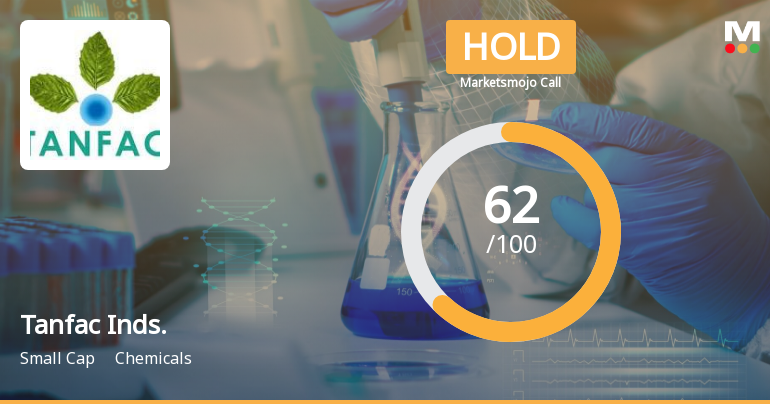

Tanfac Industries Shows Strong Profit Growth Amid Shift in Market Sentiment

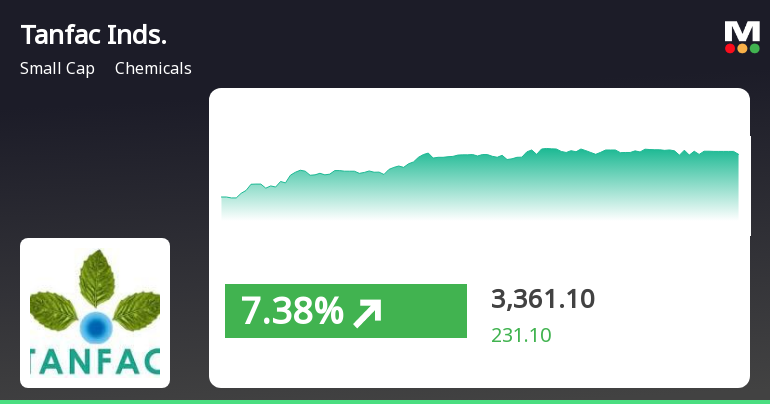

2025-03-25 08:07:02Tanfac Industries, a small-cap chemicals company, has recently seen a change in its technical outlook. The firm reported impressive quarterly results, including a substantial increase in net profit and operating profit growth, while maintaining a low debt-to-equity ratio, indicating strong financial health and stability.

Read MoreTanfac Industries Shows Mixed Technical Trends Amid Strong Performance Against Sensex

2025-03-21 08:00:08Tanfac Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3200.55, down from a previous close of 3332.75, with a notable 52-week high of 3,970.00 and a low of 1,875.65. Today's trading saw a high of 3387.95 and a low of 3161.65, indicating some volatility. In terms of technical indicators, the weekly MACD shows a mildly bearish trend, while the monthly perspective remains bullish. The Relative Strength Index (RSI) does not signal any significant movement on both weekly and monthly charts. Bollinger Bands indicate a bullish stance on both timeframes, and moving averages reflect a mildly bullish trend on a daily basis. The KST shows a bullish weekly trend but is mildly bearish on a monthly basis, while Dow Theory suggests a mildly bullish outlook weekly with no clear trend monthly. Whe...

Read More

Tanfac Industries Reports Strong Financial Growth Amidst Valuation Challenges

2025-03-19 08:01:51Tanfac Industries has recently adjusted its evaluation following strong financial results for Q3 FY24-25, showcasing a 32.35% growth in operating profit and a 245.24% increase in net profit. The company also achieved record cash reserves and net sales, reflecting its solid operational capabilities in the chemicals sector.

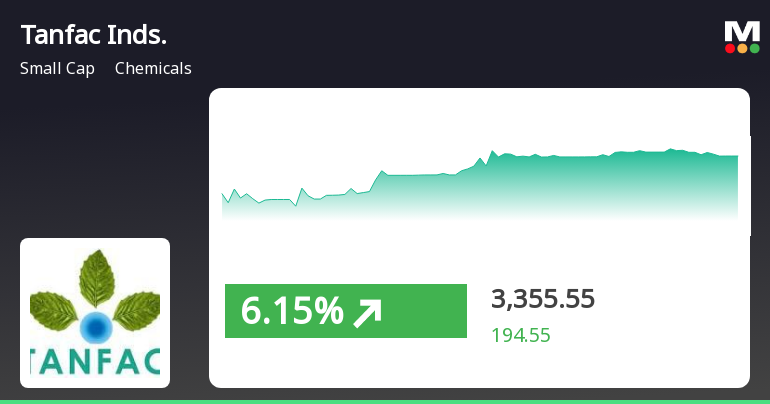

Read MoreTanfac Industries Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:00:11Tanfac Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,266.70, showing a notable increase from the previous close of 3,133.70. Over the past year, Tanfac has demonstrated impressive performance, with a return of 59.10%, significantly outpacing the Sensex, which recorded a return of 3.51% in the same period. The technical summary indicates a mixed outlook, with the MACD showing a bullish trend on a monthly basis, while the weekly perspective remains mildly bearish. The Bollinger Bands and daily moving averages suggest a bullish sentiment, while the KST presents a more cautious view with a mildly bearish monthly trend. In terms of stock performance, Tanfac has consistently outperformed the Sensex across various time frames, including a remarkable 462.30% return over three years a...

Read More

Tanfac Industries Reports Strong Financial Growth Amidst High Valuation Concerns

2025-03-03 18:35:23Tanfac Industries has recently experienced a change in evaluation following strong Q3 FY24-25 financial results, including a 32.35% increase in operating profit and a 245.24% rise in net profit. The company shows financial stability with a low debt-to-equity ratio and significant cash reserves, despite trading at a premium compared to peers.

Read More

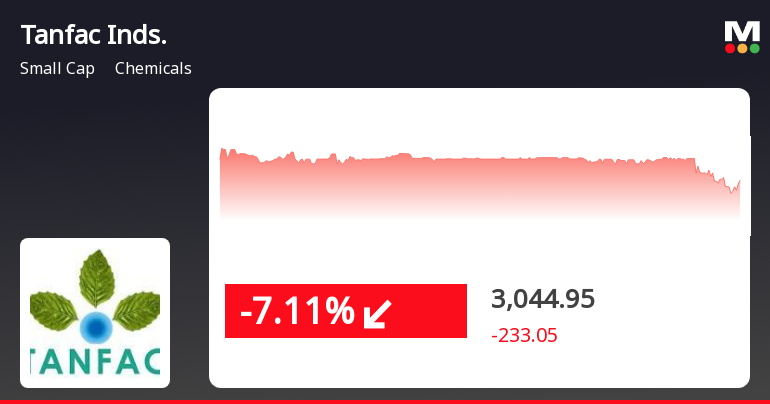

Tanfac Industries Faces Continued Stock Decline Amid Broader Market Challenges

2025-02-28 14:45:14Tanfac Industries, a small-cap chemicals company, has seen its stock decline for two consecutive days, totaling a 12.54% drop. The stock underperformed against its sector and has experienced a 5.66% decrease over the past month, indicating ongoing challenges in the current market environment.

Read More

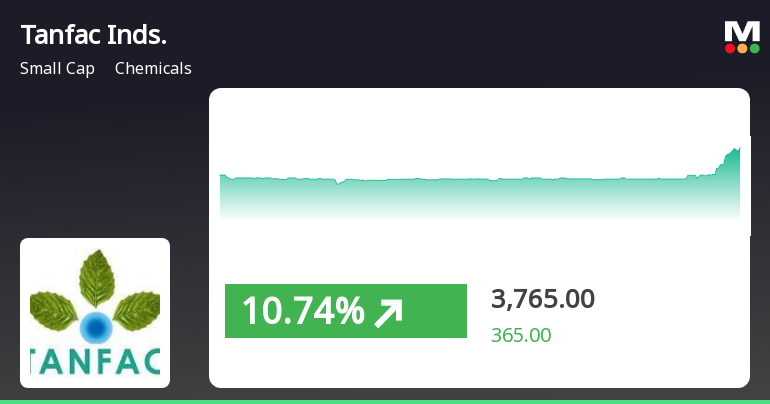

Tanfac Industries Outperforms Sector Amid Positive Market Sentiment and Strong Returns

2025-02-21 14:00:15Tanfac Industries has demonstrated strong performance in the chemicals sector, gaining 8.79% on February 21, 2025, and outperforming the Sensex. The stock has shown consistent gains over three days, accumulating a total return of 9.74%, and is trading above multiple moving averages, indicating a robust upward trend.

Read More

Tanfac Industries Shows Resilience Amid Market Volatility with Notable Stock Performance

2025-02-19 10:30:15Tanfac Industries, a small-cap chemicals company, experienced significant trading activity on February 19, 2025, reversing a two-day decline. The stock demonstrated high volatility, reaching an intraday high and low, while maintaining positions above several moving averages, showcasing its resilience amid market fluctuations.

Read More

Tanfac Industries Shows Strong Market Resilience with Notable Stock Recovery in February 2025

2025-02-13 10:30:14Tanfac Industries, a small-cap chemicals company, experienced a notable rebound on February 13, 2025, after four days of decline. The stock outperformed its sector and achieved an intraday high, while also showing strong returns over the past month, highlighting its resilience in a competitive market.

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

08-Apr-2025 | Source : BSEICRA Limited has upgraded the Credit Rating.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Announcement under Regulation 30 (LODR)-Cessation

31-Mar-2025 | Source : BSECompletion of tenure of Independent Directors.

Corporate Actions

No Upcoming Board Meetings

Tanfac Industries Ltd has declared 70% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available