Syngene International Outperforms Sector Amid Market Volatility and Resilience

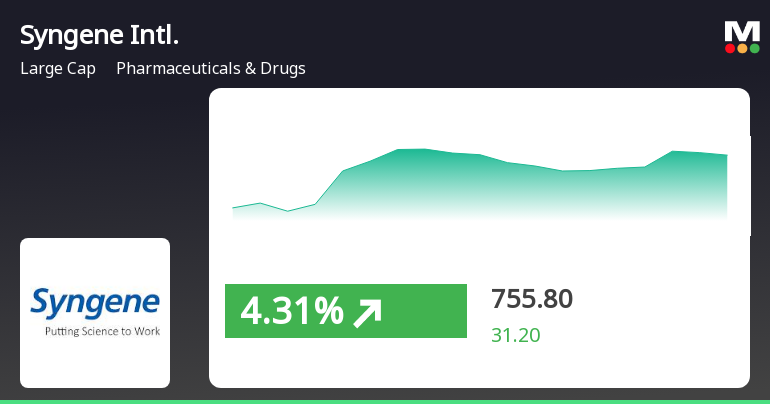

2025-04-03 09:30:17Syngene International experienced significant activity on April 3, 2025, with a notable increase in its stock price, outperforming the Pharmaceuticals & Drugs sector. The stock reached an intraday high and demonstrated high volatility, while its performance contrasts with a broader market decline, indicating relative strength.

Read MoreSyngene International Faces Bearish Technical Trends Amid Long-Term Resilience

2025-04-03 08:00:38Syngene International, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 724.60, showing a slight increase from the previous close of 718.50. Over the past year, Syngene has experienced a stock return of 0.42%, which is notably lower than the Sensex return of 3.67% during the same period. In terms of technical indicators, the weekly MACD and KST are both in a bearish position, while the monthly indicators show a mildly bearish trend. The Bollinger Bands also reflect a bearish stance on both weekly and monthly assessments. Moving averages indicate a mildly bearish trend on a daily basis, suggesting a cautious outlook in the short term. Despite these technical trends, Syngene has demonstrated resilience over longer periods. For instance, the company has achieved a remarkab...

Read MoreSyngene International Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-04-02 08:01:16Syngene International, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 718.50, slightly down from the previous close of 726.10. Over the past year, Syngene has experienced a 1.49% return, which is modest compared to the Sensex's 2.72% return during the same period. In terms of technical indicators, the weekly and monthly assessments show a bearish trend across various metrics, including MACD and Bollinger Bands. The daily moving averages also indicate a bearish sentiment, while the KST reflects a mildly bearish stance on a monthly basis. Notably, the Relative Strength Index (RSI) shows no significant signals, suggesting a period of consolidation. When comparing Syngene's performance to the Sensex, the company has shown resilience over longer periods, with a notable 194...

Read MoreSyngene International Faces Technical Trend Shifts Amid Mixed Market Sentiment

2025-04-01 08:00:26Syngene International, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 726.10, showing a slight increase from the previous close of 716.00. Over the past year, Syngene has experienced a stock return of 3.48%, while the Sensex has returned 5.11%, indicating a performance that has lagged behind the broader market. In terms of technical indicators, the weekly and monthly MACD readings suggest a bearish sentiment, while the Bollinger Bands also reflect a mildly bearish outlook. The daily moving averages align with this trend, indicating a cautious market stance. Notably, the KST and OBV metrics present a mixed picture, with weekly readings showing mild bullishness, contrasting with the monthly bearish signals. Looking at the company's return compared to the Sensex, Syngene...

Read MoreSyngene International Sees Surge in Open Interest Amid Active Market Participation

2025-03-28 15:00:05Syngene International Ltd, a prominent player in the Pharmaceuticals & Drugs sector, has experienced a significant increase in open interest today. The latest open interest stands at 7,612 contracts, reflecting a rise of 734 contracts or 10.67% from the previous open interest of 6,878. This uptick is accompanied by a trading volume of 2,417 contracts, indicating active market participation. In terms of price performance, Syngene has outperformed its sector, recording a 1.60% return for the day, while the sector itself saw a decline of 0.35%. The stock is currently trading above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. Notably, there has been a decline in investor participation, with delivery volume dropping by 64.01% compared to the 5-day average. With a market capitalization of Rs 29,427.47 crore, Syngene International continues to ...

Read MoreSyngene International Sees Significant Surge in Open Interest, Indicating Market Dynamics Shift

2025-03-24 15:00:10Syngene International Ltd, a prominent player in the Pharmaceuticals & Drugs sector, has experienced a significant increase in open interest today. The latest open interest stands at 14,331 contracts, marking a notable rise from the previous open interest of 10,290 contracts. This change represents an increase of 4,041 contracts, or 39.27%. The trading volume for the day reached 10,121 contracts, contributing to a total futures value of approximately Rs 48,604.54 lakhs. In terms of price performance, Syngene has underperformed its sector by 0.37% today, despite achieving a 1.9% gain over the last two days. The stock's current price is above its 5-day and 20-day moving averages but remains below the 50-day, 100-day, and 200-day moving averages. Additionally, the stock has seen a decline in delivery volume, which fell by 43.3% compared to the 5-day average, indicating a decrease in investor participation. W...

Read MoreSurge in Open Interest Signals Increased Market Activity for Syngene International

2025-03-24 14:00:08Syngene International Ltd, a prominent player in the Pharmaceuticals & Drugs sector, has recently experienced a significant increase in open interest (OI). The latest OI stands at 13,230 contracts, marking a notable rise of 2,940 contracts or 28.57% from the previous OI of 10,290. This surge in OI coincides with a trading volume of 8,227 contracts, reflecting active market engagement. In terms of price performance, Syngene has outperformed its sector by 0.27%, with a 1D return of 0.81%. The stock has shown consistent gains over the past two days, accumulating a total return of 2.41% during this period. While the stock is currently trading above its 5-day and 20-day moving averages, it remains below the 50-day, 100-day, and 200-day moving averages, indicating mixed momentum. Despite a decline in delivery volume, which fell by 43.3% against the 5-day average, the stock maintains sufficient liquidity for tra...

Read MoreSurge in Open Interest Signals Shifting Market Dynamics for Syngene International

2025-03-24 13:00:08Syngene International Ltd, a prominent player in the Pharmaceuticals & Drugs sector, has experienced a significant increase in open interest today. The latest open interest stands at 13,226 contracts, reflecting a notable rise of 2,936 contracts or 28.53% from the previous open interest of 10,290. This surge coincides with a trading volume of 7,504 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Syngene's stock has gained 0.87% today, aligning closely with the sector's average return of 0.71%. Over the past two days, the stock has shown a cumulative increase of 2.33%. While the stock is currently trading above its 5-day and 20-day moving averages, it remains below the longer-term averages of 50, 100, and 200 days. Despite the recent gains, there has been a decline in investor participation, with delivery volume dropping by 43.3% compared to the 5-day ave...

Read MoreSyngene International Sees Significant Rise in Open Interest Amid Market Activity

2025-03-24 12:00:04Syngene International Ltd, a prominent player in the Pharmaceuticals & Drugs sector, has experienced a notable increase in open interest today. The latest open interest stands at 11,623 contracts, reflecting a rise of 1,333 contracts or 12.95% from the previous open interest of 10,290. The trading volume for the day reached 4,922 contracts, contributing to a total futures value of approximately Rs 20,289.495 lakhs. In terms of price performance, Syngene has underperformed its sector by 0.34% today, although it has shown a positive trend over the last two days, gaining 1.94% during this period. The stock is currently trading above its 5-day and 20-day moving averages, yet remains below its 50-day, 100-day, and 200-day moving averages. Notably, there has been a decline in investor participation, with delivery volume dropping by 43.3% compared to the 5-day average. With a market capitalization of Rs 28,831.7...

Read MoreBoard Meeting Intimation for Considering And Approving The Audited Standalone And Consolidated Financial Results For The Quarter And Year Ending March 31 2025; And To Consider The Recommendation Of Final Dividend If Any.

08-Apr-2025 | Source : BSESyngene International Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 23/04/2025 inter alia to consider and approve the audited standalone and consolidated financial results for the quarter and year ending March 31 2025; and to consider the recommendation of final dividend if any.

Grant Of Performance Share Units Under Syngene Long-Term Incentive Performance Share Plan 2023 (Plan)

01-Apr-2025 | Source : BSEGrant of Performance Share Units under Syngene Long-Term Incentive Performance Share Plan 2023 (Plan)

Announcement under Regulation 30 (LODR)-Change in Management

01-Apr-2025 | Source : BSEIntimation of appointment of Mr. Peter Bains as an Additional Director designated as Managing Director & Chief Executive Officer.

Corporate Actions

No Upcoming Board Meetings

Syngene International Ltd has declared 12% dividend, ex-date: 28 Jun 24

No Splits history available

Syngene International Ltd has announced 1:1 bonus issue, ex-date: 11 Jun 19

No Rights history available