significantly outperforming the Sensex, which has seen a modest gain of 0.07%. However, the stock has faced challenges in the short term, with a decline of 12.82% over the past month and a year-to-date drop of 21.15%. The company's market capitalization stands at Rs 1,454.00 crore, and it currently has a price-to-earnings (P/E) ratio of 37.87, which is above the industry average of 34.78. Despite recent volatility, Syncom Formulations has demonstrated resilience over the long term, with a remarkable 2364.06% increase over the past fiv...

Read More

Syncom Formulations Reports Strong Quarterly Growth Amid Long-Term Challenges

2025-03-03 18:52:13Syncom Formulations (India) has recently adjusted its evaluation, reflecting a strong financial performance for the quarter ending December 2024, with a significant increase in net sales. However, long-term growth faces challenges, as historical data shows substantial declines in net sales and operating profit over the past five years.

Read More

Syncom Formulations Reports Strong Q3 Results, Highlighting Consistent Sales Growth

2025-02-11 17:14:31Syncom Formulations (India) has reported strong financial results for the quarter ending December 2024, with net sales of Rs 127.53 crore and significant growth in operating profit, profit before tax, and profit after tax. The earnings per share also reached a five-quarter high, reflecting the company's robust financial health.

Read MoreAnnouncement Under Regulation 30

05-Apr-2025 | Source : BSEAnnouncement under Regulation 30 for the demand raised under section 74 (5) of CGST ACT 2017

Closure of Trading Window

25-Mar-2025 | Source : BSEWe would inform you that pursuant to SEBI (PIT) Reg 2015 as amended from time to time the trading window shall remain close from 1st April 2025 till completion of 48 hours after the declaration of Audited Standalone and Consolidated Financial result for the quarter and year ended on 31st March 2025.

Disclosure under Regulation 30A of LODR

13-Feb-2025 | Source : BSEWe are Pleased to Inform the Installation of Solar Rooftop Project for Captive Consumption

Corporate Actions

No Upcoming Board Meetings

Syncom Formulations (India) Ltd has declared 3% dividend, ex-date: 09 Sep 22

Syncom Formulations (India) Ltd has announced 1:10 stock split, ex-date: 19 Aug 13

Syncom Formulations (India) Ltd has announced 5:2 bonus issue, ex-date: 19 Aug 13

Syncom Formulations (India) Ltd has announced 1:2 rights issue, ex-date: 13 May 09