Tarsons Products Ltd Experiences High Trading Activity Amid Market Volatility

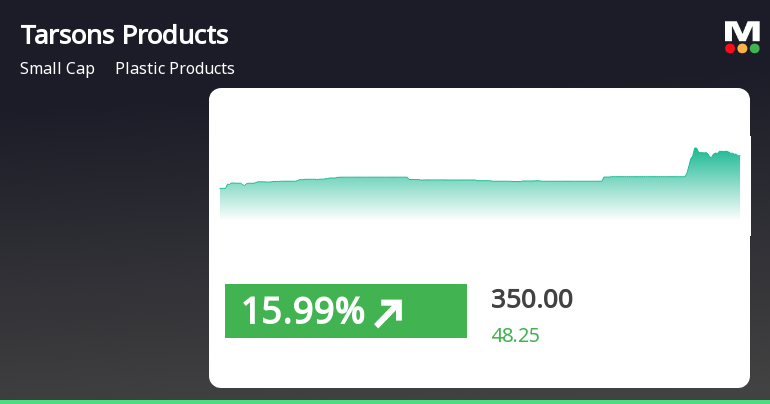

2025-04-02 10:01:42Tarsons Products Ltd, a small-cap player in the plastic products industry, has experienced significant trading activity today, hitting its upper circuit limit. The stock reached an intraday high of Rs 369.3, reflecting a notable increase of 4.26% from its previous levels. The last traded price was Rs 355.0, marking an absolute change of Rs 53.15, or a percentage change of 17.61%. Throughout the trading session, Tarsons Products demonstrated high volatility, with an intraday volatility of 6.48%. The stock's performance today, however, underperformed its sector by 2.46%. The total traded volume reached approximately 1.93 lakh shares, resulting in a turnover of Rs 6.72 crore. Despite the fluctuations, the stock remains above its 5-day, 20-day, and 50-day moving averages, although it is below the 100-day and 200-day moving averages. Notably, the delivery volume has seen a decline of 55.03% compared to the 5-d...

Read MoreTarsons Products Faces Mixed Technical Trends Amid Recent Stock Volatility

2025-04-02 08:10:00Tarsons Products, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 352.30, showing a notable increase from its previous close of 301.75. Over the past week, the stock has reached a high of 362.00 and a low of 300.05, indicating some volatility in trading. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a mildly bearish sentiment for both weekly and monthly assessments. Moving averages indicate a similar mildly bearish trend on a daily basis. Notably, the Dow Theory presents a mixed picture, with a mildly bullish weekly trend contrasted by a bearish monthly outlook. When comparing the stock's performance to the Sensex, Tarsons Products has shown a return of 8.67% over th...

Read More

Tarsons Products Shows Resilience Amid Broader Market Decline and High Volatility

2025-04-01 15:05:26Tarsons Products saw significant trading activity on April 1, 2025, with a notable increase in its stock price. The stock outperformed its sector and reached an intraday high, exhibiting high volatility. Despite a broader market decline, small-cap stocks showed resilience, with Tarsons outperforming the Sensex over the past week.

Read MoreTarsons Products Faces Technical Trend Shifts Amid Market Volatility and Bearish Indicators

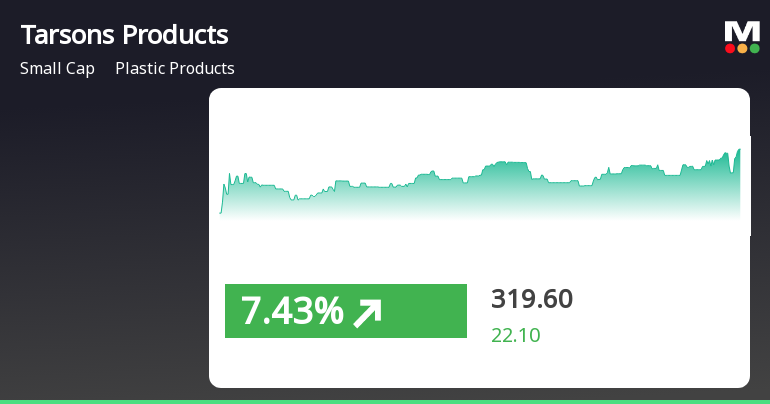

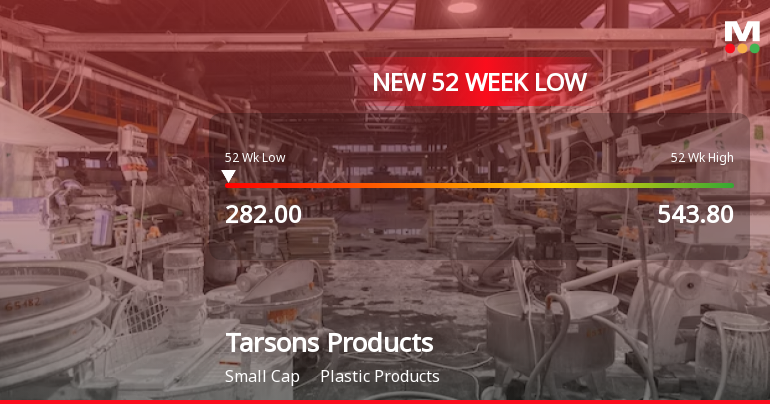

2025-03-26 08:05:01Tarsons Products, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 324.20, down from a previous close of 345.00, with a 52-week high of 543.80 and a low of 282.00. Today's trading saw a high of 342.90 and a low of 320.60, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and moving averages also reflect bearish tendencies. The KST indicates a bearish outlook on a weekly basis, while the Dow Theory presents a mildly bullish view weekly but shifts to bearish on a monthly scale. The On-Balance Volume (OBV) shows a mildly bullish trend weekly, but no clear direction monthly. In terms of performance, Tarsons Pro...

Read MoreTarsons Products Faces Technical Trend Challenges Amid Broader Market Disparities

2025-03-25 08:06:19Tarsons Products, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 345.00, showing a notable increase from the previous close of 330.60. Over the past year, the stock has experienced a decline of 16.07%, contrasting with a 7.07% gain in the Sensex, highlighting the challenges faced by the company in a broader market context. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals on both weekly and monthly charts. Bollinger Bands also indicate a mildly bearish trend, consistent with the daily moving averages. The KST reflects a bearish stance on a weekly basis, while the Dow Theory presents a mildly bullish view in the short term, juxtaposed with a bearish monthly pers...

Read MoreTarsons Products Opens Strong with 6.68% Gain, Continuing Positive Momentum

2025-03-21 13:35:19Tarsons Products, a small-cap player in the plastic products industry, has shown significant activity today, opening with a gain of 6.68%. The stock has outperformed its sector by 2.33%, marking a notable trend as it has gained consecutively over the last three days, accumulating a total return of 13.85% during this period. Throughout the trading session, Tarsons Products reached an intraday high of Rs 337.95, while dipping to a low of Rs 310.05, reflecting high volatility with an intraday fluctuation of 6.47%. In terms of performance metrics, the stock's one-day return stands at 2.54%, compared to the Sensex's 0.66%, and it has also outperformed the index over the past month with a return of 5.99% against the Sensex's 2.04%. Technical indicators reveal that while the stock is currently above its 5-day and 20-day moving averages, it remains below the longer-term 50-day, 100-day, and 200-day moving averag...

Read More

Tarsons Products Sees Notable Gains Amid Broader Market Rally and Sector Outperformance

2025-03-20 15:30:57Tarsons Products has experienced notable gains, outperforming its sector and achieving a total return over two consecutive days. The stock opened higher and reached an intraday peak, while currently positioned above shorter-term moving averages. However, it has faced significant declines over the past three months and year-to-date.

Read More

Tarsons Products Faces Significant Volatility Amid Broader Market Resilience

2025-03-18 14:06:16Tarsons Products, a small-cap plastic manufacturer, has faced notable volatility, reaching a new 52-week low and underperforming its sector. The stock has declined over four consecutive days and has struggled significantly over the past year, with a marked decrease in operating profit growth and recent quarterly earnings down sharply.

Read MoreTarsons Products Experiences Valuation Grade Change Amidst Competitive Market Challenges

2025-03-18 08:01:09Tarsons Products, a small-cap player in the plastic products industry, has recently undergone a valuation adjustment. The company's current price stands at 286.50, reflecting a decline from its previous close of 295.80. Over the past year, Tarsons has experienced a stock return of -28.41%, significantly underperforming compared to the Sensex, which recorded a return of 2.10% in the same period. Key financial metrics for Tarsons include a PE ratio of 51.00 and an EV to EBITDA ratio of 17.36. The company also reports a return on capital employed (ROCE) of 5.56% and a return on equity (ROE) of 5.63%. In comparison to its peers, Tarsons maintains a higher PE ratio than several competitors, indicating a relatively elevated valuation in the market. While the overall performance has been challenging, particularly over longer time frames, the evaluation revision reflects the company's positioning within a compet...

Read MoreRegulation 30 Of SEBI LODR Regulations 2015

09-Apr-2025 | Source : BSEPre-closure of Corporate Guarantee intimation

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st March 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEPursuant to PIT Regulations 2015 Trading Window Closure for dealing in securities of Tarsons Products Limited will remain closed for DPs and their immediate relatives w.e.f Tuesday 1st April 2025 until 48 hrs after declaration of Audited Financial Results for FY 24-25.

Corporate Actions

No Upcoming Board Meetings

Tarsons Products Ltd has declared 100% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available