Investment Trust of India Faces Volatility Amid Weak Long-Term Fundamentals

2025-03-25 15:36:41The Investment Trust of India has hit a new 52-week low, reflecting significant volatility and a notable decline over the past four days. Despite recent positive quarterly results, the stock's long-term fundamentals remain weak, with low return on equity and declining net sales growth, raising concerns about its performance.

Read MoreInvestment Trust of India Adjusts Valuation Grade Amid Market Challenges and Competitive Metrics

2025-03-21 08:00:26The Investment Trust of India has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position. The company, operating in the finance/NBFC sector, currently shows a price-to-earnings (PE) ratio of 16.71 and a price-to-book value of 0.97. Its enterprise value to EBITDA stands at 7.26, while the EV to EBIT is recorded at 8.27. The PEG ratio is notably low at 0.38, indicating potential value relative to growth. In terms of return performance, the Investment Trust of India has faced challenges, with a year-to-date return of -33.98%, contrasting with a slight decline in the Sensex of -2.29% over the same period. Over a longer horizon, the company has shown a 21.66% return over three years, although this is still below the Sensex's 31.94% return. When compared to its peers, the Investment Trust of India maintains a competitive valuation, particularly in the context ...

Read More

Investment Trust of India Reports Strong Quarterly Growth Amid Long-Term Challenges

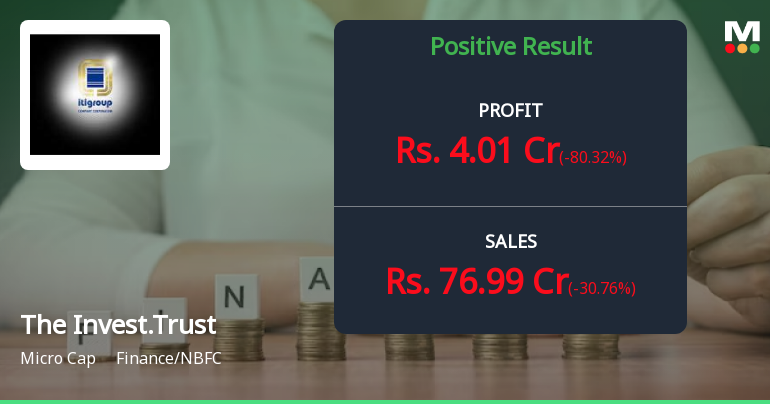

2025-03-03 18:47:05The Investment Trust of India has recently adjusted its evaluation, reflecting a complex financial landscape. While the company reported strong third-quarter growth in Profit After Tax and Net Sales, it faces long-term challenges, including low Return on Equity and declining annual sales, alongside minimal domestic mutual fund investment.

Read More

Investment Trust of India Shows Growth Amid Long-Term Financial Challenges and Market Caution

2025-02-25 18:22:52The Investment Trust of India has recently adjusted its evaluation, reflecting a complex financial standing in the finance/NBFC sector. The company reported positive third-quarter results for FY24-25, with notable growth in Profit After Tax and Net Sales, despite facing challenges in long-term fundamental strength and declining sales growth.

Read MoreInvestment Trust of India Faces Market Challenges Amid Mixed Performance Trends

2025-02-20 11:57:15The Investment Trust of India, operating within the Finance/NBFC sector, has experienced significant fluctuations in its stock performance recently. With a market capitalization of Rs 789.00 crore, the company currently holds a price-to-earnings (P/E) ratio of 19.45, slightly below the industry average of 20.81. Over the past year, The Investment Trust of India has recorded a modest gain of 1.02%, contrasting with the Sensex's performance of 3.64%. However, the stock has faced challenges in the short term, with a decline of 0.93% today, compared to a smaller drop of 0.29% in the Sensex. The one-week performance shows a more pronounced decrease of 7.15%, while the one-month performance reflects a significant drop of 14.60%. Longer-term trends indicate a mixed performance, with a notable 44.62% increase over three years, yet a decline of 23.89% year-to-date. Technical indicators suggest a bearish sentiment ...

Read More

Investment Trust of India Faces Growth Challenges Despite Recent Profit Increases

2025-02-19 19:01:48The Investment Trust of India has recently experienced a change in its evaluation, highlighting the complexities of its financial situation. While the company has shown positive performance in recent quarters, it faces challenges in long-term growth, with concerns over declining net sales and limited fundamental strength.

Read More

Investment Trust of India Reports Mixed Financial Results for December 2024

2025-02-13 18:34:49The Investment Trust of India has announced its financial results for the quarter ending December 2024, showcasing a mixed performance. While profit before tax increased significantly and operating profit reached a five-quarter high, profit after tax and net sales experienced notable declines, alongside reduced cash reserves.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEIntimation of closure of trading window for the Quarter and year ended 31st March 2025.

Announcement Under Regulation 30 Of SEBI (LODR) Regulation 2015

24-Mar-2025 | Source : BSEAnnouncement under Regulation 30 of SEBI (LODR) Regulation2015

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

24-Mar-2025 | Source : BSEOutcome of Postal Ballot

Corporate Actions

No Upcoming Board Meetings

The Investment Trust of India Ltd has declared 5% dividend, ex-date: 16 Aug 12

No Splits history available

The Investment Trust of India Ltd has announced 1:1 bonus issue, ex-date: 21 Mar 06

The Investment Trust of India Ltd has announced 4:5 rights issue, ex-date: 08 Feb 16