Texmaco Rail & Engineering Adjusts Evaluation Amid Strong Profit Growth and Operational Efficiency

2025-04-02 08:10:54Texmaco Rail & Engineering has recently experienced a score adjustment based on its financial metrics, showcasing its position in the railway industry. Key indicators include a PE ratio of 21.59, a return on capital employed of 10.86%, and significant net profit growth, despite market challenges.

Read MoreTexmaco Rail & Engineering Adjusts Valuation Grade Amid Strong Operational Metrics

2025-04-02 08:01:29Texmaco Rail & Engineering has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the railways industry. The company's price-to-earnings ratio stands at 21.59, while its price-to-book value is recorded at 2.05. Additionally, Texmaco's enterprise value to EBITDA ratio is 13.65, and its enterprise value to EBIT is 15.01, indicating a solid operational performance. The company also showcases a PEG ratio of 0.12, suggesting favorable growth prospects relative to its earnings. With a return on capital employed (ROCE) of 10.86% and a return on equity (ROE) of 7.78%, Texmaco demonstrates effective capital utilization and shareholder returns. In comparison to its peers, Texmaco's valuation metrics appear more favorable. Rites is positioned at a higher price-to-earnings ratio of 29.25, while Titagarh Rail shows a significantly elevated PEG ratio of 2.66. ...

Read More

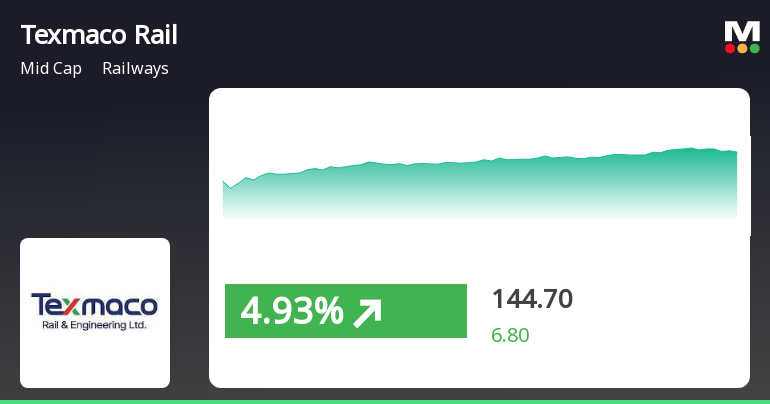

Texmaco Rail & Engineering Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-21 10:20:17Texmaco Rail & Engineering saw a significant rise on March 21, 2025, outperforming the broader market and the railways sector. The stock's performance is mixed across various moving averages. While it has outperformed the Sensex recently, its year-to-date performance shows a notable decline compared to the index.

Read More

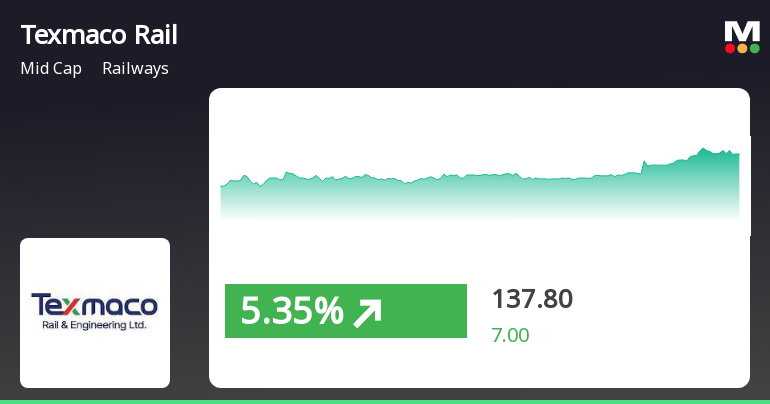

Texmaco Rail & Engineering Shows Short-Term Gains Amid Mixed Long-Term Performance

2025-03-19 11:50:17Texmaco Rail & Engineering has experienced notable stock activity, outperforming the railway sector recently. The stock reached an intraday high and has shown a positive short-term trend. However, it faces longer-term challenges, with declines over the past month and year-to-date, despite significant growth over the past three years.

Read More

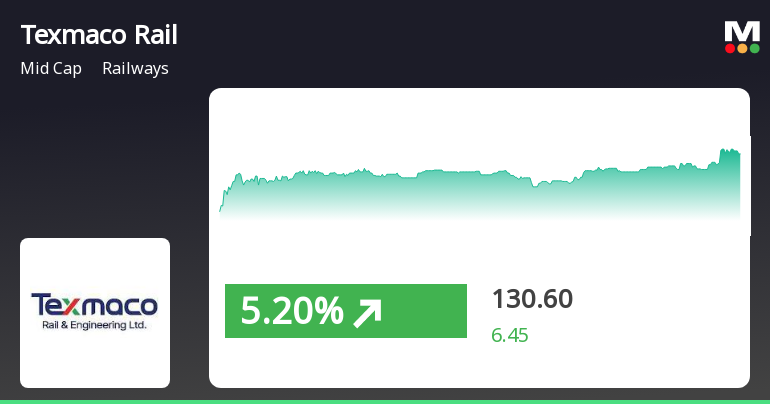

Texmaco Rail Shows Potential Trend Reversal Amid Broader Market Gains

2025-03-18 15:00:50Texmaco Rail & Engineering experienced a notable increase in stock price on March 18, 2025, following a series of declines. Despite this uptick, the company remains below key moving averages and has faced significant declines over the past month and year, reflecting ongoing market challenges.

Read More

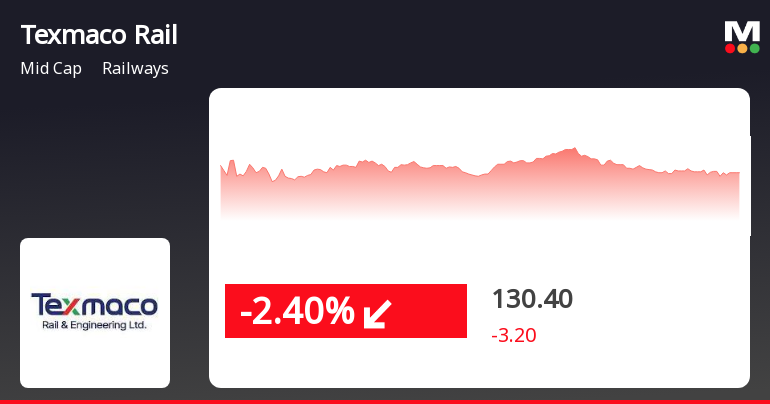

Texmaco Rail & Engineering Faces Market Volatility Amid Broader Railway Sector Decline

2025-03-10 13:50:17Texmaco Rail & Engineering saw a notable decline on March 10, 2025, after five days of gains, underperforming the broader railway sector. The stock's moving averages indicate a mixed trend, with recent short-term gains contrasting with longer-term declines, while maintaining strong performance over three and five years.

Read More

Texmaco Rail & Engineering Faces Challenges Amid Sustained Stock Decline and Market Volatility

2025-03-03 09:36:50Texmaco Rail & Engineering has reached a new 52-week low, reflecting a significant decline over the past six days. The company is trading below multiple moving averages and has seen a substantial decrease in its one-year performance, highlighting ongoing challenges in the market.

Read More

Texmaco Rail & Engineering Hits New Low Amid Broader Sector Challenges

2025-02-28 09:37:55Texmaco Rail & Engineering has reached a new 52-week low, continuing a downward trend over the past five days. The stock is trading below key moving averages and has declined significantly over the past year, contrasting with the broader market's modest gains, reflecting ongoing challenges in the railways sector.

Read More

Texmaco Rail & Engineering Hits 52-Week Low Amid Broader Railway Sector Challenges

2025-02-27 15:35:26Texmaco Rail & Engineering has reached a new 52-week low, reflecting ongoing challenges in the railway sector. The stock has declined significantly over the past year, underperforming compared to broader market indices. Current trading metrics indicate a sustained period of underperformance against various moving averages.

Read MoreAnnouncement Under Reg 30(5)

01-Apr-2025 | Source : BSEAnnouncement under Reg 30(5)

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Appointment Of Chief Financial Officer

25-Mar-2025 | Source : BSEAppointment of Chef Financial Officer

Corporate Actions

No Upcoming Board Meetings

Texmaco Rail & Engineering Ltd has declared 50% dividend, ex-date: 19 Sep 24

No Splits history available

No Bonus history available

Texmaco Rail & Engineering Ltd has announced 2:7 rights issue, ex-date: 21 Oct 21