Talbros Automotive Components Faces Bearish Technical Trends Amid Mixed Performance Indicators

2025-03-28 08:02:16Talbros Automotive Components, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 248.00, down from a previous close of 256.45, with a 52-week high of 395.30 and a low of 200.05. Today's trading saw a high of 259.00 and a low of 244.10, indicating some volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD and Bollinger Bands show bearish trends on a weekly basis, while the monthly indicators reflect a mildly bearish stance. The moving averages also align with this bearish outlook. Notably, the On-Balance Volume (OBV) indicates a bullish trend on a weekly basis, contrasting with the overall bearish sentiment. In terms of performance, Talbros has shown mixed results compared to the Sensex. Over the past week, the stock returned -3.37%, while the S...

Read MoreTalbros Automotive Components Faces Mixed Technical Trends Amid Strong Long-Term Performance

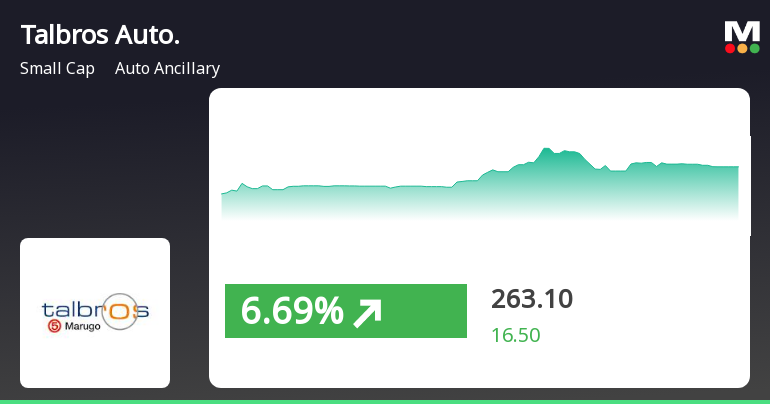

2025-03-24 08:01:31Talbros Automotive Components, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 263.95, showing a notable increase from the previous close of 256.65. Over the past week, Talbros has demonstrated a strong performance with a return of 22.20%, significantly outpacing the Sensex, which returned 4.17% in the same period. In terms of technical indicators, the MACD and KST suggest a bearish outlook on a weekly basis, while the monthly indicators reflect a mildly bearish sentiment. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments, indicating a neutral momentum. Bollinger Bands and moving averages also align with a mildly bearish trend, suggesting a cautious market sentiment. Despite the recent challenges, Talbros has shown resilience over longer periods, w...

Read MoreTalbros Automotive Components Faces Technical Trend Shifts Amid Market Volatility

2025-03-21 08:01:55Talbros Automotive Components, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 256.65, down from a previous close of 263.90, with a notable 52-week high of 395.30 and a low of 200.05. Today's trading saw a high of 273.80 and a low of 254.10, indicating some volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) remains neutral for both weekly and monthly evaluations. Bollinger Bands and Moving Averages also reflect bearish sentiments, particularly on a daily basis. The KST indicates a bearish trend weekly, with a mildly bearish outlook monthly. Interestingly, the On-Balance Volume (OBV) shows a bullish trend on a weekly basis, although it lacks a definitive trend m...

Read MoreTalbros Automotive Components Shows Mixed Technical Trends Amid Market Fluctuations

2025-03-20 08:02:08Talbros Automotive Components, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 263.90, has shown notable fluctuations, with a 52-week high of 395.30 and a low of 200.05. Today's trading saw a high of 272.35 and a low of 250.60, indicating active market engagement. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also align with this trend, indicating a cautious market environment. The On-Balance Volume (OBV) presents a mildly bullish stance on a weekly basis, contrasting with the monthly bearish perspective. When comparing the company's performance to the Sensex, Talbros has demonstrated resilience over various time frames. Over the past week, the stock r...

Read More

Talbros Automotive Components Shows Strong Performance Amid Broader Market Gains

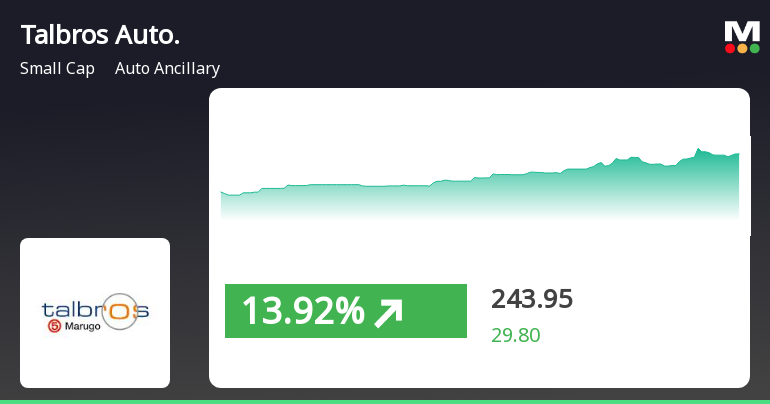

2025-03-19 10:20:18Talbros Automotive Components has experienced notable gains, outperforming its sector and achieving a total return of 23.28% over two days. The stock opened higher and reached an intraday high, while also showing resilience in its performance compared to broader market indices.

Read MoreTalbros Automotive Components Adjusts Valuation Amidst Competitive Auto Ancillary Landscape

2025-03-19 08:00:35Talbros Automotive Components has recently undergone a valuation adjustment, reflecting its current standing in the auto ancillary sector. The company’s price-to-earnings ratio stands at 17.32, while its price-to-book value is recorded at 2.56. Other key financial metrics include an EV to EBIT ratio of 16.71 and an EV to EBITDA ratio of 12.48, indicating its operational efficiency. In terms of returns, Talbros has shown a notable performance over the past three years, with a return of 155.70%, significantly outpacing the Sensex's 30.14% during the same period. However, the year-to-date return of -17.58% suggests challenges in the current market environment. The company also boasts a return on capital employed (ROCE) of 14.61% and a return on equity (ROE) of 14.59%, highlighting its profitability. When compared to its peers, Talbros maintains a competitive position, with several companies in the sector als...

Read More

Talbros Automotive Components Outperforms Auto Ancillary Sector Amid Mixed Market Trends

2025-03-18 10:35:21Talbros Automotive Components has experienced notable trading activity, outperforming the auto ancillary sector. The stock is currently above its short-term moving averages but below longer-term ones. Despite recent gains, its performance over the past three months and year-to-date shows significant declines compared to the broader market.

Read More

Talbros Automotive Components Outperforms Sector Amid Broader Market Gains

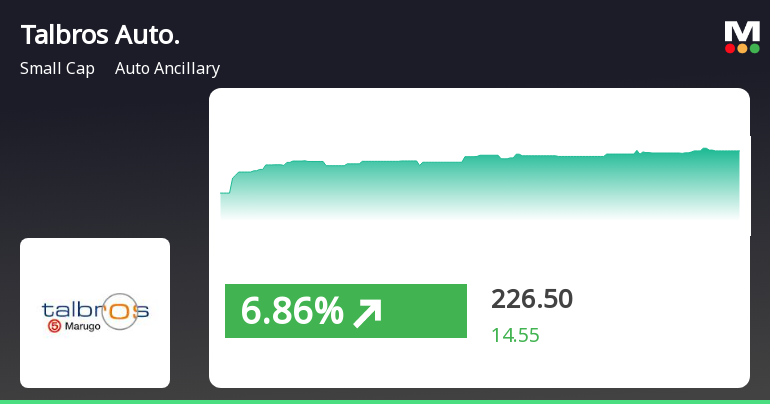

2025-03-05 12:05:19Talbros Automotive Components has experienced notable trading activity, gaining 7.01% on March 5, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, reaching an intraday high. Despite today's performance, it has faced challenges with a year-to-date decline. The broader market also saw positive movement.

Read More

Talbros Automotive Components Hits 52-Week Low Amid Sustained Decline in Market Performance

2025-03-03 10:07:03Talbros Automotive Components has reached a new 52-week low, reflecting a significant decline amid consecutive losses over the past six days. The stock is trading below multiple moving averages and has dropped 26.90% over the past year, contrasting with the relatively stable performance of the Sensex.

Read MoreDisclosure Under SEBI (SAST) Regulations 2011

07-Apr-2025 | Source : BSEDisclosure under Reg 31(4) of SEBI (SAST) Regulations 2011

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

17-Mar-2025 | Source : BSEIntimation of Schedule of Analyst/ Investor Meeting

Corporate Actions

No Upcoming Board Meetings

Talbros Automotive Components Ltd has declared 10% dividend, ex-date: 29 Nov 24

Talbros Automotive Components Ltd has announced 2:10 stock split, ex-date: 27 Oct 23

No Bonus history available

No Rights history available