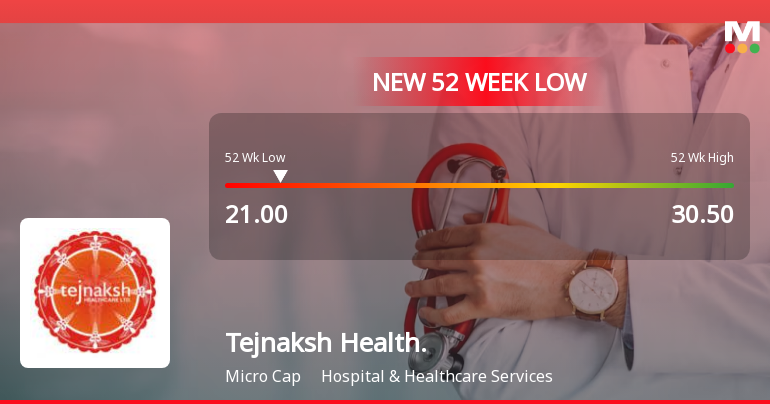

Tejnaksh Healthcare Faces Challenges Amid Declining Stock Performance and Weak Fundamentals

2025-03-27 13:08:46Tejnaksh Healthcare, a microcap in the Hospital & Healthcare Services sector, is nearing a 52-week low, having declined 7.37% over three days. With a one-year return of -12.36% and weak long-term fundamentals, the company faces significant challenges despite a recent profit increase of 84.8%.

Read More

Tejnaksh Healthcare Faces Evaluation Shift Amid Mixed Market Performance Indicators

2025-03-21 08:02:22Tejnaksh Healthcare has recently experienced a change in its evaluation, reflecting a shift in its technical outlook amid mixed performance indicators. The company has shown inconsistent stock performance and faces challenges in its long-term growth trajectory, despite maintaining a moderate return on equity.

Read MoreTejnaksh Healthcare Faces Ongoing Challenges Amidst Microcap Sector Struggles

2025-03-20 18:00:45Tejnaksh Healthcare, operating within the Hospital & Healthcare Services sector, has shown notable activity in the market today. The company's market capitalization stands at Rs 46.00 crore, categorizing it as a microcap stock. Currently, Tejnaksh Healthcare has a price-to-earnings (P/E) ratio of 19.79, which is significantly lower than the industry average of 52.71, indicating a potential disparity in valuation compared to its peers. Over the past year, Tejnaksh Healthcare has experienced a decline of 8.87%, contrasting sharply with the Sensex, which has gained 5.89% during the same period. In the short term, the stock has seen a decrease of 1.01% today, while the Sensex has risen by 1.19%. Performance metrics over various time frames reveal a consistent underperformance, with a 3-year decline of 74.84% compared to the Sensex's growth of 31.94%. Technical indicators suggest a bearish trend in the weekly ...

Read More

Tejnaksh Healthcare Faces Ongoing Challenges Amidst Market Volatility and Declining Profits

2025-03-18 12:36:55Tejnaksh Healthcare, a microcap in the Hospital & Healthcare Services sector, reached a new 52-week low today after experiencing significant volatility. The company has faced a 16.72% decline over the past year, with weak long-term fundamentals and low profitability reflected in its Return on Equity.

Read MoreTejnaksh Healthcare Shows Resilience Amid Broader Market Decline and Valuation Discrepancies

2025-03-10 18:00:06Tejnaksh Healthcare, a microcap player in the Hospital & Healthcare Services sector, has shown notable activity today, with its stock price increasing by 1.66%. This uptick comes amid a broader market trend, as the Sensex experienced a decline of 0.29%. Over the past week, Tejnaksh Healthcare has outperformed the Sensex, gaining 9.17% compared to the index's 1.41% rise. Despite this recent performance, the company has faced challenges over the past year, with a decline of 11.46%, while the Sensex remained relatively stable with a slight decrease of 0.01%. Year-to-date, Tejnaksh Healthcare has managed a gain of 6.35%, contrasting with the Sensex's loss of 5.15%. In terms of technical indicators, the weekly MACD is bearish, while the monthly outlook is mildly bullish. The stock's price is currently positioned with a P/E ratio of 21.05, significantly lower than the industry average of 50.61, suggesting a po...

Read MoreTejnaksh Healthcare's Stock Surge Highlights Valuation Disparities in Healthcare Sector

2025-03-05 18:00:28Tejnaksh Healthcare, operating within the Hospital & Healthcare Services sector, has shown significant activity today, with its stock rising by 5.71%. This increase comes against a backdrop of a market capitalization of Rs 48.00 crore, categorizing it as a microcap company. The stock's price-to-earnings (P/E) ratio stands at 20.18, notably lower than the industry average of 50.07, indicating a potential valuation disparity within the sector. Over the past year, Tejnaksh Healthcare has experienced a decline of 18.09%, contrasting sharply with the Sensex, which has seen a marginal increase of 0.07%. In the short term, the stock's performance over the past week has been slightly negative, down 1.38%, while it has managed a year-to-date gain of 1.95%, outperforming the Sensex's decline of 5.64%. Technical indicators present a mixed picture, with the MACD showing bearish signals on a weekly basis but mildly bu...

Read More

Tejnaksh Healthcare Reports Flat Performance Amid Highest Profit Before Tax in December 2024

2025-02-12 11:51:12Tejnaksh Healthcare has announced its financial results for Q3 FY24-25, showing a flat performance. The company achieved its highest Profit Before Tax in five quarters at Rs 0.80 crore and surpassed last year's sales figures in nine months. However, cash and cash equivalents have declined to their lowest level in three years.

Read More

Tejnaksh Healthcare Reports Flat Q3 Performance Amid Declining Operating Profits

2025-01-30 18:53:14Tejnaksh Healthcare, a microcap in the Hospital & Healthcare Services sector, has recently adjusted its evaluation amid flat financial performance for the September 2024 quarter. The company has faced a decline in operating profits over five years, while its stock shows some technical bullish momentum despite trading at a historical discount.

Read MoreRenewal Of DSIR Approval For Tejnaksh Healthcares Research Lab

05-Apr-2025 | Source : BSEWe are pleased to inform you that Tejnaksh Healthcare Research lab has been recently renewed approval by the department of Scientific and Industrial Research (DSIR) For the next two years Please Refer the letter for more information

Closure of Trading Window

25-Mar-2025 | Source : BSEKindly Refer the announcement relating to closure of the trading window in the letter attached

Shareholder Meeting / Postal Ballot-Scrutinizers Report

24-Feb-2025 | Source : BSEPlease find the Scrutinizer Report for the meeting held on 22nd Feb 2025 commenced at 3.00 pm concluded at 3.10 pm

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Tejnaksh Healthcare Ltd has announced 5:10 stock split, ex-date: 19 Jul 23

Tejnaksh Healthcare Ltd has announced 36:10 bonus issue, ex-date: 26 Apr 18

No Rights history available