Syrma SGS Technology Adjusts Evaluation Amid Strong Sales Growth and Debt Management Concerns

2025-03-25 08:26:02Syrma SGS Technology has recently seen a change in its evaluation score, influenced by its strong debt management and impressive net sales growth. Despite a solid financial performance, the stock is currently in a mildly bearish technical range, with a slight decline in institutional investor participation noted.

Read MoreSyrma SGS Technology Shows Mixed Technical Trends Amid Market Volatility

2025-03-25 08:06:25Syrma SGS Technology, a midcap player in the electronics components industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 482.80, showing a notable increase from the previous close of 468.40. Over the past year, Syrma has experienced a slight return of 0.12%, while the Sensex has gained 7.07% in the same period. The technical summary indicates a mixed outlook, with the MACD on a weekly basis showing bearish signals, while the KST reflects bullish tendencies. The Bollinger Bands and moving averages suggest a mildly bearish sentiment in the short term. Notably, the stock's performance over the past week has been strong, with a return of 15.96%, significantly outperforming the Sensex's 5.14% return. Syrma's 52-week high stands at 646.50, while the low is recorded at 376.30, indicating a volatile trading range. The company's recent per...

Read More

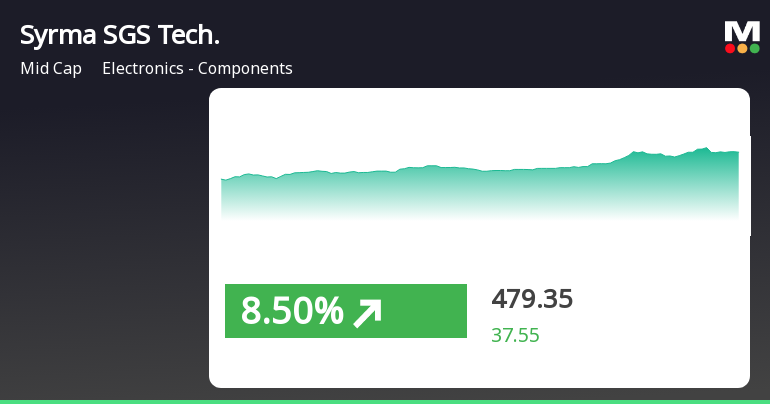

Syrma SGS Technology Surges Amid Broader Small-Cap Market Strength

2025-03-19 10:50:30Syrma SGS Technology has experienced notable activity, outperforming its industry and achieving a strong upward trend over the past three days. The stock reached an intraday high, and while it shows mixed signals in longer-term performance, it has outperformed the broader market, including the Sensex.

Read More

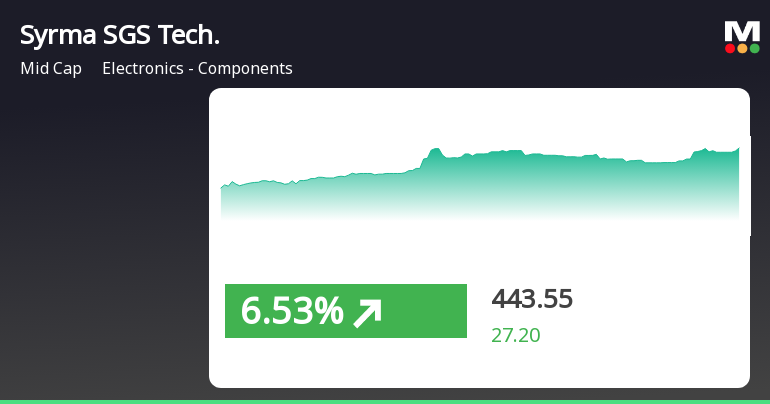

Syrma SGS Technology Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-18 10:20:30Syrma SGS Technology, a midcap electronics components firm, has experienced significant activity, gaining 6.45% on March 18, 2025. The stock has shown consecutive gains over two days, outperforming its sector. Despite this, it remains below several long-term moving averages and has a year-to-date decline of 25.91%.

Read More

Syrma SGS Technology Faces Market Challenges Despite Strong Sales Growth and Low Debt Ratio

2025-03-18 08:24:30Syrma SGS Technology has recently experienced a change in its evaluation, reflecting various financial metrics and market dynamics. In Q3 FY24-25, the company reported a significant increase in net sales and demonstrated strong debt servicing capabilities, despite facing challenges such as reduced institutional investor participation and a negative stock performance over the past year.

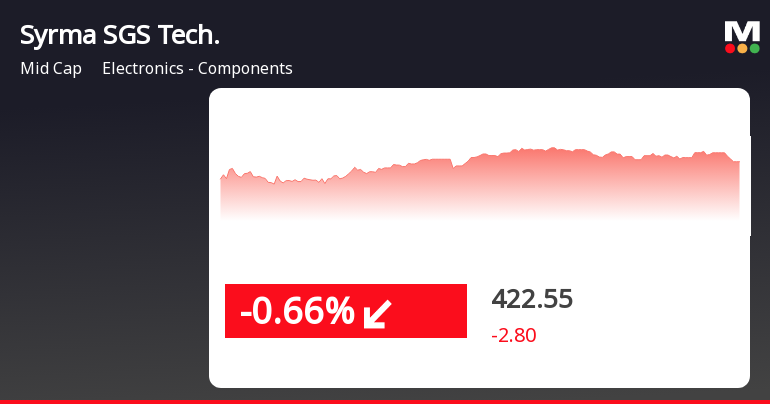

Read MoreSyrma SGS Technology Experiences Technical Trend Adjustments Amid Market Challenges

2025-03-18 08:04:44Syrma SGS Technology, a midcap player in the electronics components industry, has recently undergone a technical trend adjustment. The company's current stock price stands at 416.35, slightly above the previous close of 413.45. Over the past year, Syrma has faced challenges, with a return of -17.14%, contrasting with a positive return of 2.10% for the Sensex during the same period. The technical summary indicates a bearish sentiment, with the MACD showing a bearish trend on a weekly basis. Moving averages also reflect a bearish stance, while Bollinger Bands suggest a mildly bearish outlook. Notably, the KST indicator presents a bullish signal on a weekly basis, indicating some divergence in the technical indicators. In terms of price performance, Syrma's stock has fluctuated between a 52-week high of 646.50 and a low of 376.30. Recent trading sessions have seen the stock reach a high of 425.85 and a low o...

Read MoreSyrma SGS Technology Faces Market Challenges Amid Mixed Technical Indicators

2025-03-17 18:00:57Syrma SGS Technology Ltd, a mid-cap player in the Electronics - Components industry, has shown notable activity today, with its stock rising by 0.70%. This performance comes against the backdrop of a challenging year, where the stock has declined by 17.14%, significantly underperforming the Sensex, which has gained 2.10% over the same period. Currently, Syrma SGS Technology boasts a market capitalization of Rs 7,441.00 crore and a price-to-earnings (P/E) ratio of 52.42, which is lower than the industry average P/E of 64.07. Despite today's uptick, the stock has faced headwinds over the past week, down 2.12%, and has seen a more pronounced decline of 31.20% over the last three months. Technical indicators present a mixed picture, with the Moving Averages signaling a bearish trend on a daily basis, while the KST shows bullish momentum on a weekly basis. The stock's performance metrics highlight its current ...

Read More

Syrma SGS Technology Faces Trend Reversal Amid Broader Market Decline

2025-03-10 15:20:25Syrma SGS Technology, a midcap electronics components firm, saw a significant decline on March 10, 2025, reversing a brief period of gains. The stock underperformed compared to its sector and has faced challenges over the past month and three months, despite a modest weekly gain. Overall market sentiment remains bearish.

Read MoreSyrma SGS Technology Faces Mixed Technical Trends Amidst Market Challenges

2025-02-28 08:00:43Syrma SGS Technology, a midcap player in the electronics components industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 414.65, down from a previous close of 425.10. Over the past year, Syrma has faced challenges, with a return of -21.12%, contrasting sharply with a 2.08% gain in the Sensex during the same period. The technical summary reveals a mixed outlook. The MACD indicates bearish momentum on a weekly basis, while the daily moving averages suggest a mildly bullish trend. However, the Bollinger Bands and Dow Theory present a bearish stance on the weekly timeframe. The On-Balance Volume (OBV) shows a mildly bullish trend, yet the monthly indicators lack definitive signals. In terms of price performance, Syrma's 52-week high was 646.50, while it has seen a low of 376.30. Recent trading activity has shown vola...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

06-Feb-2025 | Source : BSEIntimation under Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 (the Listing Regulations) for participating in Investor Meetings

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

04-Feb-2025 | Source : BSEEarnings call transcript of the Investors Conference Call held for the Unaudited Financial Results (Consolidated and Standalone) of the Company for the quarter and nine months ended December 31 2024

Corporate Actions

No Upcoming Board Meetings

Syrma SGS Technology Ltd has declared 15% dividend, ex-date: 10 Sep 24

No Splits history available

No Bonus history available

No Rights history available