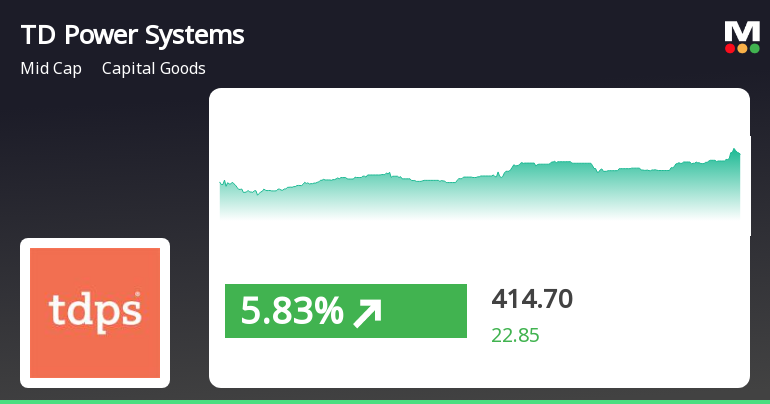

TD Power Systems Outperforms Sector Amid Broader Market Gains and Strong Momentum

2025-03-24 14:45:19TD Power Systems has experienced notable stock performance, gaining 6.39% on March 24, 2025, and outperforming its sector. Over the past six days, it has achieved a total return of 28.43%. The stock is trading above all key moving averages, reflecting strong performance in the broader market context.

Read More

TD Power Systems Faces Technical Shift Amid Strong Financial Performance and Investor Confidence

2025-03-20 08:04:05TD Power Systems has recently experienced a change in its evaluation, with technical indicators signaling a mildly bearish trend. Despite this, the company showcases strong financial fundamentals, including low debt and significant growth in operating and net profits, alongside high institutional holdings and consistent outperformance of the BSE 500.

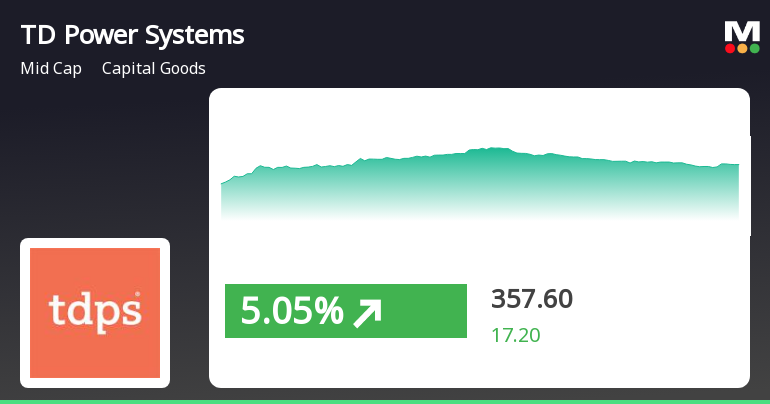

Read MoreTD Power Systems Faces Mixed Technical Trends Amid Strong Historical Performance

2025-03-20 08:00:14TD Power Systems, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 369.65, showing a notable increase from the previous close of 357.30. Over the past year, TD Power Systems has demonstrated a robust performance with a return of 38.37%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment, while the On-Balance Volume (OBV) suggests a mildly bullish trend on a weekly basis. The company's...

Read More

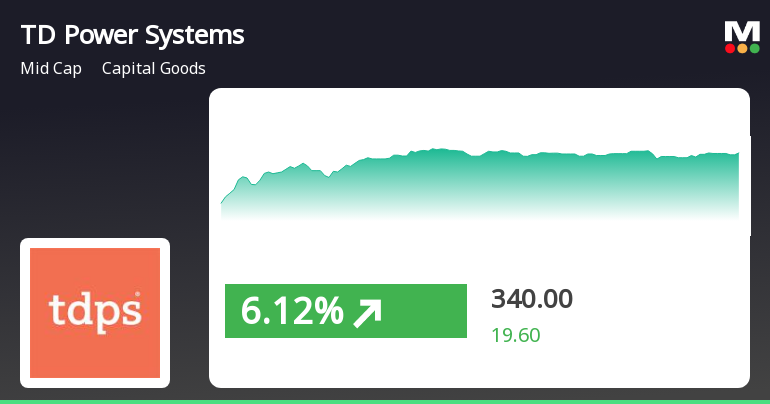

TD Power Systems Outperforms Sector Amid Broader Market Trends and Small-Cap Gains

2025-03-18 10:00:52TD Power Systems experienced notable gains on March 18, 2025, outperforming its sector and achieving a significant return over the past two days. The stock's performance over the last year has also been strong, significantly exceeding the broader market's growth during the same period.

Read More

TD Power Systems Shows Resilience Amid Market Volatility with Recent Gains

2025-03-17 10:00:20TD Power Systems saw a significant rebound on March 17, 2025, after four days of decline, outperforming its sector. While the stock is above its 20-day moving average, it remains below several longer-term averages. The broader market also experienced gains, with the Sensex rising notably.

Read More

TD Power Systems Reports Strong Growth Amidst Market Valuation Concerns

2025-03-07 08:02:36TD Power Systems has recently adjusted its evaluation, reflecting strong financial performance in Q3 FY24-25, with significant growth in net and operating profits. The company maintains a low debt-to-equity ratio and high institutional holdings, indicating financial stability and investor interest, despite emerging bearish technical trends.

Read More

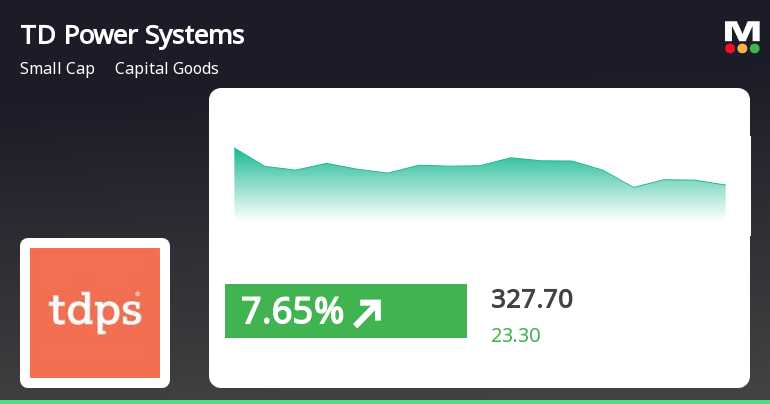

TD Power Systems Shows Strong Rebound Amid Broader Market Decline

2025-03-04 09:30:18TD Power Systems experienced a notable rebound on March 4, 2025, gaining 7.49% after four days of decline. The stock showed significant intraday volatility, reaching a high of Rs 336.65. In contrast, the broader market, represented by the Sensex, faced a negative trend, nearing its 52-week low.

Read MoreTD Power Systems Experiences Valuation Grade Change Amid Competitive Market Challenges

2025-03-04 08:00:12TD Power Systems, a small-cap player in the capital goods sector, has recently undergone a valuation adjustment. The company's current price stands at 304.40, reflecting a decline from its previous close of 310.00. Over the past year, TD Power Systems has shown a return of 2.79%, outperforming the Sensex, which recorded a slight decline of 0.98% during the same period. Key financial metrics for TD Power Systems include a PE ratio of 31.57 and an EV to EBITDA ratio of 21.83. The company also boasts a robust return on capital employed (ROCE) of 30.70% and a return on equity (ROE) of 17.55%. However, when compared to its peers, TD Power Systems presents a higher valuation profile, with competitors like J Kumar Infra and Patel Engineering showing significantly lower PE ratios and EV to EBITDA metrics. In terms of market performance, TD Power Systems has faced challenges recently, with a year-to-date return of...

Read More

TD Power Systems Shows Strong Financial Growth Amid Market Challenges and Adjustments

2025-03-03 18:41:24TD Power Systems has recently experienced an evaluation adjustment, reflecting its strong financial performance in the third quarter of FY24-25. The company reported significant growth in operating and net profits, alongside a record net sales figure. Its low debt-to-equity ratio and high institutional holdings further highlight its financial stability.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31 March 2025.

Announcement Under Regulation 30 Of SEBI (LODR) 2015.

03-Apr-2025 | Source : BSEAnnouncement under Regulation 30 of SEBI (LODR) 2015 - Receipt of Cautionary Email from BSE dated April 2 2025.

Announcement Under Regulation 30 Of SEBI (LODR) 2015

02-Apr-2025 | Source : BSEAnnouncement under Regulation 30 of the SEBI (LODR) 2015 -Receipt of Cautionary Email from NSE dated April 1 2025.

Corporate Actions

No Upcoming Board Meetings

TD Power Systems Ltd has declared 30% dividend, ex-date: 11 Nov 24

TD Power Systems Ltd has announced 2:10 stock split, ex-date: 31 Oct 22

No Bonus history available

No Rights history available