Thangamayil Jewellery Shows Mixed Technical Trends Amid Strong Long-Term Performance

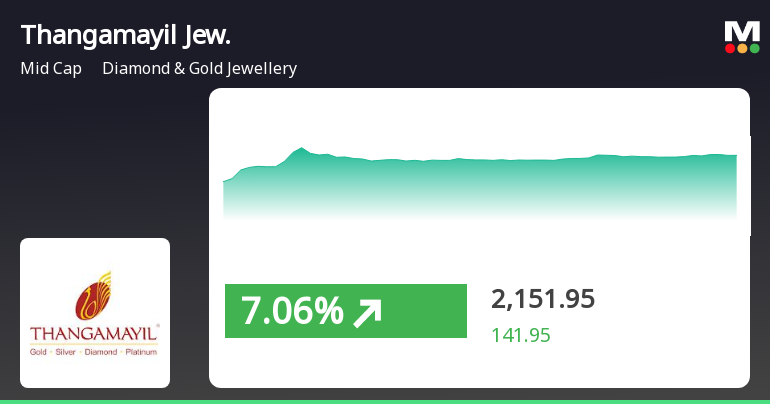

2025-04-02 08:05:46Thangamayil Jewellery, a midcap player in the Diamond and Gold Jewellery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2006.70, showing a slight increase from the previous close of 2004.65. Over the past year, Thangamayil has demonstrated significant resilience, with a remarkable return of 58.22%, far surpassing the Sensex's return of 2.72% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. Bollinger Bands reflect a bullish stance in both weekly and monthly evaluations. However, moving averages present a mildly bearish outlook on a daily basis, suggesting some volatility in short-term performance. In terms of returns, Thangamayil has outperformed the Sensex across multiple...

Read MoreThangamayil Jewellery Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-04-01 08:02:06Thangamayil Jewellery, a midcap player in the Diamond and Gold Jewellery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2004.65, slightly down from the previous close of 2010.00. Over the past year, Thangamayil has demonstrated significant resilience, achieving a remarkable 60.54% return compared to the Sensex's 5.11% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. Bollinger Bands are bullish for both weekly and monthly assessments, suggesting a potential for upward movement. The KST and OBV metrics also reflect a mildly bullish stance on a weekly basis, indicating positive momentum. In terms of price action, Thangamayil reached a high of 2205.90 today, with a low...

Read MoreThangamayil Jewellery Experiences Valuation Grade Change Amid Strong Performance Metrics

2025-04-01 08:00:21Thangamayil Jewellery, a midcap player in the Diamond and Gold Jewellery industry, has recently undergone a valuation adjustment. The company's current price stands at 2004.65, with a notable 52-week high of 2,558.06 and a low of 1,129.95. Key financial metrics reveal a PE ratio of 53.92 and an EV to EBITDA of 31.56, indicating a premium valuation compared to its peers. For instance, PC Jeweller, which holds an attractive valuation, has a significantly lower PE ratio of 21.11 and a higher EV to EBITDA of 46.88. Meanwhile, P N Gadgil Jewellers presents a fair valuation with a PE of 44.55, while Rajesh Exports is categorized as risky with a PE ratio of 143.27. In terms of performance, Thangamayil has shown strong returns, outperforming the Sensex over various periods. Over the past year, the stock has returned 60.54%, compared to the Sensex's 5.11%. This trend continues over three and five years, where Tha...

Read More

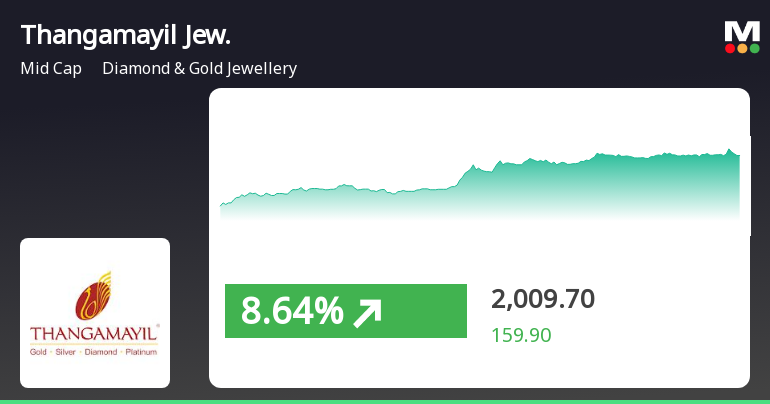

Thangamayil Jewellery Shows Resilience with Strong Gains Amid Market Decline

2025-03-28 09:35:22Thangamayil Jewellery has demonstrated strong performance in the diamond and gold jewellery sector, gaining 6.48% on March 28, 2025. The stock has risen for three consecutive days, totaling a 16.87% increase, and has outperformed the Sensex significantly over the past year, reflecting robust trading activity.

Read MoreThangamayil Jewellery Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-28 08:02:09Thangamayil Jewellery, a midcap player in the Diamond and Gold Jewellery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2010.00, showing a notable increase from the previous close of 1849.80. Over the past year, Thangamayil has demonstrated impressive performance, with a return of 65.26%, significantly outpacing the Sensex's return of 6.32% during the same period. The technical summary indicates a mixed outlook, with the MACD showing mildly bullish signals on a weekly basis, while the monthly perspective leans mildly bearish. Bollinger Bands reflect bullish trends on both weekly and monthly charts, suggesting some volatility in price movements. The moving averages present a mildly bearish stance on a daily basis, indicating short-term challenges. In terms of returns, Thangamayil has consistently outperformed the Sensex acros...

Read More

Thangamayil Jewellery Shows Strong Market Performance Amid Broader Sensex Recovery

2025-03-27 11:05:21Thangamayil Jewellery has demonstrated strong market performance, gaining 6.55% today and outperforming its sector. The stock has risen for two consecutive days, achieving a total return of 7.54%. It is trading above key moving averages, reflecting a robust upward trend, while the broader market also shows recovery.

Read More

Thangamayil Jewellery Adjusts Evaluation Amid Strong Financial Performance and Market Caution

2025-03-25 08:15:27Thangamayil Jewellery has recently experienced an evaluation adjustment reflecting changes in its technical outlook. The company reported strong financial performance for Q3 FY24-25, with notable growth in profit metrics and net sales. However, technical indicators suggest a cautious sentiment amid challenges related to its debt levels.

Read MoreThangamayil Jewellery Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:01:55Thangamayil Jewellery, a midcap player in the Diamond and Gold Jewellery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1820.00, showing a notable increase from the previous close of 1747.05. Over the past year, Thangamayil has demonstrated impressive performance, with a return of 63.08%, significantly outpacing the Sensex's return of 4.77% during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance monthly. The Bollinger Bands reflect a mildly bearish trend weekly and a mildly bullish trend monthly, suggesting mixed signals in market sentiment. The moving averages also indicate a mildly bearish trend on a daily basis. When comparing stock performance to the Sensex, Thangamayil has shown resilience, particularly over longer periods, with ...

Read More

Thangamayil Jewellery Reports Strong Profit Growth Amid Debt Management Challenges

2025-03-18 08:13:23Thangamayil Jewellery has recently adjusted its evaluation, reflecting a mix of financial metrics and market dynamics. In Q3 FY24-25, the company reported significant growth in profit before tax and profit after tax, alongside robust net sales. However, challenges remain in debt management and long-term growth outlook.

Read MoreOpening Of New Branches At Virugambakkam & Iyyappanthangal Chennai - Tamilnadu.

07-Apr-2025 | Source : BSEOpening of New Branches

Board Meeting Outcome for To Consider Postal Ballot For Re-Appointment Of Independent Director Shri.S.M.Chandrasekaran By The Shareholder

02-Apr-2025 | Source : BSETo consider Postal Ballot for Re-appointment of Independent Director Shri.S.M.Chandrasekaran by the shareholder

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 28 2025 for N.B. Kumar

Corporate Actions

No Upcoming Board Meetings

Thangamayil Jewellery Ltd has declared 60% dividend, ex-date: 18 Jul 24

No Splits history available

Thangamayil Jewellery Ltd has announced 1:1 bonus issue, ex-date: 17 Jul 23

Thangamayil Jewellery Ltd has announced 2:15 rights issue, ex-date: 11 Feb 25