TCFC Finance Adjusts Valuation Grade Amidst Competitive Market Positioning

2025-03-06 08:01:15TCFC Finance, a microcap player in the Finance/NBFC sector, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings ratio stands at 8.28, while its price-to-book value is notably low at 0.50. Other key metrics include an EV to EBIT ratio of 6.85 and an EV to EBITDA ratio of 6.84, indicating a competitive position in the market. The company also boasts a dividend yield of 3.40%, with a return on capital employed (ROCE) of 7.20% and a return on equity (ROE) of 5.98%. These figures suggest a stable operational performance, although the stock has faced challenges recently, with a year-to-date return of -27.56%, contrasting with a slight gain in the Sensex. In comparison to its peers, TCFC Finance's valuation metrics appear more favorable than some, particularly against companies like Vardhman Holdings and Nisus Finance, which exhibit higher pri...

Read More

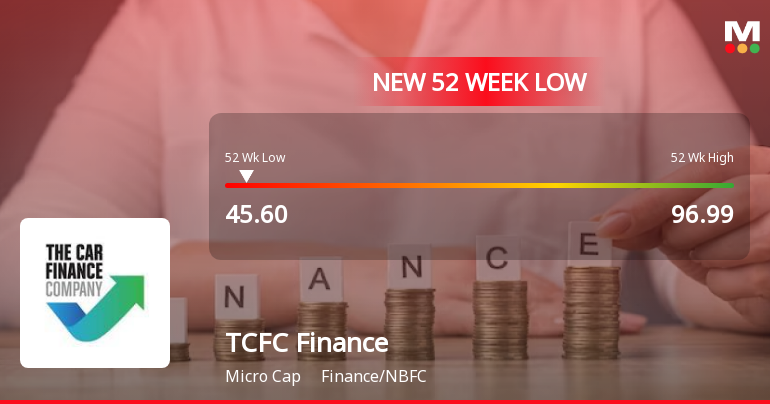

TCFC Finance Faces Significant Volatility Amid Broader Sector Challenges

2025-02-28 10:35:32TCFC Finance has reached a new 52-week low, reflecting significant volatility and a continued downward trend. The stock is trading below key moving averages and has underperformed its sector. Despite a notable dividend yield, its performance over the past year contrasts sharply with broader market gains.

Read More

TCFC Finance Shows Signs of Trend Reversal Amid Ongoing Market Challenges

2025-02-17 10:06:11TCFC Finance has shown notable activity today, reversing a four-day decline with a 3.38% gain. Despite this, the stock remains below key moving averages and has declined 20.24% over the past year. It offers a high dividend yield of 3.47%, attracting interest amid ongoing challenges.

Read More

TCFC Finance Faces Significant Volatility Amid Broader Financial Sector Challenges in October 2023

2025-02-14 13:36:03TCFC Finance has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over the past four days. The stock is currently trading below multiple moving averages, reflecting a bearish trend. Over the past year, it has underperformed compared to the Sensex, despite offering a high dividend yield.

Read More

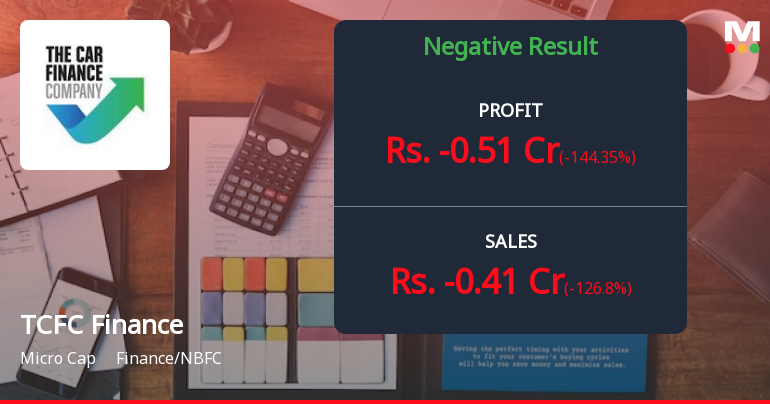

TCFC Finance Reports Q3 FY24-25 Results Amidst Adjusted Evaluation Score

2025-02-05 18:47:34TCFC Finance has announced its financial results for the quarter ending February 2025, reflecting a negative performance for Q3 FY24-25. Despite this, the company's evaluation score has improved slightly from -16 to -15 over the past three months, indicating a nuanced change in its financial assessment.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

06-Feb-2025 | Source : BSENewspaper publication of unaudited Financial Results for quarter and Nine Months ended 31st December 2024

Unaudited Standalone Financial Results Of The Company For The Quarter And Nine Months Ended 31St December 2024

05-Feb-2025 | Source : BSEUnaudited Standalone Financial Results of the Company for the quarter and Nine months ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

TCFC Finance Ltd has declared 18% dividend, ex-date: 23 Jul 24

No Splits history available

No Bonus history available

No Rights history available