Jammu & Kashmir Bank's Quality Grade Change Reflects Strong Performance Metrics and Stability

2025-03-19 08:00:04The Jammu & Kashmir Bank has recently undergone an evaluation revision, reflecting its performance metrics and market position within the public banking sector. Over the past five years, the bank has demonstrated notable growth in net profit, achieving a rate of 40.05%. Additionally, its net interest income growth stands at 7.99%, indicating a solid foundation for revenue generation. The bank's capital adequacy ratio is reported at 11.25%, which is a critical indicator of financial stability and risk management. Furthermore, the bank maintains a gross non-performing asset (NPA) ratio of 4.08%, significantly lower than the average of 6.76% in the industry, showcasing effective asset quality management. In terms of operational efficiency, the average cost-to-income ratio is 64.71%, while the net interest margin averages 3.94%. The bank's return on assets (ROA) averages 0.77%, reflecting its ability to gener...

Read More

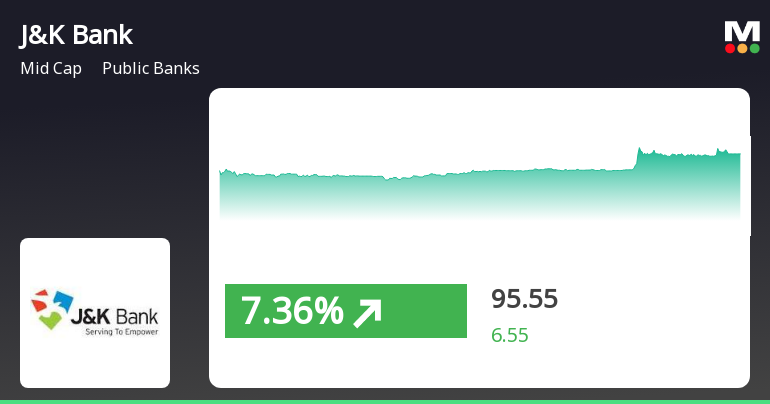

Jammu & Kashmir Bank Outperforms Public Banking Sector Amid Broader Market Gains

2025-03-05 15:50:34The Jammu & Kashmir Bank has experienced notable stock activity, outperforming the public banking sector. It has shown consecutive gains over two days and is currently above its short-term moving averages. In the broader market, the Sensex has risen sharply but remains below its 52-week high.

Read More

Jammu & Kashmir Bank Reports Strong Q3 FY24-25 Performance Amid Market Adjustments

2025-01-30 18:53:45Jammu & Kashmir Bank has recently adjusted its evaluation, reflecting strong financial performance in Q3 FY24-25. The bank reported a 40.05% annual growth in net profit, a robust provision coverage ratio of 74.12%, and consistent positive results over the last 11 quarters, indicating solid financial health.

Read More

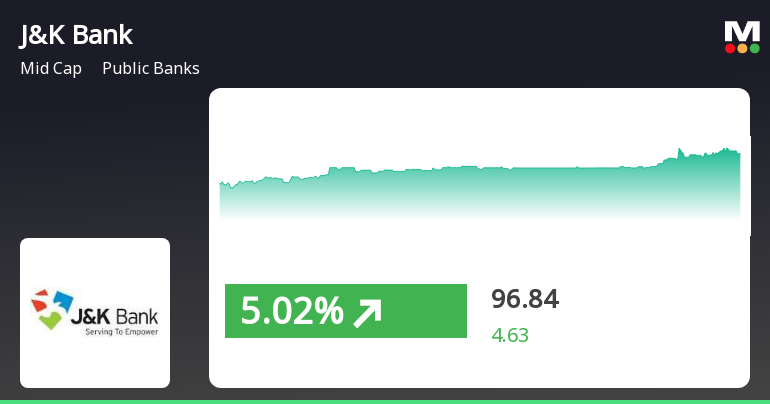

Jammu & Kashmir Bank Outperforms Sector Amid Mixed Long-Term Trends

2025-01-30 10:20:19The Jammu & Kashmir Bank's stock experienced notable activity on January 30, 2025, outperforming its sector. It reached an intraday high and demonstrated short-term strength, while showing resilience over the past month compared to the broader market. The bank's performance reflects its current position in the public banking sector.

Read More

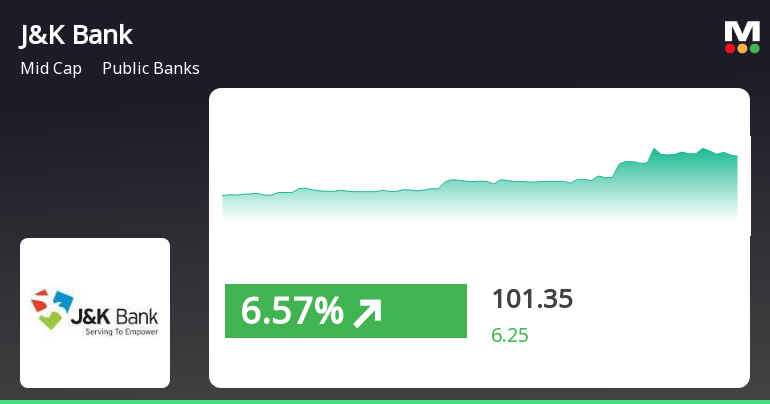

Jammu & Kashmir Bank Stock Rebounds Amid Sector Outperformance and Increased Volatility

2025-01-28 14:50:20The Jammu & Kashmir Bank's stock surged significantly today, marking a reversal after two days of decline. It outperformed its sector and reached an intraday high, showcasing high volatility. While currently above its short-term moving averages, it remains below longer-term averages, reflecting mixed performance over the past month.

Read MoreOrder Of Honble High Court

09-Apr-2025 | Source : BSEOrder of Honble High Court

FUND RAISING BY ISSUANCE OF DEBT SECURITIES BY LARGE ENTITIES

07-Apr-2025 | Source : BSEFund Raising by Issuance of Debt Securities by Large Entities

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance under Regulation 74 of SEBI (DP) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

The Jammu & Kashmir Bank Ltd. has declared 215% dividend, ex-date: 09 Aug 24

The Jammu & Kashmir Bank Ltd. has announced 1:10 stock split, ex-date: 04 Sep 14

No Bonus history available

No Rights history available